Your cart is currently empty!

The Business Case for Canadian LNG – Part 2

April 23, 2025

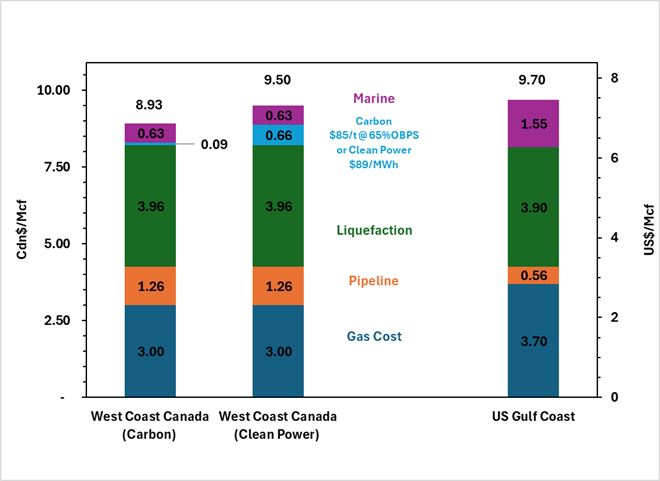

In this Part 2, we examine the competitive economics for west coast Canada LNG. As we will demonstrate, the economics are in west coast BC’s favour when compared to US Gulf Coast (USGC) Projects. It is only after costs associated with made-in-Canada legislation and policies are included, that major LNG Projects, on the scale of LNG Canada, are challenged.

April 15, 2024

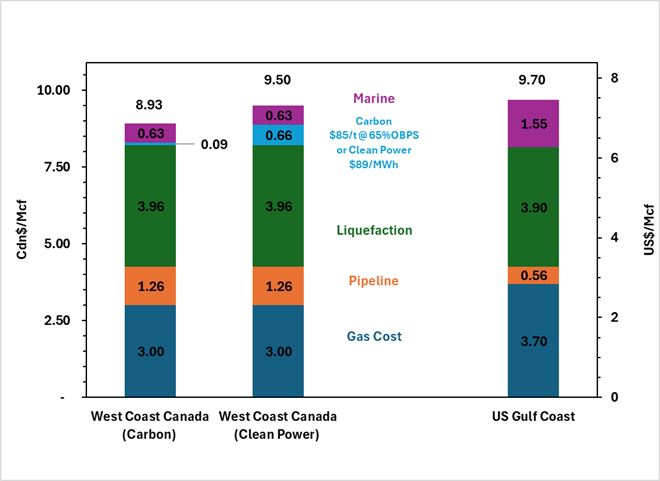

Natural gas power generation has a significantly lower CO2 emissions intensity than coal-fired power. Further, Canada also has lower ambient temperatures than most other LNG producing jurisdictions resulting in much lower CO2 emissions intensity than competing LNG projects in Australia, the US Gulf Coast (USGC) and Qatar.

Incorrys analyzed LNG Canada’s 3.2 Bcf/d of gas exports, and their net impact on global GHG emissions, if used to displace coal-fired power generation in Asia (“displacing heavier hydrocarbons” as Minister Wilkinson suggests). For the LNG Canada project alone, which is due to come online in 2025, Incorrys forecasts a minimum* net reduction in global GHG emissions of 75 mtpa of CO2e.

