Russian Natural Gas Exports

May 10, 2022

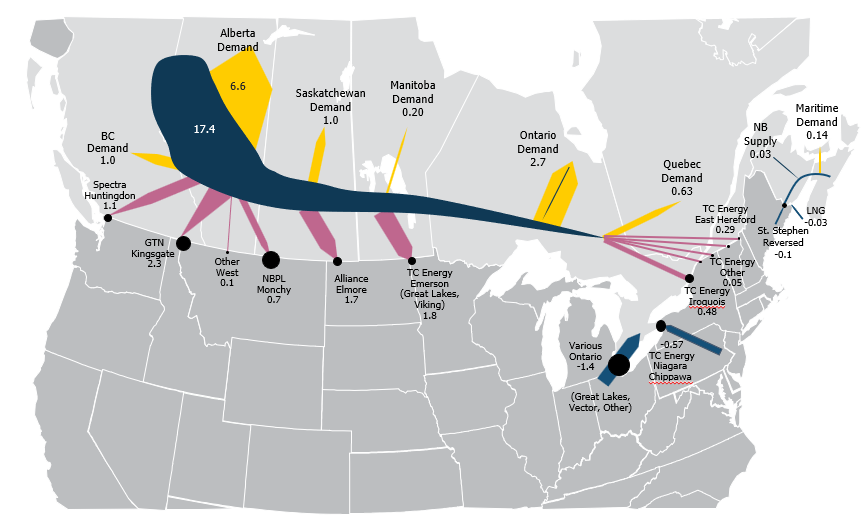

Russian natural gas exports by country in 2021 (Bcf/d).

Russia exported 18 Bcf/d to Europe (OECD) in 2021, mostly by pipeline. Germany is the largest importer of Russian gas in Europe (4.7 Bcf/d).

Russian Gas Replacement in Europe

May 10, 2022

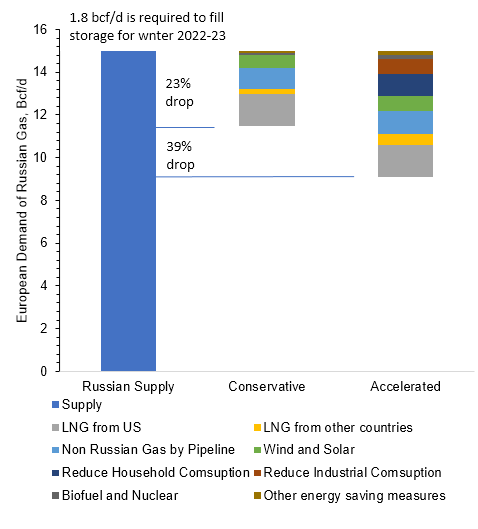

Incorrys assessment of Russian gas replacement in Europe before the end of 2022 under 2 scenarios: Conservative Scenario and Accelerated Scenario.

The EU currently consumes 15 Bcf/d of natural gas from Russia, an additional 1.8 Bcf/d is required to fill storage for the winter 2022-23.

Russian Gas Export to Europe

May 11, 2022

Europe’s natural gas supply mix consists of Russian pipelines via Ukraine, pipeline deliveries from other countries, LNG imports, and domestic production.

Supplies from Russia have increased from about 25% through 2010 to a peak of 37% in 2019. Decline in 2021 mainly due to impact of Covid on demand.

