World Oil And Gas Prices

Brent / Urals Differential 2022-2025

November 17, 2025

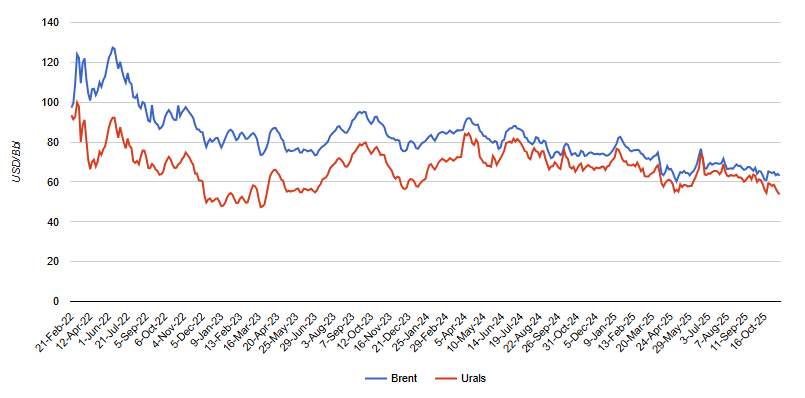

The weekly Brent oil price and Russia’s Urals oil price (USD/Bbl), from February 2022 through November 2025, illustrates the price differential between these two prices.

Since April 2022, the Urals price has been about 70% of Brent. Should Brent fall to $72, Russian oil revenue will be insufficient to balance the Russian budget. If it drops to $60, a significant portion of Russian oil production will become uneconomical.

North American Oil And Gas Prices

Henry Hub Natural Gas Influences (2021-2030)

August 15, 2021

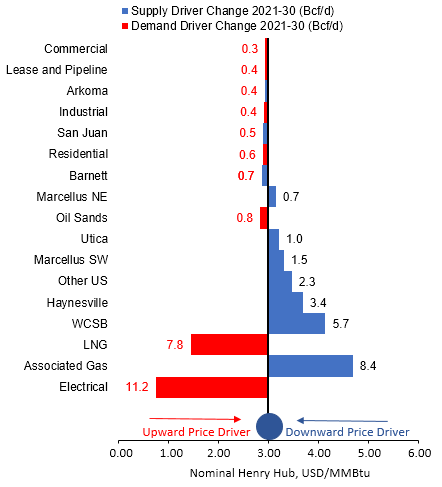

How changes in various supply and demand fundamental drivers impact Henry Hub natural gas prices over the 2021-30 time period. The largest contributors are natural gas for the electric generation sector, liquefied natural gas (LNG) exports, and supply growth.

Worldwide LNG Impacting Henry Hub (2010-2021)

August 16, 2021

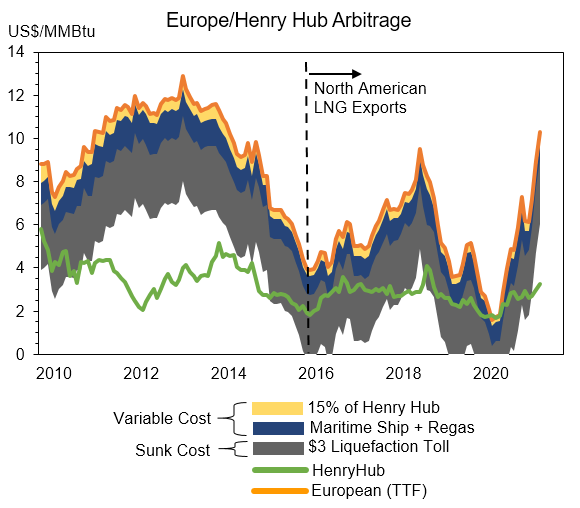

Illustrates the historical impact of the European Title Transfer Facility (TTF) liquefied natural gas (LNG) price spreads on Henry Hub prices. From 2010 to 2015, European pricing was well in excess of North American pricing, even considering cost of liquefaction and shipping. This drove the rapid development of liquefaction capacity in the US.

