Your cart is currently empty!

June 28, 2023

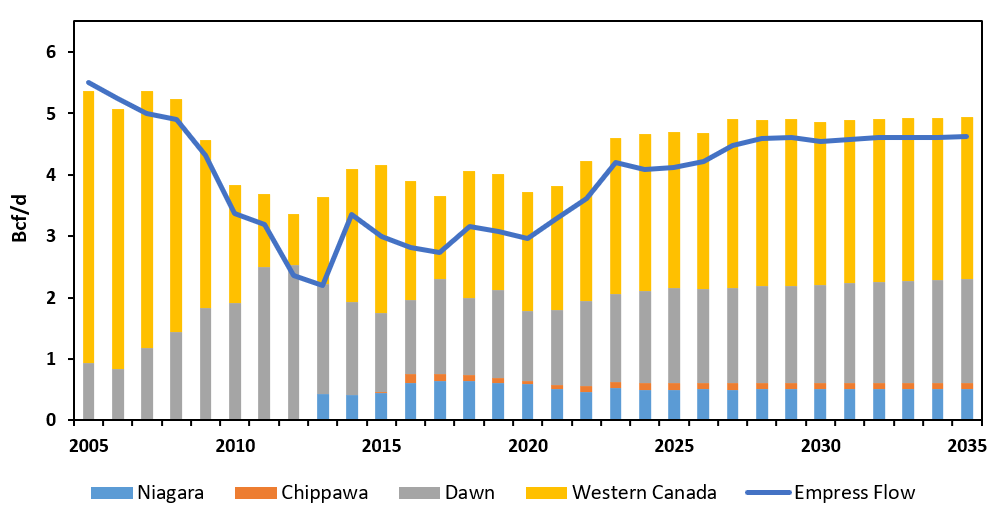

In 2005, 84% of the 5.4 Bcf/d of market requirements was sourced from Western Canada with just under a 1 Bcf/d of Dawn imports to accounting for the remainder. It also illustrates the competition with Marcellus shale flows as Empress flows from Western Canada declined over 50% from about 5.5 Bcf/d in 2005 to just over 2.0 Bcf/d by 2013; Dawn and Niagara/Chippawa increased in market share to 61%. A toll settlement post 2013 resulted in a recovery in Empress flows into the 3 Bcf/d range through today.

Additionally, a couple of creative tolling agreements on the TC mainline in terms of a Dawn long-term fixed-price proposal and the North Bay fixed-price proposal that have uptake and provide about 2.0-2.5 Bcf/d of firm long-term committed pipeline capacity at a toll that is fixed. People who utilized uptake for that capacity now have certainty in terms of tolls going forward. As the increased demand in the Eastern Triangle ticks up, we’ll see marginal sources from Western Canada where we have low cost Montney supply. Enhancements on the NGTL system in Alberta provides egress options for that Montney supply, which has been constrained.

As we go forward, Niagara and Chippewa go from export pipeline to import pipelines bringing gas into the eastern triangle and taking some market share from Dawn. By 2020, Western Canada share had decreased by almost half to 45%, with imports at Dawn (Vector now bi-directional serving Unita gas to both Chicago and Ontario) and Niagara/ Chippawa increasing in market share to 55%.

In 2035, Incorrys expects market share of supply sources to stabilize at about 50:50 with commitments to long-term pipeline capacity and increased power demand resulting from shuttered Ontario Nuclear capacity. Underpinned by Dawn and North Bay LTFP commitments, Empress flows are expected to reach 4.4 Bcf/d by 2025 and 4.6 Bcf/d by 2035.

See Also:

Canadian Natural Gas Exports by Pipeline Forecast to 2035

Eastern Triangle Demand Forecast to 2035

Eastern Triangle Exports Forecast to 2035