Russian Oil Export

May 11, 2022

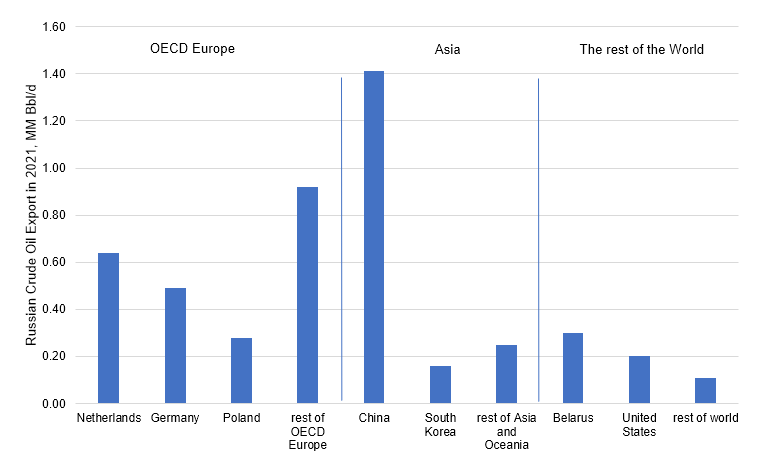

Russian oil exports in 2021, by country, sorted by OECD Europe, Asia, and the rest of the world.

China was the largest importer accounting for 30% of the total (total Asia: 38%) while total OECD Europe accounted for almost 50%. The rest of the world represented about 13%.

North American Gas Demand to 2030

June 14, 2021

Forecast to 2030 of natural gas demand in North America by sector, including residential, commercial, power generation, industrial, LNG exports, and fuel.

The largest growth drivers for natural gas are liquefied natural gas (LNG) exports and increased use for power generation as the industry retires and closes coal-fired plants.

North American Gas Demand by Region

June 14, 2021

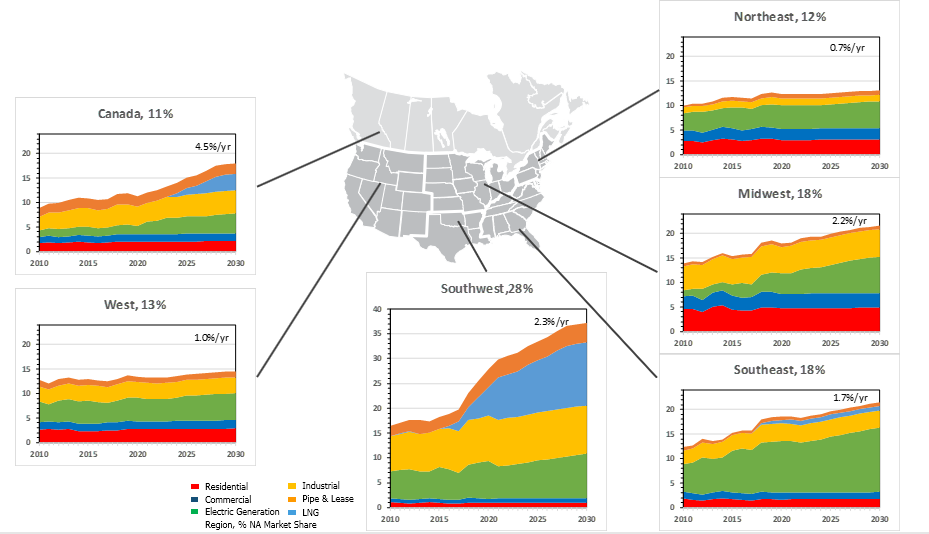

Breakdown of North American gas demand by region and end-use sector to 2030.

Regionally, the US Southwest is expected to lead natural gas demand growth due to strong LNG export development. Declining coal-fired capacity drives growth in gas use, especially in the Midwest and Southeast regions.

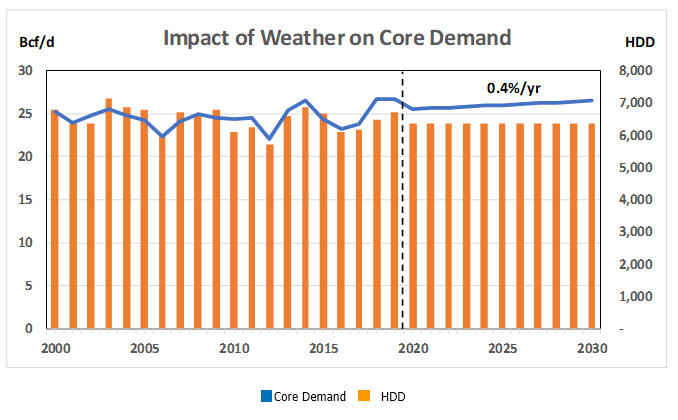

Core Demand for North American Natural Gas

June 18, 2021

Historical North American natural gas demand for the core sectors (residential and commercial) which mainly uses natural gas for winter heating loads. As such, increases and decreases in core sector demand is highly correlated to Heating Degree Days (HDD).

