February 09, 2026

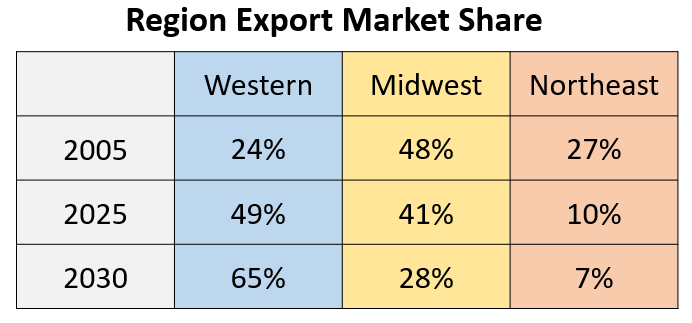

Increased competition from Marcellus supply has pushed out Canadian gas from Northeast markets – 27% of export market share in 2005, now 10%. However, New England pipeline development gridlock has stopped pipelines such as Constitution and Northeast Energy Direct from being constructed thereby allowing Canadian exports to remain strong via pipelines serving those markets (Iroquois and PNGTS). Competition from Bakken associated gas in US Midwest market has reduced Canadian gas competitiveness on the Northern Border pipeline. West Coast markets are expected to remain strong and growing with the expanded GTN capacity and completion of LNG Canada/Coastal GasLink Projects.

See Also:

Canadian Natural Gas Supply-Demand Balance Forecast to 2030

Alberta and Northeast BC Natural Gas Production Allocation Forecast to 2035

Natural Gas Requirements for Oil Sands Forecast to 2030