Your cart is currently empty!

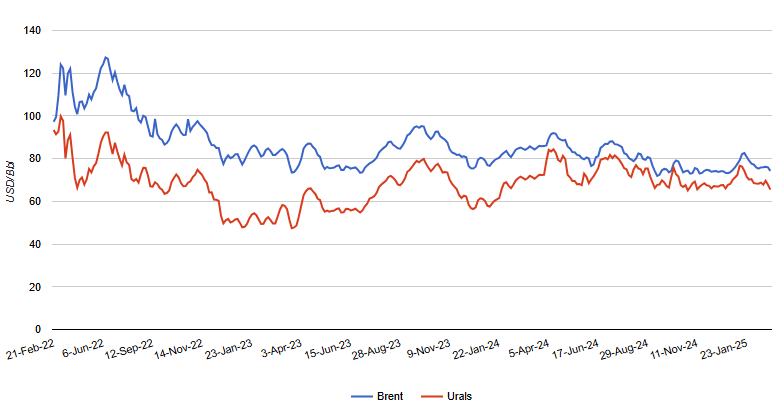

Brent / Urals Differential 2022-2025

March 13, 2025

The weekly Brent oil price and Russia’s Urals oil price (USD/Bbl), from February 2022 through February 2025, illustrates the price differential between these two prices.

Since April 2022, the Urals price has been about 70% of Brent. Should Brent fall to $72, Russian oil revenue will be insufficient to balance the Russian budget. If it drops to $60, a significant portion of Russian oil production will become uneconomical.

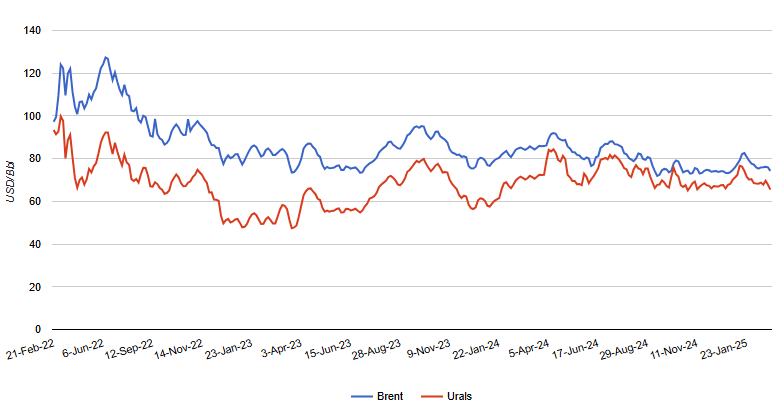

October 5, 2022

Compares the cost of Russian oil to the expected price cap of USD $40-60/bbl and the Q3 2022 prices for both the Urals and Brent prices. Additional chart showing the Urals price forecast to 2025 used for the Russian budget projections. Explores the impact of the proposed price cap on Russian oil as part of the sanctions being imposed by the G7 and EU. The goal is to reduce funds flowing to Russia. The price cap plan has both pros and cons.

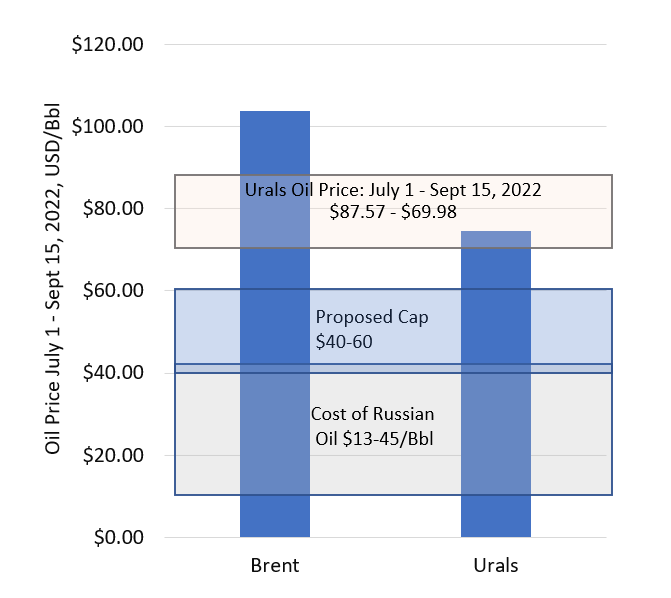

August 15, 2021

How changes in various supply and demand fundamental drivers impact Henry Hub natural gas prices over the 2021-30 time period. The largest contributors are natural gas for the electric generation sector, liquefied natural gas (LNG) exports, and supply growth.