January 9, 2024

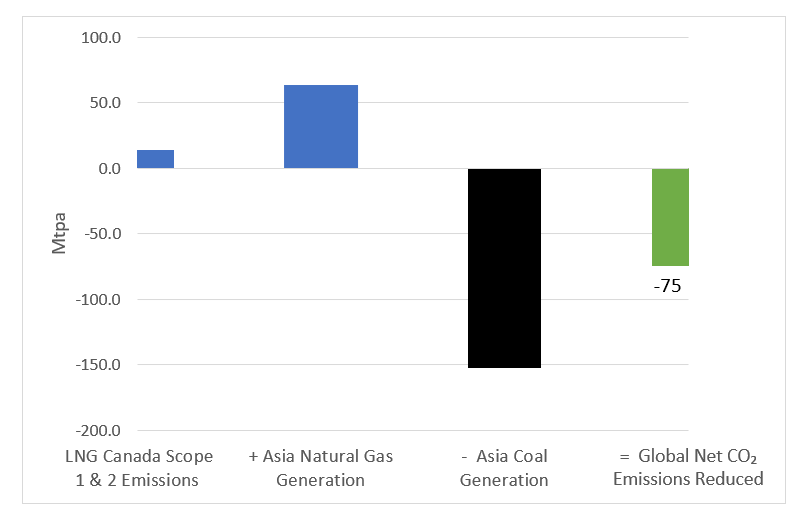

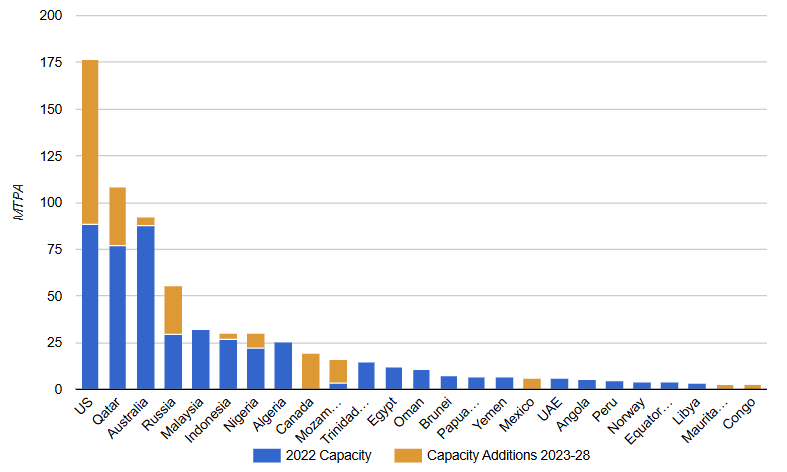

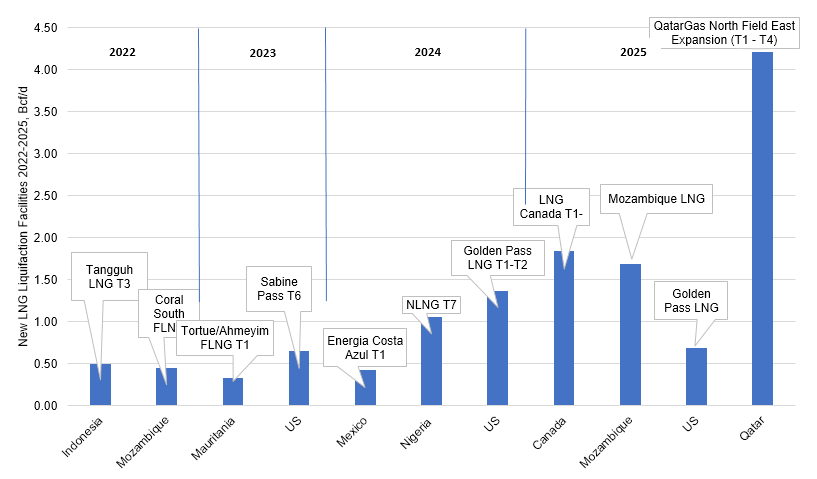

Global LNG liquefaction capacity growth from 2022-2028 in mtpa and Bcf/d equivalent. Additional charts showing 2022 LNG exports by country and 2028 liquefaction capacity by country.

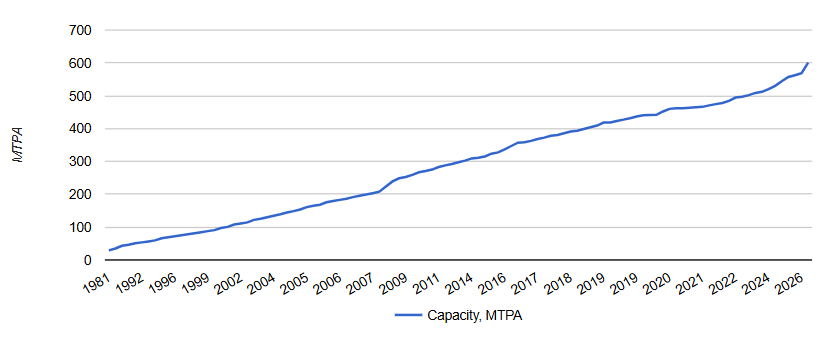

A total of almost 20 million tons per annum (mtpa) of new LNG liquefaction capacity was brought online in 2022, pushing the global total to over 475 mtpa, a 4% increase over the 456 mtpa in 2021. In total, global liquefaction capacity is expected to reach almost 685 mtpa (about 90 Bcf/d of natural gas) in 2028, up over 200 mtpa (~40%) from 2022.

January 11, 2024

Global LNG liquefaction capacity stood at 476 mtpa (62 Bcf/d) by 2022. In July 2023, projects totaling 207 mtpa(27 Bcf/d) are being developed globally.