The core sector customer count drives normalized demand growth.

North American Industrial Demand for Natural Gas

June 18, 2021

North American industrial demand forecast for natural gas to 2030, by region.

Industrial demand is the most price sensitive of all of the demand sectors. During the 2000’s, price increases caused overall industrial demand to decline. However, with the rapid production growth in low cost shale gas, lost industrial demand began to recover.

Canadian Natural Gas Demand

Canadian Natural Gas Demand To 2030

November 26, 2020

Total Canadian natural gas demand through 2030 by end-use sector including, residential, commercial, electrical, industrial, Oil Sands, Liquefied natural Gas (LNG), and fuel.

Growth is driven by the power generation sector, where natural gas use replaces coal, and LNG exports.

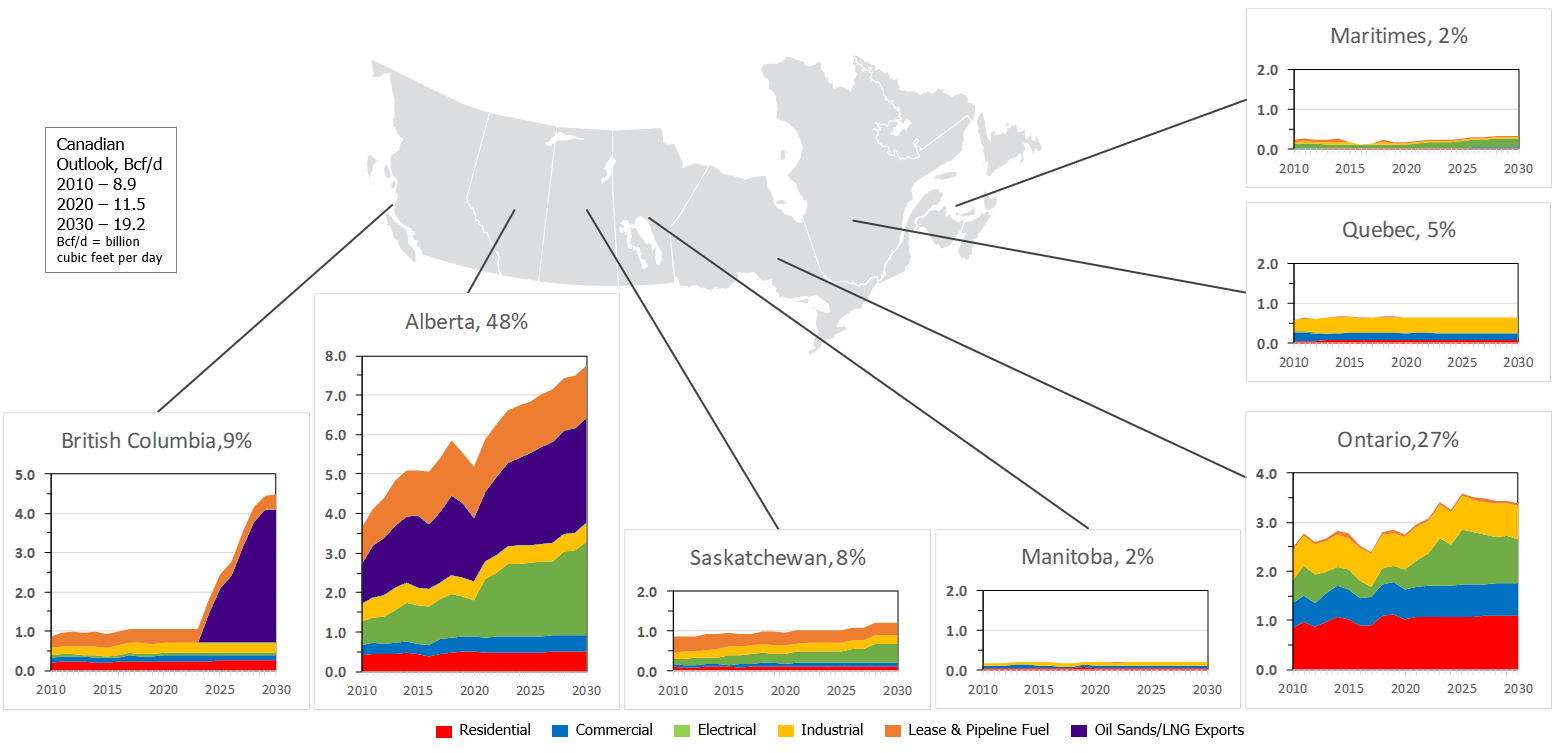

Canadian Provincial Natural Gas Demand Outlook

November 26, 2020

