Your cart is currently empty!

January 12, 2024

Canada enjoys shorter shipping distances (and therefore costs) to both Asia and Europe compared to most LNG exporting countries, and lower ambient temperatures make liquefaction more efficient and less carbon intensive.

Canada’s Montney, Liard and Horn River shale plays can support several more Canadian LNG export projects which could offset most of Canada’s total CO2 emissions, and certainly all of Canada’s emissions from the oil and gas sector.

Since 2011, 18 LNG export projects have been proposed in Canada (13 in BC, 2 In Quebec, and 3 in Nova Scotia). Combined, they represent over 200 mtpa of capacity (29 Bcf/d).

Today, only 1 small facility is operating, 3 are approved or under construction and 1 is proposed. In total, they represent about 30 mtpa.

The Shell led LNG Canada is nearing completion with deliveries from the first train (0.9 Bcf/d) expected in 2025. Incorrys expects the complete 2 phase, 4 train facility (3.6 Bcf/d) to be fully operational before 2030.

LNG Exports are the largest growth driver of Canadian natural gas demand growing to 3.9 Bcf/d (30 mtpa) by 2030 with LNG Canada accounting for over 90% of the total.

A smaller lower mainland project (Tilbury) is expected to begin exports in 2023 with Woodfibre’s net-zero facility starting in 2027. Overall Lower mainland exports reach 0.3 Bcf/d by 2030.

Potential for 0.4 Bcf/d Cedar LNG Haisla Nation/Pembina project in 2031 (have an option for capacity on the Coastal GasLink pipeline that feeds LNG Canada).

Ksi Lisims (12 mtpa) Project FID would be required very soon to fall within this forecast window.

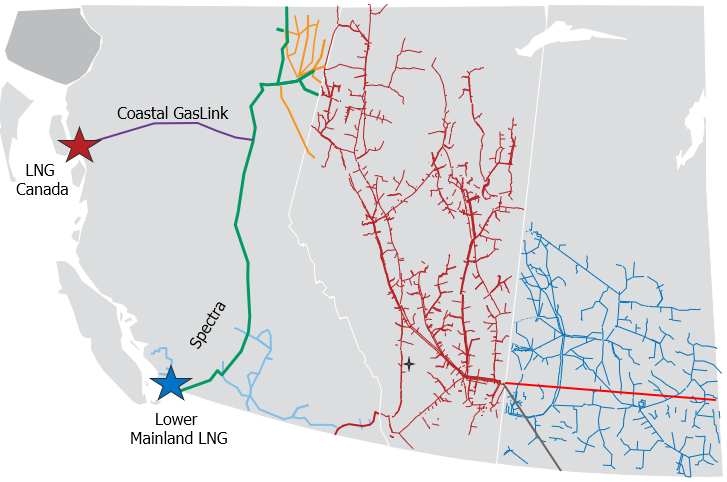

Map of Western Canada Pipelines Supplying LNG Projects

See Also:

West Coast Canada LNG Export Projects by Status

Liquefaction Capacity by Country Forecast to 2028

LNG Shipping Distances To Asia (Approximate)

LNG Export & Import Shipping Routes