Henry Hub Price Forecast to 2035

February 09, 2026

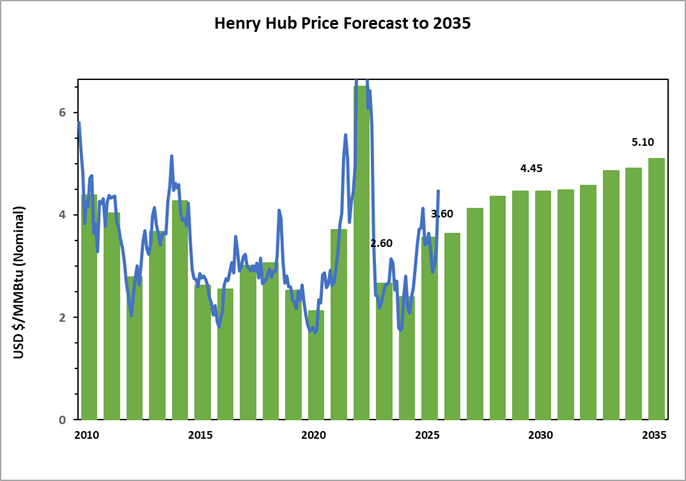

Henry Hub monthly and annual natural gas prices (USD/MMBtu) from 2010-2025 and Incorrys annual price forecast from 2026-2035.

Uncertainty in 2020 commodity markets saw Henry Hub pricing fall, largely due to Covid’s impact that lead to a substantial drop in LNG exports (to 3.1 Bcf/d in September 2020 from 8.0 Bcf/d in January 2020). The lower than expected commodity prices led to underinvestment and a corresponding drop in rig counts and production. The 2020 price of 2.13 USD/MMBtu is down 30% from the $3.00+ seen in 2018 and 2019.

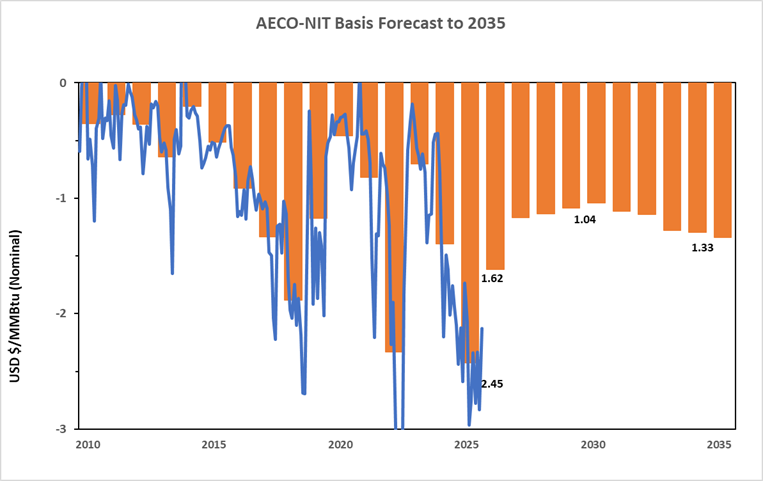

AECO-NIT Basis and Price Forecast to 2035

February 09, 2026

AECO-NIT (Nova Inventory Transfer) actual and annual basis differentials relative to Henry Hub for 2010-2025 and Incorrys annual basis forecast for 2026-2035. Additional information includes the corresponding AECO-NIT natural gas prices.