Forecast to 2030 of total Canadian natural gas demand by province and end-use sector including residential, commercial, electric, industrial, fuel, and Oil Sands & liquefied natural gas (LNG) exports (Bcf/d).

Demand growth is driven by power generation (natural gas replacing coal as a fuel), LNG exports, and Alberta oil sands.

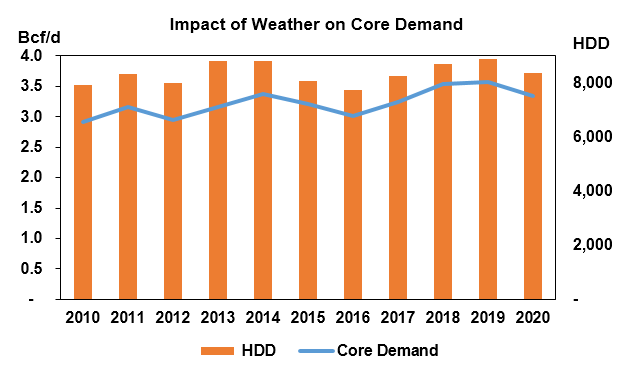

Core Demand For Natural Gas In Canada

November 26, 2020

Historical Canadian natural gas demand for the core sectors (residential and commercial) which mainly use natural gas for winter heating loads. As such, increases and decreases in core sector demand is highly correlated to Heating Degree Days (HDD). The core sector customer count drives normalized demand growth.

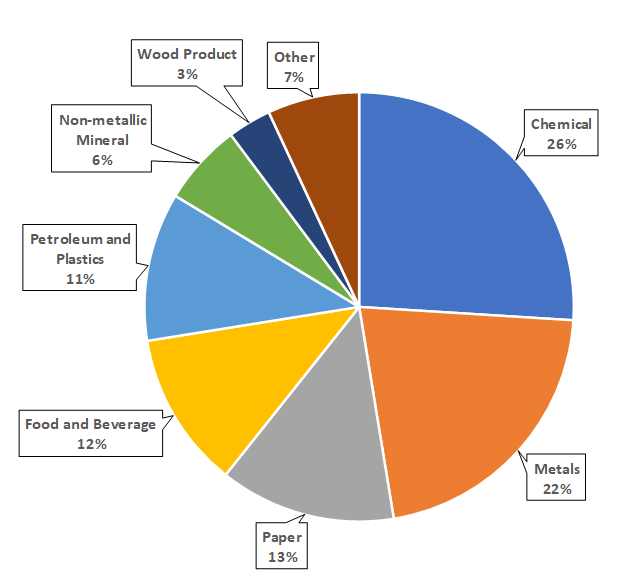

Industrial Demand for Canadian Natural Gas

November 26, 2020

Canadian natural gas industrial demand by sub-sector including the five most gas-intensive sub-sectors: chemical manufacturing (fertilizer and methanol), fabricated and primary metals, paper, food and beverage, and petroleum and plastics.