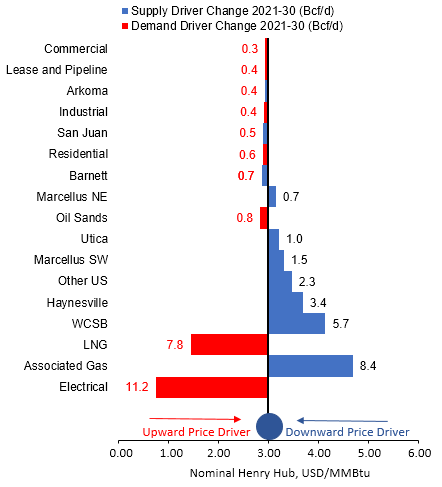

August 16, 2021

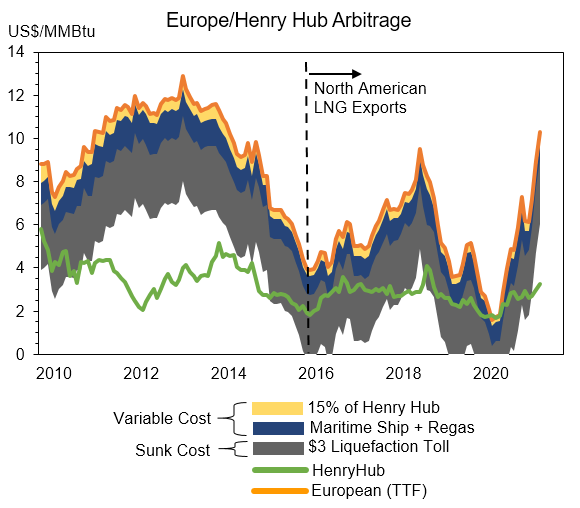

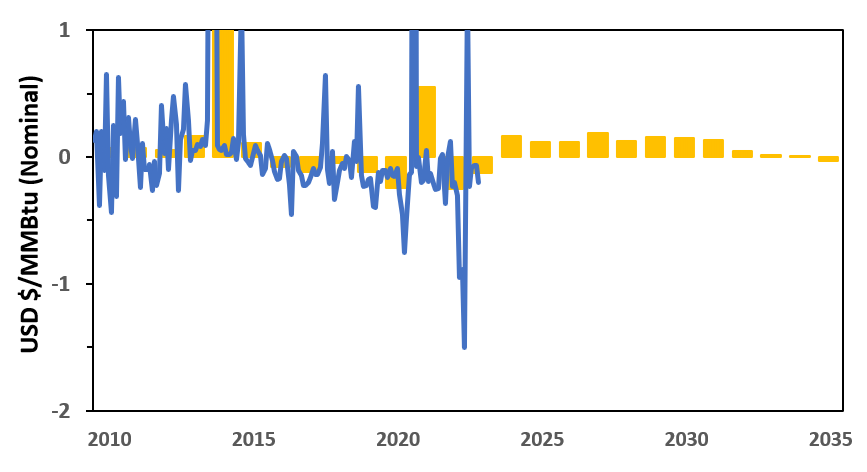

Illustrates the historical impact of the European Title Transfer Facility (TTF) liquefied natural gas (LNG) price spreads on Henry Hub prices. From 2010 to 2015, European pricing was well in excess of North American pricing, even considering cost of liquefaction and shipping. This drove the rapid development of liquefaction capacity in the US.