January 11, 2024

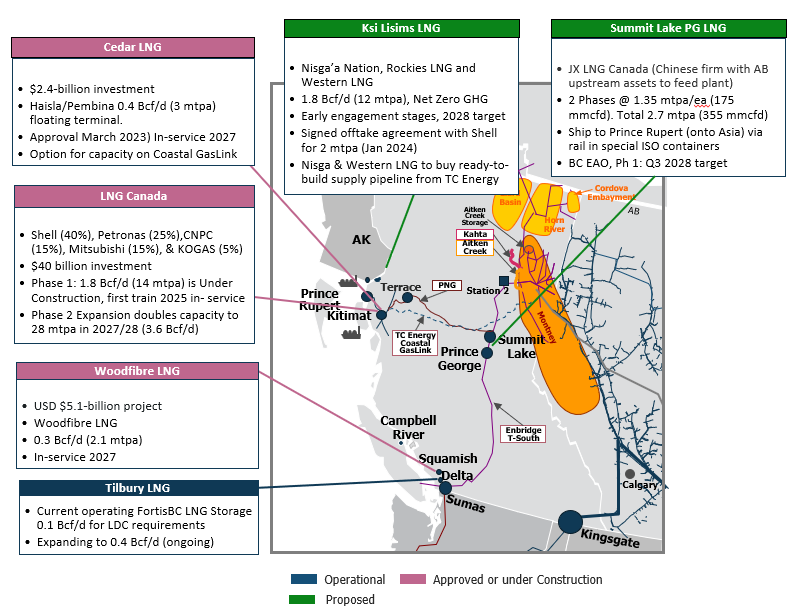

Status of the operational, under-construction, and proposed Canadian liquefied natural gas (LNG) projects, including capacities and in-service dates. Access to pipeline connectivity is a crucial piece for developing western Canada LNG export liquefaction projects.

January 12, 2024

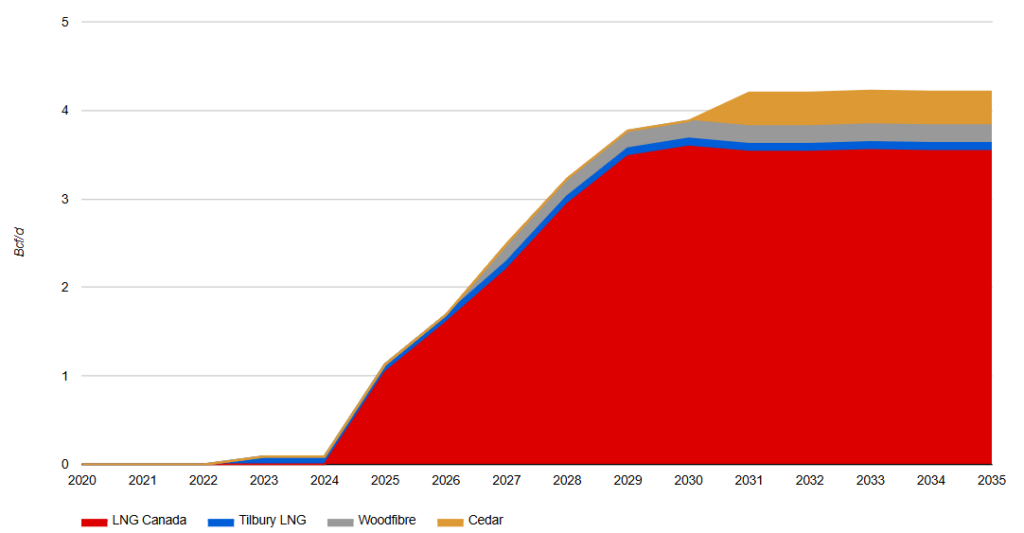

Forecast to 2035 of Canadian liquefied natural gas (LNG) exports led by Shell’s LNG Canada facility on the west coast. Also discusses the impact LNG Canada will have on Canada’s supply/demand. Additional map showing the locations and pipelines supplying facilities.

LNG exports are the largest Canadian demand driver over the last half of the decade as LNG Canada is expected to begin exporting in 2025. Completion of LNG Canada’s second train moves their total demand to 3.6 Bcf/d by 2030 and, coupled with the 0.3 Bcf/d from two smaller terminals (Tilbury and Woodfibre) in BCs lower mainland yields total Canadian LNG exports of 3.9 Bcf/d by 2030.

January 11, 2024

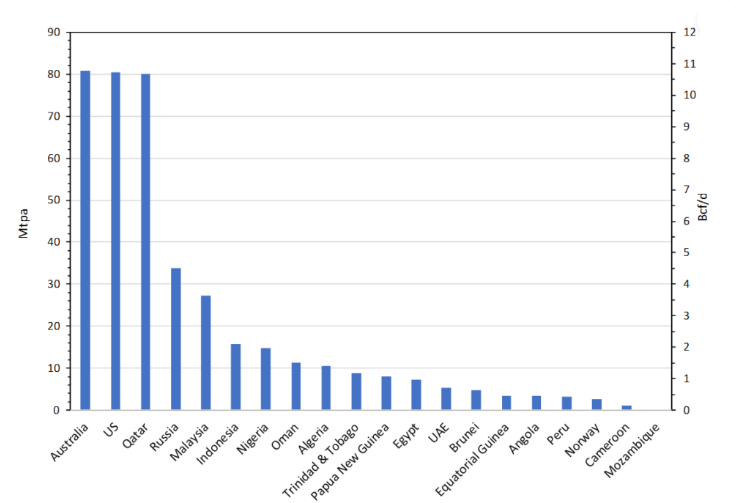

Liquefied natural gas (LNG) exports, by country, for 2022 in MTPA (million tons per annum), led by Australia, US, and the Qatar. In 2022, there were 20 countries exporting LNG led by Australia, the US, Qatar, Russia, and Malaysia. Combined, these top exporters accounted for 75% of the world total.

