Your cart is currently empty!

May 10, 2022

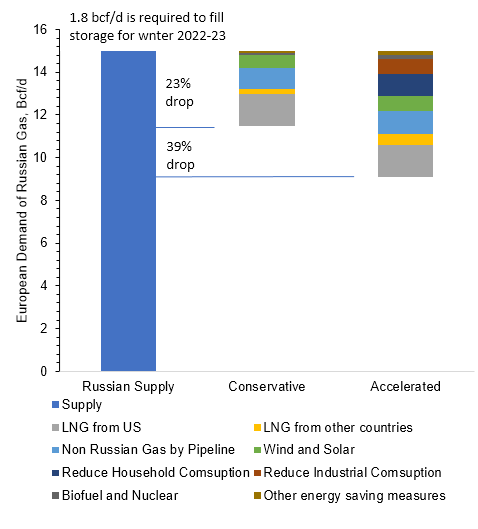

The EU currently consumes 15 Bcf/d of natural gas from Russia, an additional 1.8 Bcf/d is required to fill storage for the winter 2022-23. The EU is currently analyzing multiple scenarios to reduce dependency on Russian gas. Incorrys presents its own assessments of Russian gas replacement before the end of 2022 conservative and accelerated*:

Conservative Scenario – Russian gas imports are reduced by 23% (21% with storage requirements) before the end of 2022.

Accelerate Scenario – Russian gas imports are reduced by 39% (35% with storage requirements).

In both scenarios Europe must rely on increased LNG imports. Around 1.5 Bcf/d of incremental supply will need to come from US and another 0.2 – 0.5 Bcf/d from other countries. Since the current LNG market is tight, sourcing additional LNG supply to the EU may lead to increased LNG pricing worldwide. Gas supply by pipeline from other countries (Algeria, Norway, and Azerbaijan) can grow by 0.5 – 0.8 Bcf/d. In can be partially achieved by reducing methane leaks and flaring. Additional wind and solar power generation capacity will reduce gas demand by 0.6 – 0.7 Bcf/d. The Accelerated Scenario also includes reductions in household and industrial consumption. Turning down the thermostat for heating by just 1°C would reduce gas demand by 1 Bcf/d. Industrial demand can be lowered by reducing, or even shutting down, production at some industries, including fertilize and steel. The Accelerated Scenario also includes extending the life of nuclear plants and more a extensive use of biofuel.

See also:

Russian Natural Gas Exports

Russian Gas Export to Europe

Russian Oil Export

References:

* Accelerated scenario uses data from IEA’s A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas