August 16, 2021

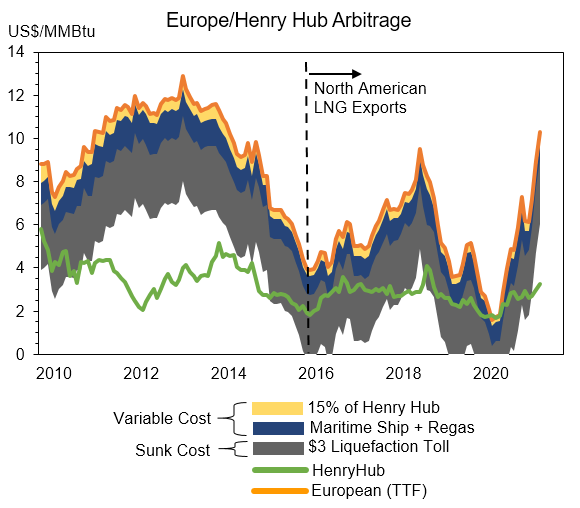

Figure shows European natural gas price (TTF) versus Henry Hub pricing over the past decade. In the first half of the decade, European pricing was well in excess of North American pricing, even considering cost of Liquefaction and shipping – this drove the development of liquefaction capacity with Sabine Pass starting exports in 2016.

- Most worldwide liquefaction projects do not have alternative markets for gas production. North America is a large integrated market with well functioning price and storage hubs providing the ability to balance supply and demand from overseas markets.

- Since 2016, the European-Henry Hub pricing spreads have been wide enough to cover Variable costs (15% of Henry Hub liquefaction plant gate charge, maritime shipping, and regasification charge) with the exception of the summer of 2019 and the Covid impacted 2020.

- Spreads have recently widened enough to fully cover the costs to Europe (variable plus the sunk cost take-or-pay liquefaction toll).

- Incorrys expects 9.5 Bcf/d of LNG Exports in 2021, up 3 Bcf/d from 2020 levels. As this grows to 17 Bcf/d in 2030, swings in overseas supply and demand will increase volatility at Henry Hub.

See Also:

Henry Hub Natural Gas Influences (2021-2030)

Henry Hub Price Forecast to 2035

AECO-NIT Basis and Price Forecast to 2035

West Texas Intermediate (WTI) Price Forecast to 2030

Western Canada Select (WCS) Price Forecast to 2030