February 16, 2024

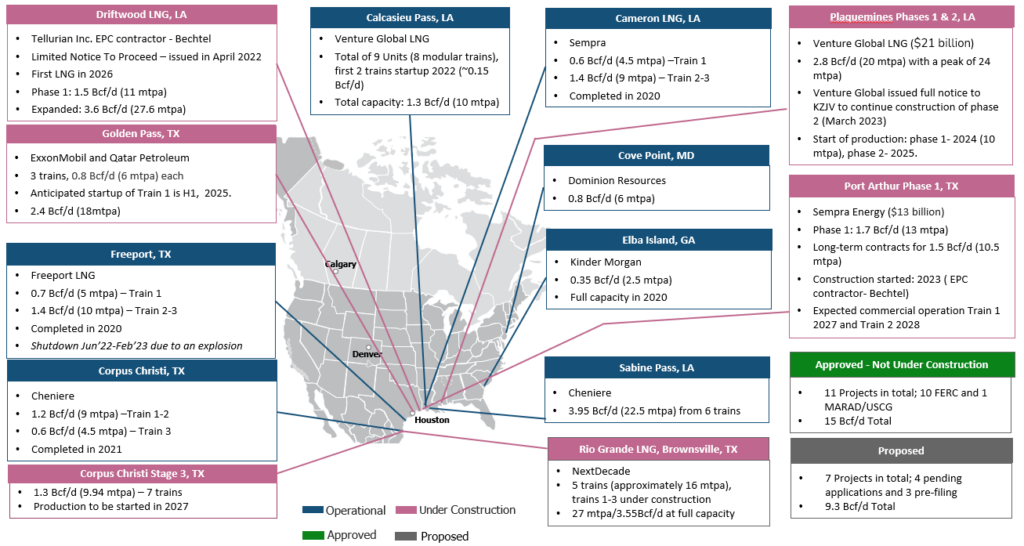

Status of the operational and under-construction US liquefied natural gas (LNG) export projects, including capacities in million tonnes per annum (MTPA) and in-service dates.

The U.S. became the world’s largest LNG producer by installed capacity in 2022 driven by the boom in LNG plant construction. As of today (July, 2023) there are 5 projects under construction phase in USA (with total capacity above 88 mtpa or 11.7 Bcf/d). These projects represent almost 100% of the current capacity in USA (12,3Bcf/d) and planned to be on full capacity already in Y2028.

January 11, 2024

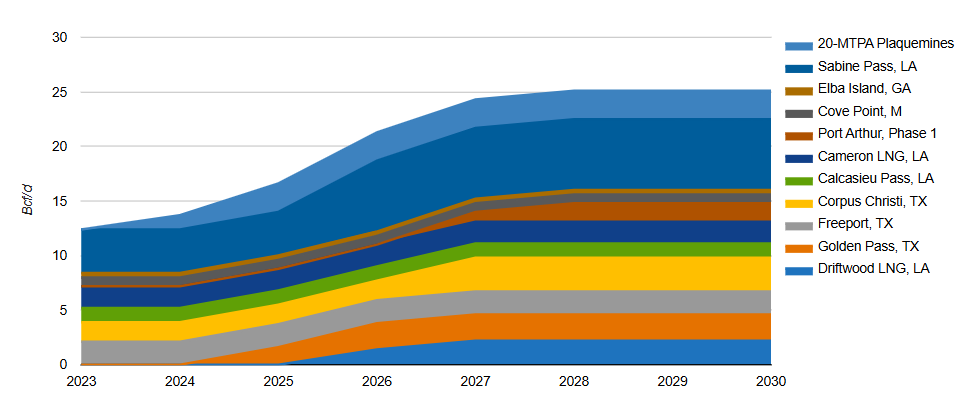

Forecast to 2030 of North American liquified natural gas (LNG) exports from 9 US and 1 Canadian facility. Additional map showing the locations of the facilities. LNG Exports are expected to increase over the next decade as Henry Hub pricing continues to offer worldwide buyers the ability to transact in a highly liquid and transparent market.

January 11, 2024

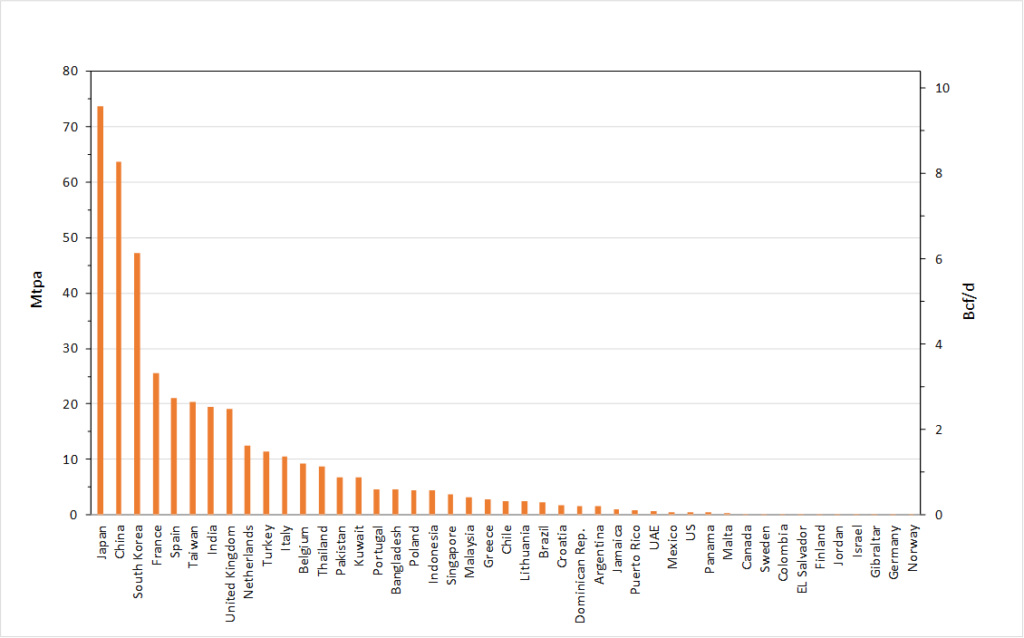

Liquefied natural gas (LNG) 2022 imports by country, in MTPA (million tons per annum), led by Japan, China, and South Korea. Global LNG trade reached a new record of over 400 mtpa (53 Bcf/d) in 2022 with El Salvador (0.2 mtpa) and Germany (0.07 mtpa) joining the ranks. In total, there are now 46 countries importing LNG worldwide.

January 11, 2024

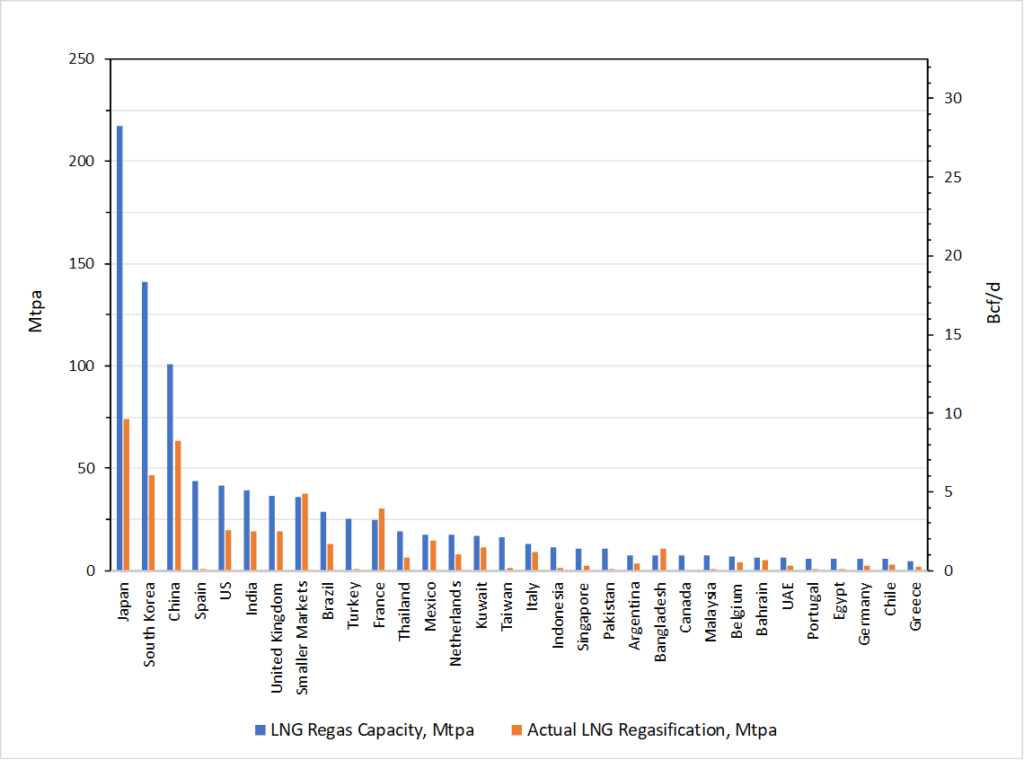

In 2022, Japan, South Korea, and China had the largest liquefied natural gas (LNG) regasification capacity in the world. Early last year, 39 countries had LNG receiving capabilities .

