February 09, 2026

Station 2 Basis Drivers

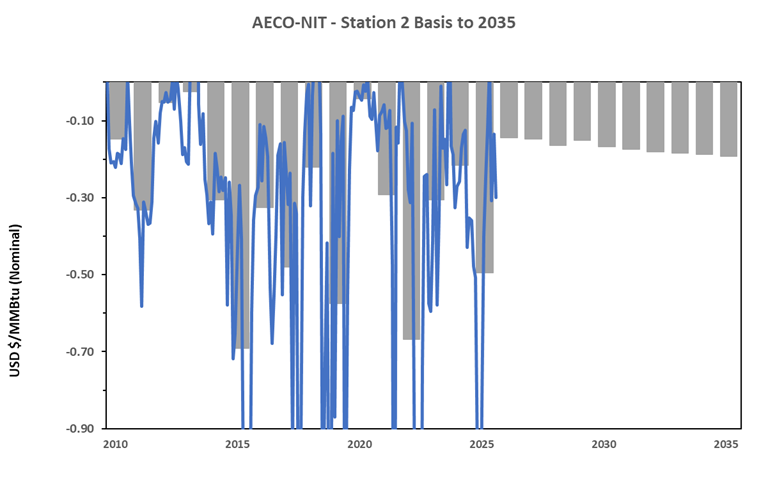

- Recent NGTL connection to Aitken Creek Storage and enhanced USJR capacity should provide increased Station 2 connectivity to AECO-NIT summer season pricing, when AECO-NIT-Station 2 basis tends to widen. Less seasonal volatility – narrows basis.

- LNG Canada offtake reliability going forward provides steady gas flows off Canada’s west coast reducing volatility – narrows basis.

- Enbridge 300 MMcf/d T-South expansion expected in 2027 to feed Woodfibre LNG – widens basis.

Note: Station 2, located in northeastern BC, is the gathering point for much of the gas from northern BC gas wells and processing plants; gas can either flow south down the mainline into the Pacific NW, or eastward into Alberta and into the Alliance pipeline.

See Also:

Henry Hub Price Forecast to 2035

AECO-NIT Basis and Price Forecast to 2035

Dawn Basis and Price Forecast to 2035

Chicago Basis and Price Forecast to 2035

Malin Basis and Price Forecast to 2035