Your cart is currently empty!

June 21, 2023

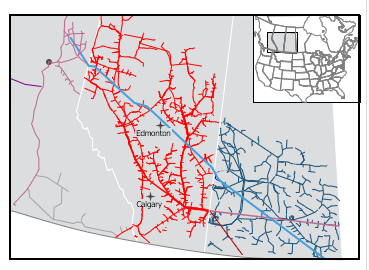

There’s about 300- 400 MMcfd of production from Saskatchewan that’s not included to give a sense of allocation from various western pipe.

On the bottom we have Oil Sands located North and East of Edmonton.

Next there is Alberta and T-North demand mainly to meet core residential/commercial heating demand plus some industrial demand. Much of the industrial demand is located around the Edmonton area in the Alberta Heartland Industrial zone to support plastics and NGL processing.

On top of that is the TransCanada mainline coming from Empress at the Alberta/Saskatchewan border and Northern Border Pipeline.

Alliance Pipeline from northeast BC picks of gas in the Montney region in Alberta as well. Some production is also picked up in eastern Alberta and Saskatchewan, but not very much.

Station 2 flows into the Westcoast system in northeast BC and flows down to the lower mainland Vancouver area and exports at Sumas into the Pacific Northwest.

GTN basically flows from North of Calgary, down into interior BC and then exported at Kingsgate into the GTN system to California.

As we go forward, BC LNG basically provides the basis for how much supply is required from the Alberta Montney area. We expect supply to grow at a strong pace of 3.5% a year from 2022-2030 driven by the BC LNG development. Supply growth flattens out post 2030.

With Saskatchewan supply declining over the last decade or so, the Alberta Montney provides most of the growth from this shale gas area, with a lot of liquids production.

Essentially, supply growth is dependent on natural gas demand requirements.

Western Canadian Pipeline System

See Also:

Canadian Natural Gas Exports by Pipeline Forecast to 2035

Canadian Natural Gas Supply-Demand Balance Forecast to 2030

Eastern Triangle Demand Forecast to 2035