January 11, 2024

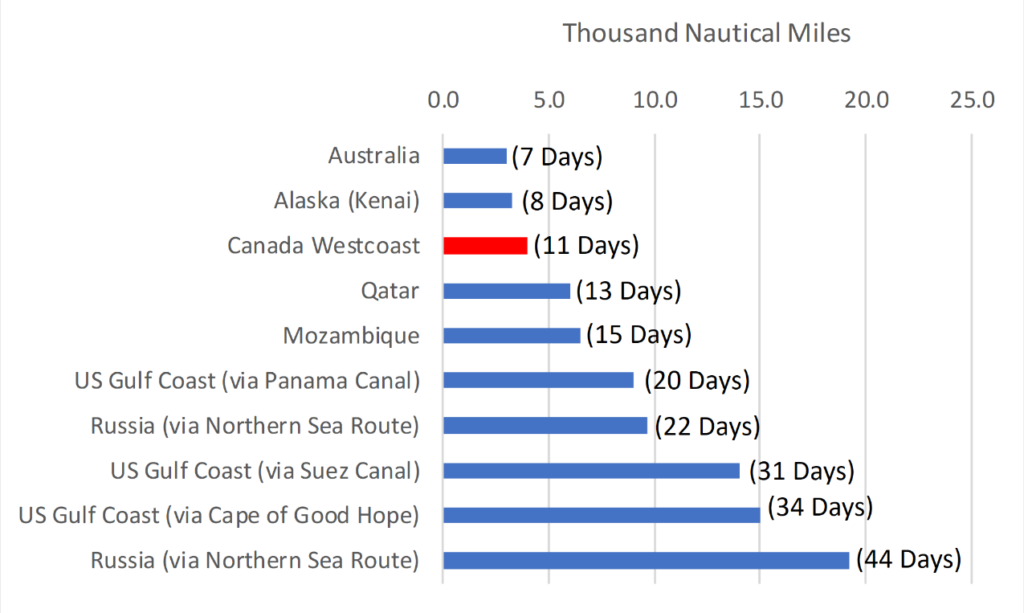

Shipping costs are a large component of the delivered price of LNG. The longer the voyage, the higher the transportation costs.

January 11, 2024

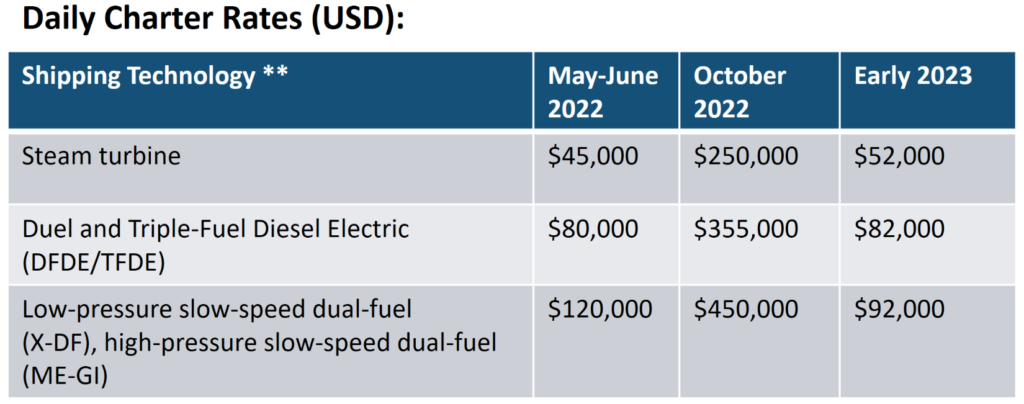

2022 charter rates for shipping LNG by technology type. At the beginning of 2022, charter rates eased briefly before ticking upwards with the start of the Russian invasion of the Ukraine in February. This sparked increased LNG demand in Europe pushing charter rates higher.

January 11, 2024

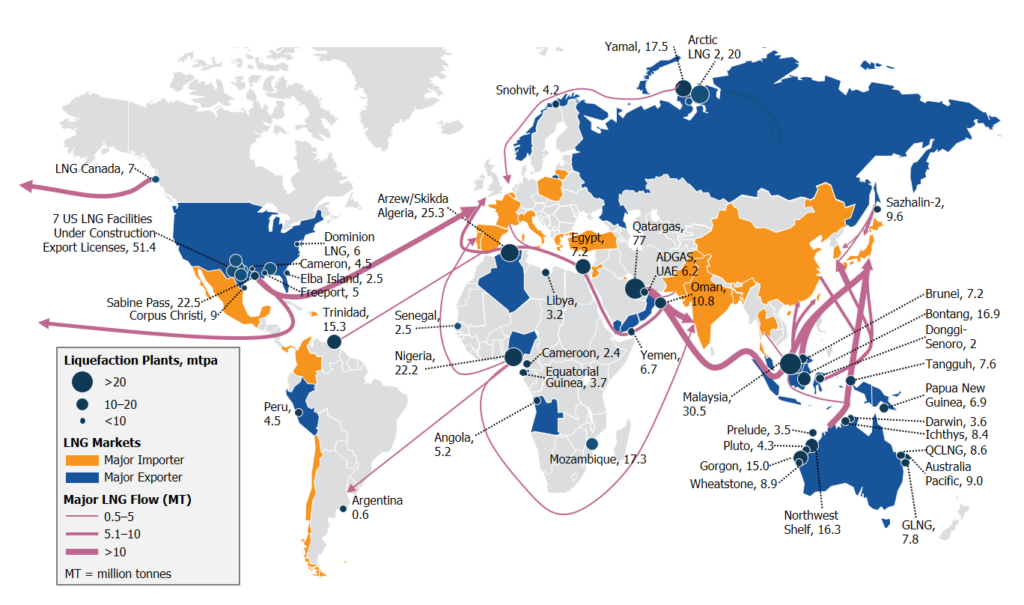

Worldwide liquefied natural gas (LNG) liquefaction facilities (operating and under construction), shipping routes, and flows. LNG is flowing to Europe and east Asian markets primarily from the Middle East, Indonesia, Malaysia, Australia, and recently the US.