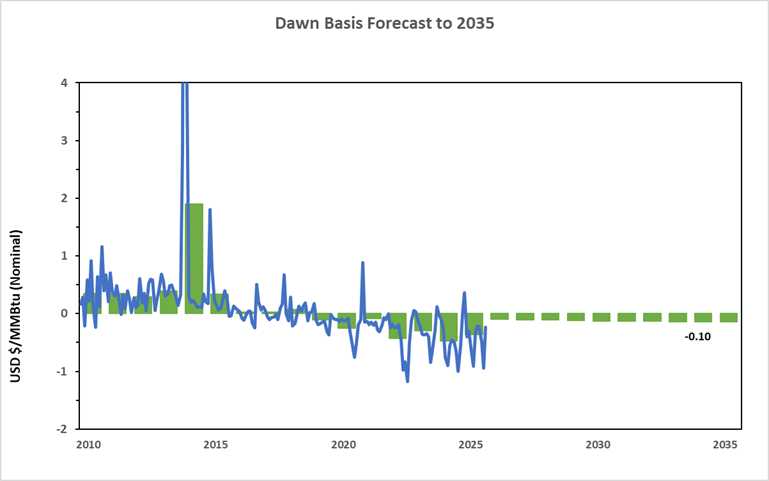

Dawn Basis and Price Forecast to 2035

February 09, 2026

Dawn actual and annual basis differentials relative to Henry Hub for 2010-2025 and Incorrys annual basis forecast for 2026-2035. Additional information includes the corresponding Dawn natural gas prices.

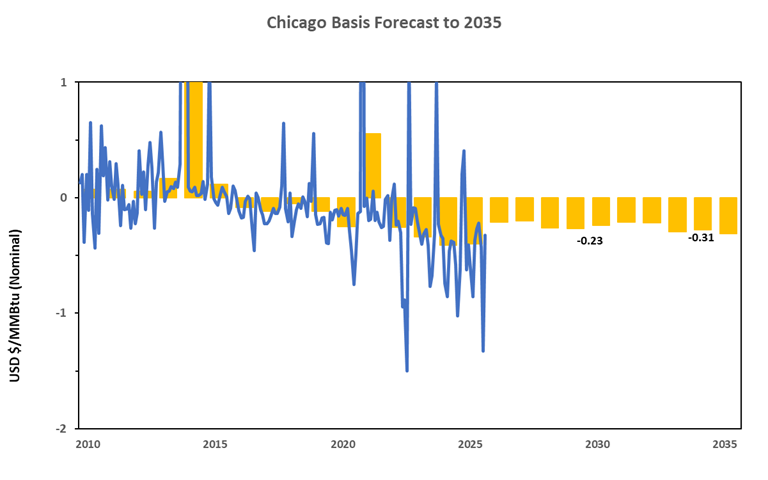

Chicago Basis and Price Forecast to 2035

February 09, 2026

Chicago actual and annual basis differentials relative to Henry Hub for 2010-2025 and Incorrys annual basis forecast for 2026-2035. Additional information includes the corresponding Chicago natural gas prices.

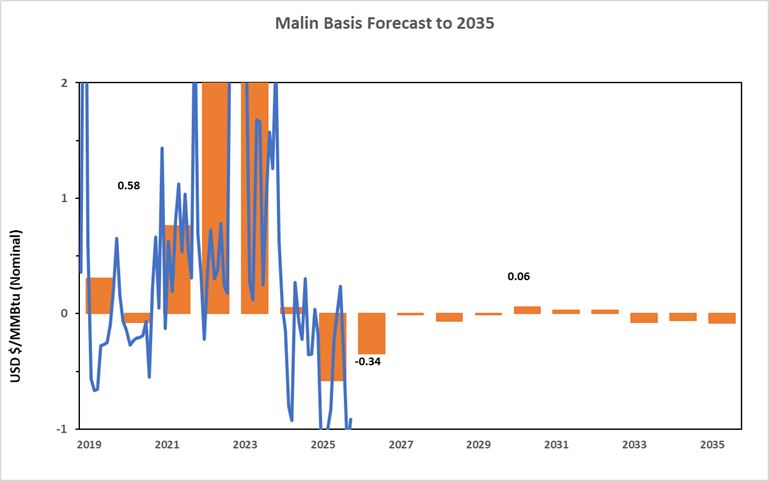

Malin Basis and Price Forecast to 2035

February 09, 2026

Malin actual and annual basis differentials relative to Henry Hub for 2010-2025 and Incorrys annual basis forecast for 2026-2035. Additional information includes the corresponding Malin natural gas prices.