Chemical manufacturing accounts for just over 25% of the total and tends to be the gas-intensive of the industrial sub-sector. Fabricated and primary metals account for just under 25%.

Canadian Natural Gas Exports by Pipeline

June 21, 2023

Canadian natural gas exports by pipeline, from 2005 to 2035 including a table showing the regional export market share for 2005, 2022, and 2030.

West Coast export markets grow driven primarily by BC LNG exports coupled with expansion of Gas Transmission North (GTN). On the East Coast, increased competition with Marcellus supply has pushed out Canadian gas exports from northeast markets although lack of new pipeline build has allowed exports to remain strong into New England.

Canadian Natural Gas Supply-Demand Balance

2022

July 7, 2023

Overview of the Canadian natural gas supply-demand balance for 2010, 2020, 2022, and 2030, showing the receipt and delivery volumes of natural gas by province and export/import points..

The biggest changes in the Canadian supply-demand balance between 2010 and 2030 is competition with Marcellus shale gas limiting western Canadian supply into the eastern region and increased Alberta supply for liquefied natural gas exports from the west coast.

Canadian LNG Exports Growth

June 28, 2023

Forecast to 2035 of Canadian liquefied natural gas (LNG) exports led by Shell’s LNG Canada facility on the west coast. Also discusses the impact LNG Canada will have on Canada’s supply/demand. Additional map showing the locations and pipelines supplying facilities.

LNG exports are the largest Canadian demand driver over the last half of the decade as LNG Canada is expected to begin exporting in 2025. Completion of LNG Canada’s second train moves their total demand to 3.6 Bcf/d by 2030 and, coupled with the 0.3 Bcf/d from two smaller terminals (Tilbury and Woodfibre) in BCs lower mainland yields total Canadian LNG exports of 3.9 Bcf/d by 2030.

Alberta and Northeast BC Natural Gas Production Allocation

June 21, 2023

Forecast to 2035 of the allocation of supply for both intra-Alberta and ex-Alberta (via pipeline) demand. Includes a schematic of the Western Canadian pipeline system.

Supply growth is driven largely by the demand from liquefied natural gas (LNG) exports from the West Coast beginning in 2025.

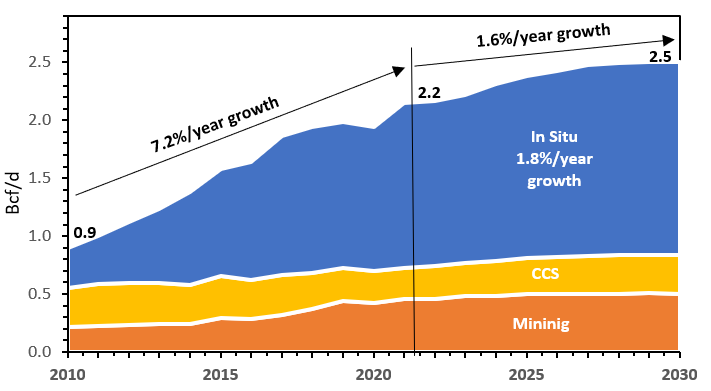

Natural Gas Requirements for Oil Sands

July 11, 2024

Demand forecast to 2030 for western Canada’s oil sands mining, carbon capture & storage (CCS), and in-situ natural gas requirements.

Natural gas requirements for Canadian oil sands grew at an average annual rate of 7.2% from 2010 through 2023 from under 1 Bcf/d to 2.2 Bcf/d. Incorrys is forecasting annual growth in oil sands natural gas demand to slow to 1.6% from 2023 to 2030 as the rate of in situ slows.