January 11, 2024

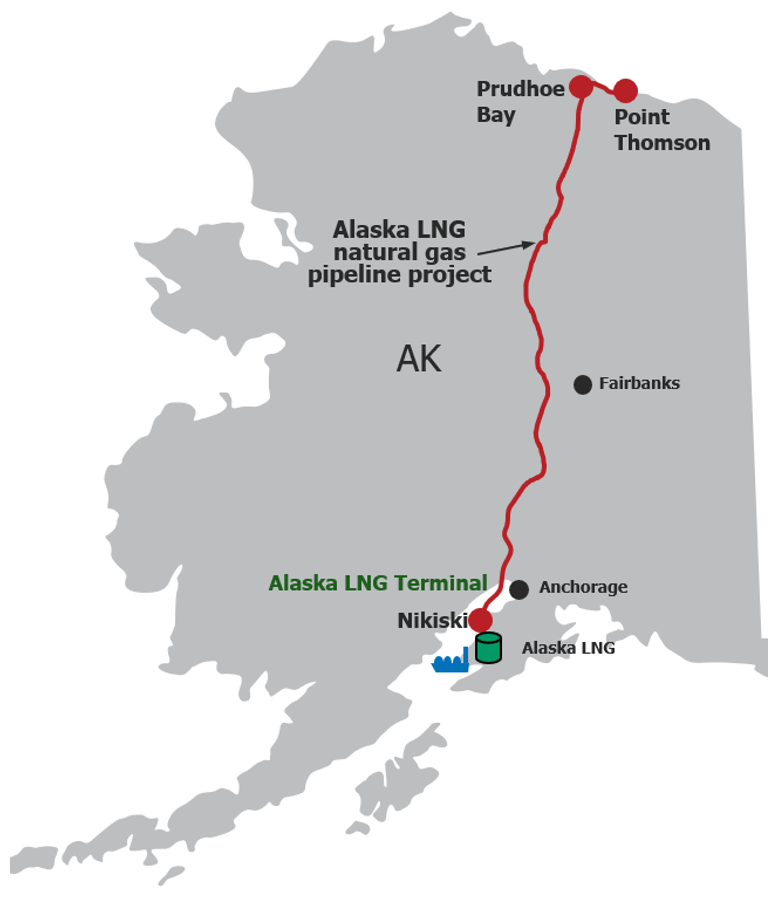

The Alaska liquefied natural gas (LNG) project and corresponding pipeline, from the North Slope to southcentral Alaska. Proponent: Alaska Gasline Development Corporation (AGDC)

January 11, 2024

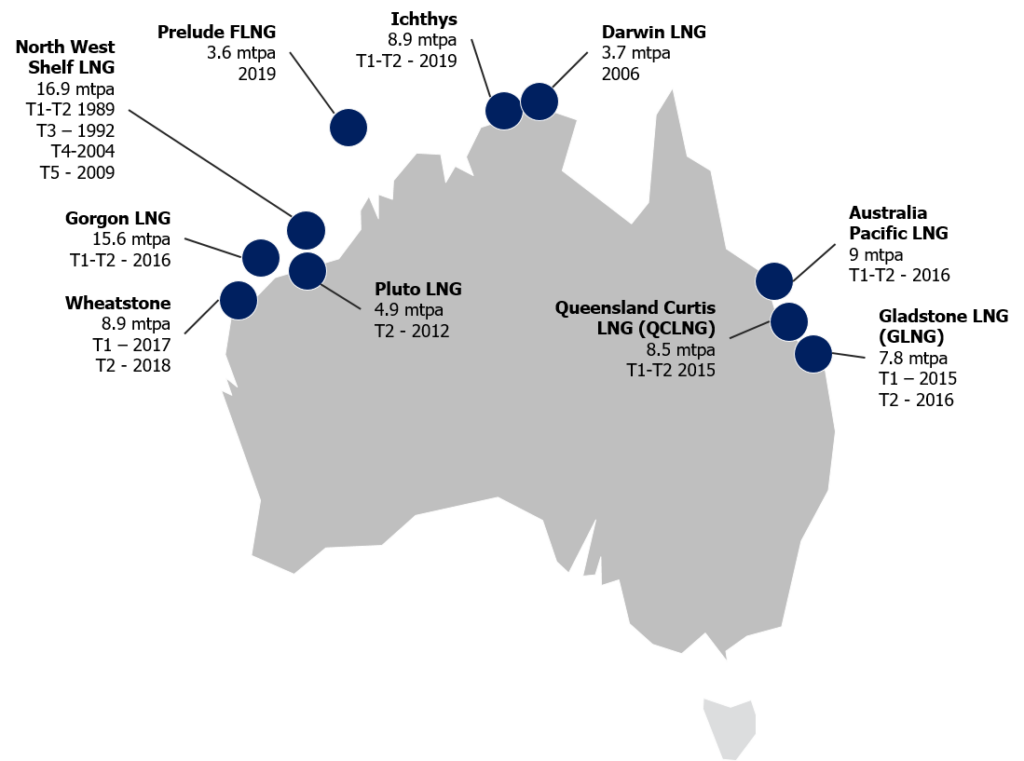

Australian liquefied natural gas (LNG) export projects with capacity and operating in-service dates. Currently, Australia has ten operating LNG export facilities; the largest facility is Gorgon, developed by Chevron, ExxonMobil, and Shell.

