February 09, 2026

- LNG Exports are the largest growth driver of Canadian demand.

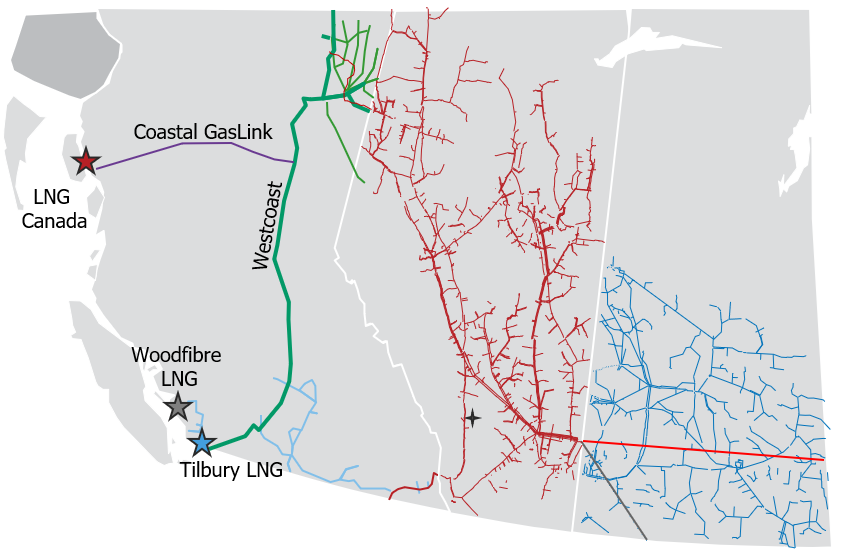

- LNG Canada: The Shell-led 3.2 Bcf/d project began commercial exports on June 30, 2025.

- Completion of Phase 2 expansion increases LNG Canada’s demand to 3.6 Bcf/d by 2030.

- A smaller lower mainland project (Tilbury) is expected to begin exports in 2023 with Woodfibre starting in 2027 and overall Lower mainland exports reaching 0.3 Bcf/d by 2030. We do not expect the Ksi Lisims LNG Project to proceed under current federal and provincial regulation requiring costly grid power for liquefaction.

Map of Western Canada Pipelines Supplying LNG Projects

See Also:

West Coast Canada LNG Export Projects by Status

Liquefaction Capacity by Country Forecast to 2028

LNG Shipping Distances To Asia (Approximate)

LNG Export & Import Shipping Routes