April 15, 2025

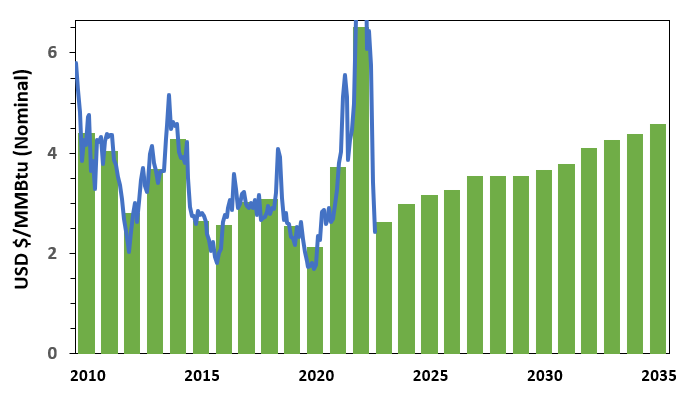

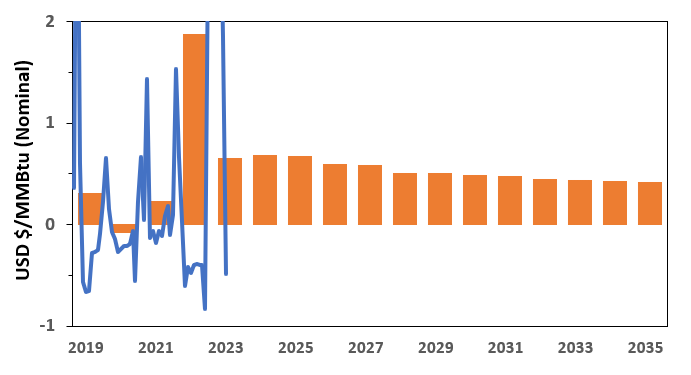

Henry Hub monthly and annual natural gas prices (USD/MMBtu) from 2010-2022 and Incorrys annual price forecast from 2023-2035.

Uncertainty in 2020 commodity markets, mainly due to Covid, saw natural gas prices drop significantly from 2019 with Henry Hub prices down by 30%. As the markets recover, Incorrys expects Henry Hub prices to generally escalate over the forecast period. However, prices increased rapidly over the past 2 years to over $6.50 in 2022 driven primarily by energy security concerns following Russia’s invasion of the Ukraine in February 2022. Incorrys expects a more balanced market in 2023 and forecasts Henry Hub prices to escalate over the forecast period.

April 15, 2025

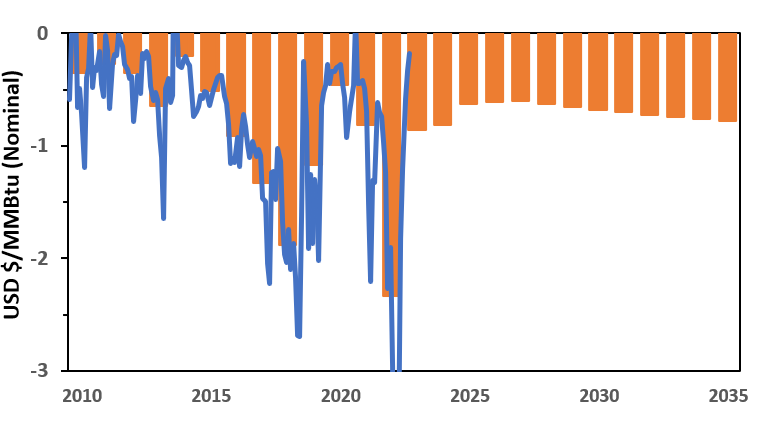

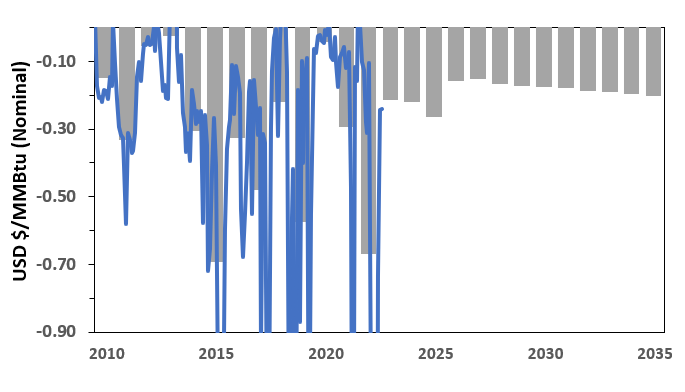

AECO-NIT (Nova Inventory Transfer) actual and annual basis differentials relative to Henry Hub for 2010-2022 and Incorrys annual basis forecast for 2023-2035. Additional information includes the corresponding AECO-NIT natural gas prices.

Incorrys expects the AECO basis to narrow in 2023-2025 as the Henry Hub price resets in 2023, increased pipeline capacity out of Alberta comes online, and the startup of LNG Canada in 2025. The basis differential widens over the remainder of the forecast.