April 15, 2025

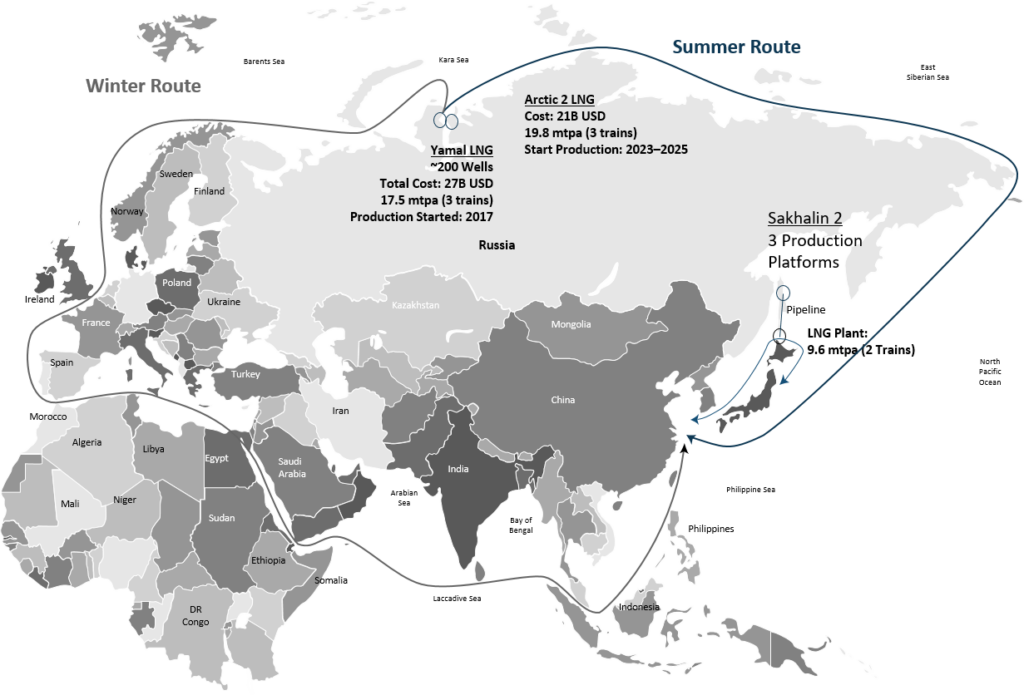

Russian liquefied natural gas (LNG) projects showing capacity in million tones per annum (MTPA), operating in-service rates and seasonal shipping routes. The majority of Russian LNG produced will be shipped to the Asia/Pacific region (mostly China) through the Bering Strait in the summer and the Suez Canal in the winter.

November 3, 2021

Forecast of world liquefied natural gas (LNG) liquefaction capacity growth through 2025, in MTPA (million tons per annum). Early last year, liquefaction projects totaling 900 MTPA were proposed, primarily in the US and Canada, although most will be uneconomical and not be built.

April 8, 2022

World liquefied natural gas (LNG) liquefaction capacity growth in Bcf/d, by country and project, between 2022 and 2025. LNG imports to Europe is one of the supply sources intended to replace natural has from Russia. The US plans to deliver an additional 15 Bcm (1.5 Bcf/d) by the end of 2022 with additional annual increases in the years ahead.

April 7, 2022

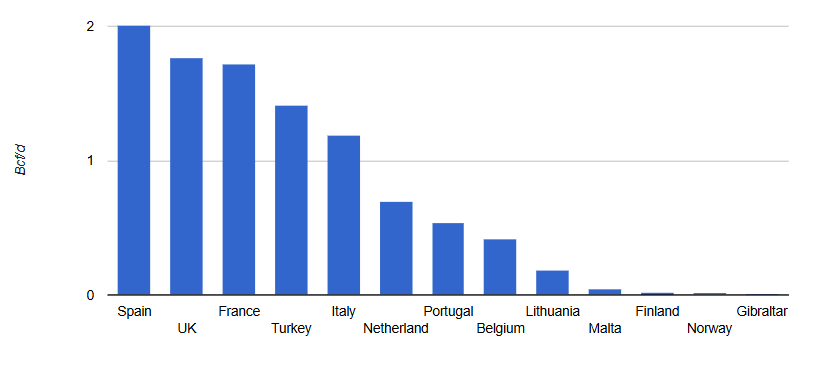

European liquefied natural gas (LNG) 2020 imports by country, in Bcf/d, led by Spain, UK, and France. There are currently 37 LNG regasification terminals located throughout Europe, of which 26 are located in EU member states.