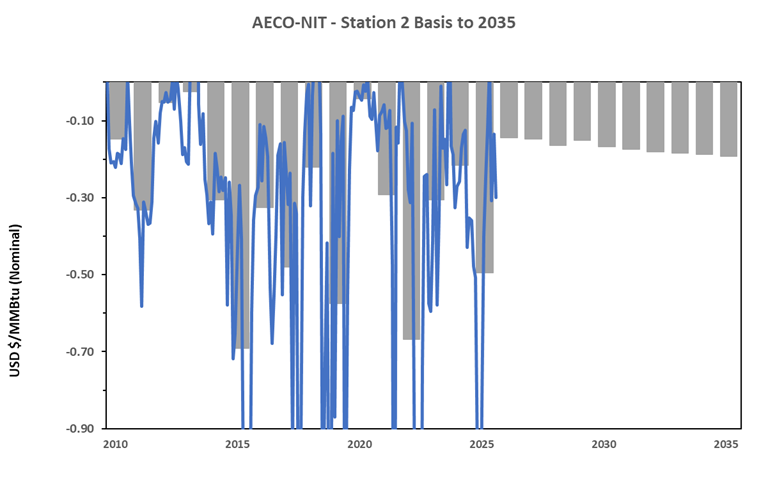

Station 2 Basis and Price Forecast to 2035

February 09, 2026

Station 2 actual and annual basis differentials relative to AECO NIT for 2010-2025 and Incorrys annual basis forecast for 2026-2035. Additional information includes the corresponding Station 2 natural gas prices.

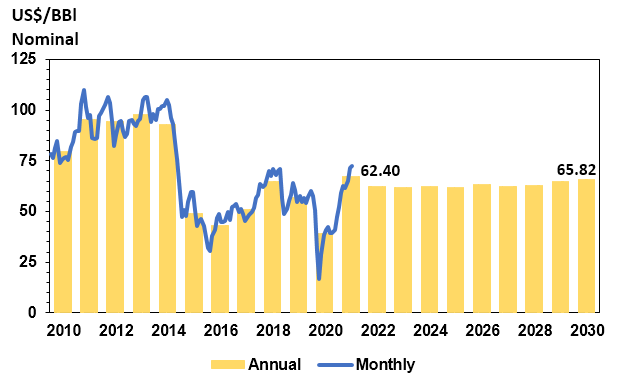

West Texas Intermediate (WTI) Price Forecast to 2030

April 15, 2025

West Texas intermediate (WTI) monthly and annual crude oil prices since 2010 and Incorrys annual price forecast to 2030. Uncertainty in 2020 commodity markets, mainly due to Covid, also saw crude oil prices drop significantly from 2019 with WTI down about 50%. Incorrys expects the West Texas Intermediate (WTI) price to increase marginally through 2030.

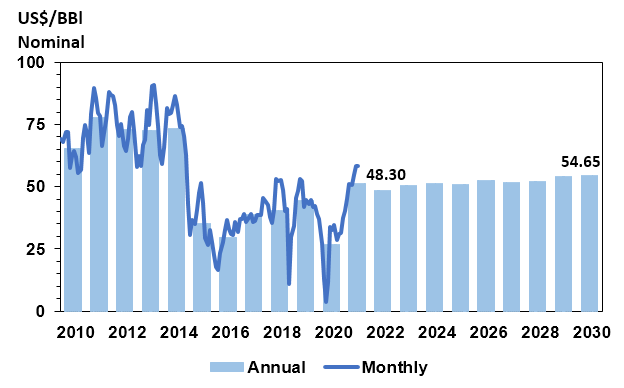

Western Canada Select (WCS) Price Forecast to 2030

April 15, 2025

Western Canada Select (WCS) actual and annual crude oil prices since 2010 and Incorrys annual price forecast to 2030. Additional information includes the corresponding basis differentials to West Texas Intermediate (WTI) price. WCS 2020 prices were down 60% year-over-year, again, primarily due to the impact of Covid. Incorrys expects the Western Canada Select price to increase slowly through to 2030.