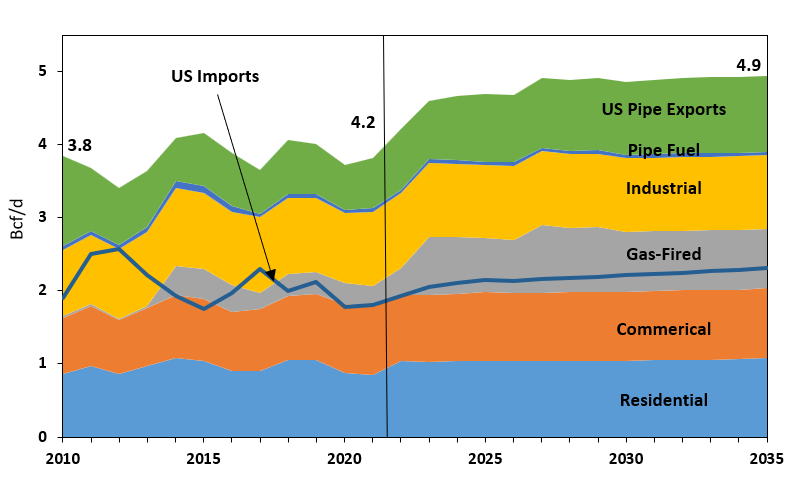

Eastern Triangle Demand to 2035

June 27, 2023

Ontario’s Eastern Triangle natural gas demand to 2035 by end-use sector including residential, commercial, electric, industrial, fuel, and US pipeline exports and imports. Additional map illustrating the Eastern Triangle region.

As gas-fired demand increases, Incorrys believes US imports will remain steady and the eastern triangle market will be satisfied by increased western Canada gas supplies. Increased gas utilization in the Eastern Triangle, coupled with further depreciation of TC Mainlines prairies facilities, will put downward pressure on tolls post 2026 settlement.

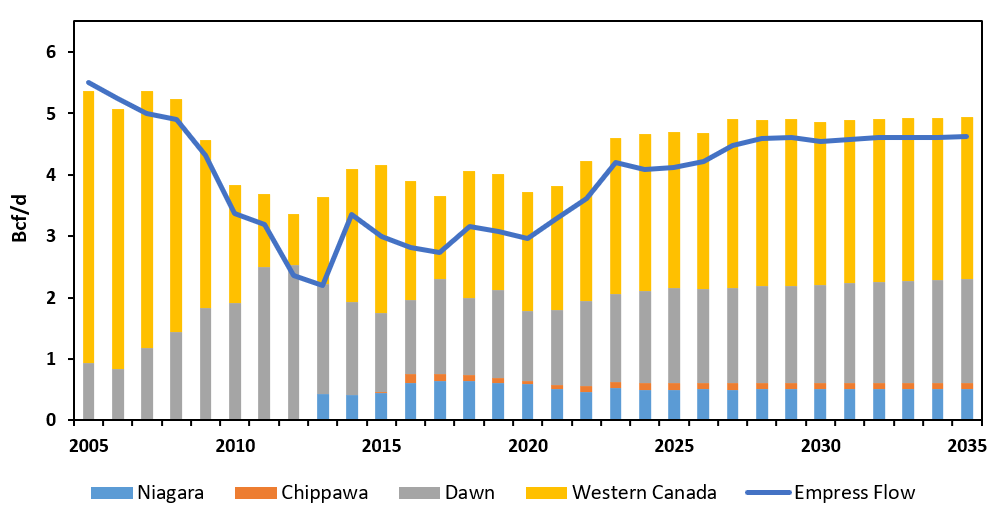

Eastern Triangle Supply Sources to 2035

June 28, 2023

Overview of supply sources required to meet Ontario’s Eastern Triangle natural gas demand to 2035, by export and import points. Additional map showing the Eastern Triangle.

The composition of gas supply sources has changed over time and illustrates the impact Marcellus shale flows had on Empress flows from Western Canada through 2013. In 2035, Incorrys expects market share of supply sources to stabilize at about 50:50.

Eastern Triangle Exports to 2030

March 10, 2022

Eastern Triangle natural gas exports forecast to 2030 by export point. Additional map illustrating the Eastern Triangle region.

Incorrys expects slight growth in the eastern triangle from a couple of expansion projects but do not expect any more large, long-haul pipeline capacity increases in North America.