April 15, 2025

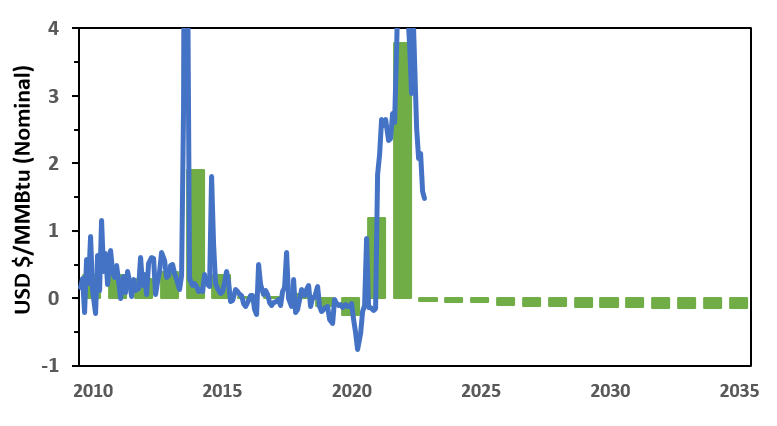

Dawn actual and annual basis differentials relative to Henry Hub for 2010-2022 and Incorrys annual basis forecast for 2023-2035. Additional information includes the corresponding Dawn natural gas prices.

This past winter proved difficult for Dawn/US Northeast pricing; colder than normal, competing with Europe for LNG availability, and high fuel oil pricing. A return to more normal weather conditions and better European supply security should bring more normalized pricing to Dawn.

April 15, 2025

Chicago actual and annual basis differentials relative to Henry Hub for 2010-2022 and Incorrys annual basis forecast for 2023-2035. Additional information includes the corresponding Chicago natural gas prices. Chicago continues to be well supplied in summer and competes for natural gas supply in winter months.

April 15, 2025

Malin actual and annual basis differentials relative to Henry Hub for 2010-2022 and Incorrys annual basis forecast for 2023-2035. Additional information includes the corresponding Malin natural gas prices. Strong basis as California and the Pacific NW continues to struggle with security of supply in meeting winter peak-day requirements due to lack of storage and pipeline development.

April 15, 2025

Station 2 actual and annual basis differentials relative to AECO NIT for 2010-2022 and Incorrys annual basis forecast for 2023-2035. Additional information includes the corresponding Station 2 natural gas prices.

Increased Station 2 connectivity to AECO-NIT is expected to lead to less seasonal volatility thereby narrowing the basis. The largest impact in the forecast occurs in 2025 when LNG Canada begins operations.

April 15, 2025

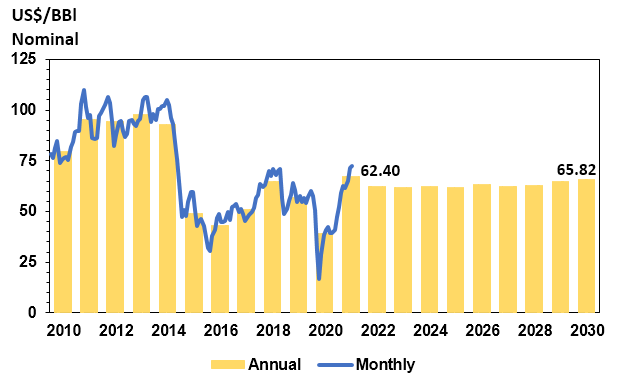

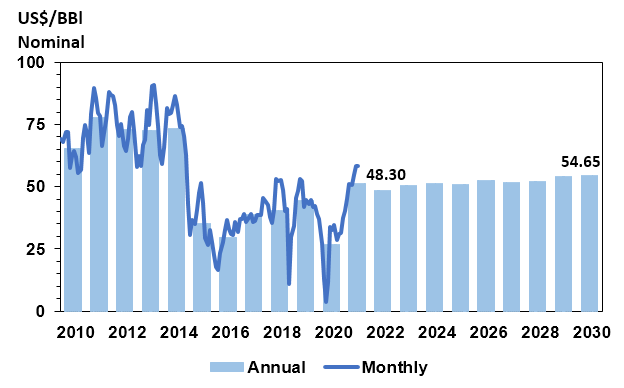

West Texas intermediate (WTI) monthly and annual crude oil prices since 2010 and Incorrys annual price forecast to 2030. Uncertainty in 2020 commodity markets, mainly due to Covid, also saw crude oil prices drop significantly from 2019 with WTI down about 50%. Incorrys expects the West Texas Intermediate (WTI) price to increase marginally through 2030.

April 15, 2025

Western Canada Select (WCS) actual and annual crude oil prices since 2010 and Incorrys annual price forecast to 2030. Additional information includes the corresponding basis differentials to West Texas Intermediate (WTI) price. WCS 2020 prices were down 60% year-over-year, again, primarily due to the impact of Covid. Incorrys expects the Western Canada Select price to increase slowly through to 2030.