October 5, 2022

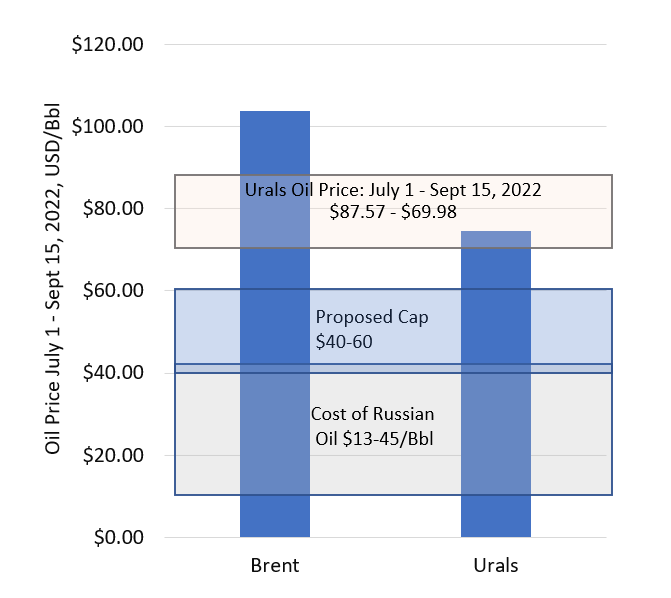

While the G7 and EU have agreed to impose a price cap on Russian oil (applied to the maritime transportation), they are still discussing some of the implementation aspects. In December 2022, the US and allies agreed to set the initial cap at USD $60. While it is expected to change over time, Incorrys expects it to stay range bound between $40-$70/Bbl. The goal is to reduce funds flowing to Russia – below the current market price for Russian oil. Currently, 60% of the Russian government’s income comes from the sale of oil and gas. In the case of a cap, total oil supply will not be reduced, and global oil prices will not be affected as much as sanctions prohibiting the purchase of Russian oil. The cap would also help to lower prices for consumers. The price cap plan has both pros and cons.

How the cap is expected to work.

The price cap will apply worldwide to all countries that have not yet banned Russian oil import by tankers. EU member states with large shipping industries (such as Malta, Greece and Cyprus) will receive some additional exceptions from the price cap. Tankers from these countries will still be able to transport Russian oil if it is priced below the cap. The EU will also establish a monitoring system, which would assess circumvention practices intent on avoiding the price cap. If the EU’s executive found a “significant loss of business” due to evasive measures, the EU would be able to propose mitigation measures against the country to avoid their fallout (source: EURACTIV).

On September 2022, the US Department of Treasury issued the “Preliminary Guidance on Implementation of a Maritime Services Policy and Related Price Exception for Seaborne Russian Oil”. The U.S. defined the cap implementation the following way: “a policy with regards to a broad range of services related to the maritime transportation (the “maritime services policy”) of Russian Federation origin crude oil and petroleum products (“seaborne Russian oil”).” (see https://home.treasury.gov/system/files/126/cap_guidance_20220909.pdf). This document also describes how the process how to avoid circumvention practices related to price cap.

About 95% of the world’s oil tanker fleet is insured by the International Group of Protection & Indemnity Clubs in London and some firms based in continental Europe. Owners of oil tankers belonging to any country will refuse to carry Russian oil if they can’t get high-grade insurance. Also, the operators of the Suez Canal don’t permit uninsured ships to sail through the channel. Government will impose a rule, that the tanker insurance will not be provided if oil is sold above the cap. However, if the price is below the cap, the insurance will be issued. This and other similar measures will help to control purchases of Russian oil with a cap. In response, the Russian government backed reinsurance company Russian National Reinsurance Company provides the reinsurance that British and European insurers refuse to issue.

Pros of the Cap:

- Reductions in Russian oil export volumes will not be as dramatic as they would be under a full ban on Russian oil imports. They can be re-directed, but it should not significantly reduce global oil supply and will not affect an already tight oil market. Some drop in Russian oil production is expected as operating costs in certain areas (basins) would be lower than revenue. The Russian Ministry of Energy expects that Russian oil production will drop 7.5% in 2023 compared to 2022, however the actual drop can be significantly different. Total Russian oil production in October 2022 was 9.9 MM Bbl/d; about the same as a year ago.

Cons of the Cap

- For the cap to work, all major buyers of Russian oil should agree on the maximum price. Since the EU (with some exceptions), the UK, and the U.S. have already stopped buying Russian oil or will stop buying it shortly, the cap must be supported by other buyers, in particular China and India. However, it is unclear if these countries will join a cartel and the U.S. and allies don’t have enough economic instruments to convince them to do it. Although countries such as China and India would be in favor of low prices for Russian Oil, they would prefer to rely on current Ural/Brent differentials, rather than use a cap to reduce the price.

- OPEC may also be against a cap as it may create a precedent and negatively affect oil markets. The introduction of a price cap impacted OPEC+’s recent decision to cut production by 2 MM Bbl/d starting in November 2022.

- If the price cap is too low, Russia may refuse to sell oil to countries which set up the cap as its oil revenue will be lower than cost. In this case, oil prices will increase worldwide and reach $185/Bbl or more. Russia will receive its revenue on smaller volumes but at a greater price. Another option for Russia would be to only sell oil with the cap under certain conditions, which would indirectly compensate Russia for lost revenue.

- The mechanism to control the cap would be complex and has never been tested. Certain companies may try to find a way around the cap; for example, by blending Russian oil with oil from other countries.

- There are significant challenges in calculating the actual cap, due to the difficulties in estimating the cost of Russian oil. The cost of Russian oil ranges from USD $13 to $45, depending on if it is a full cycle cost, half cycle cost, or just operational expenses. It also depends significantly on the production basin. If full cycle cost is used as a basis for the cap, the Russian government may try to use oil sale proceeds to finance the war rather than invest back into exploration and development of future oil projects.

Incorrys Views

According to Russian budget projections, even a Urals price of ~ USD $70 will lead to a budget deficit of 2% of GDP. If the price is less than USD $70, the budget deficit will increase and must be covered by the Russian reserve fund. The price cap may reduce Russian oil revenue, while Ural oil prices remain relatively high (> USD 50-60). Otherwise, Russian oil revenue will decrease without the cap. Russia will try to mitigate the negative effect of an oil price drop by postponing some oil exploration and development and a partial devaluation of currency. Within the next 1 – 1.5 years, a reduction of oil revenue will lead to faster depletion of the Russian reserve fund.

Urals Price (USD) Used for Russian Budget Projections