Your cart is currently empty!

July 11, 2024

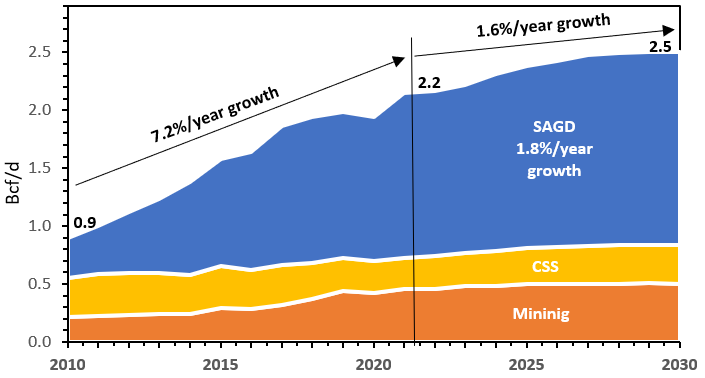

Natural gas requirements for Canadian oil sands grew at an average annual rate of 7.2% from 2010 through 2023 from under 1 Bcf/d to 2.2 Bcf/d. This strong growth is primarily due to growth in the natural gas intensive in situ operations.

Incorrys is forecasting annual growth in oil sands natural gas demand to slow to 1.6% from 2023 to 2030 as the rate of in situ slows.

Observations:

- Natural gas demand for mining grew from 0.2 Bcf/d in 2010 to almost 0.5 Bcf/d in 2023. Incorrys is forecasting gas demand to peak at 0.5 Bcf/d by 2026 and remain flat thereafter.

- Natural gas demand for CSS is relatively stable at around 0.3 Bcf/d.

- SAGD gas demand increased from 0.4 Bcf/d in 2010 to 1.5 Bcf/d in 2023. Incorrys is forecasting natural gas demand for SAGD to grow through 2030 to almost 1.7 Bcf/d.

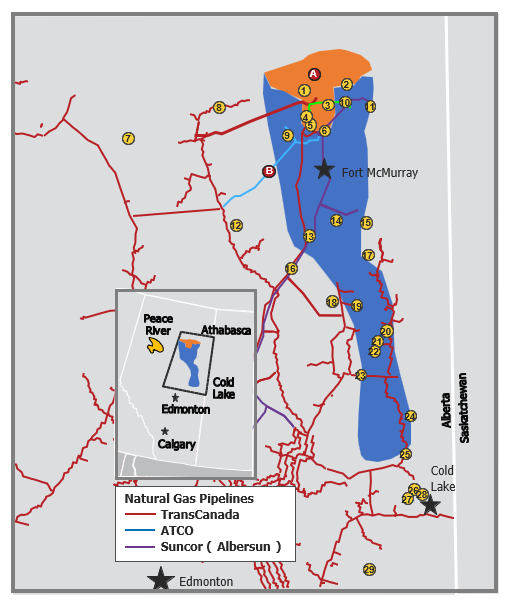

Map of the Region

See Also:

Canadian Natural Gas Exports by Pipeline Forecast to 2035

Canadian Natural Gas Supply-Demand Balance Forecast to 2030

Alberta and Northeast BC Natural Gas Production Allocation Forecast to 2035