November 13, 2025

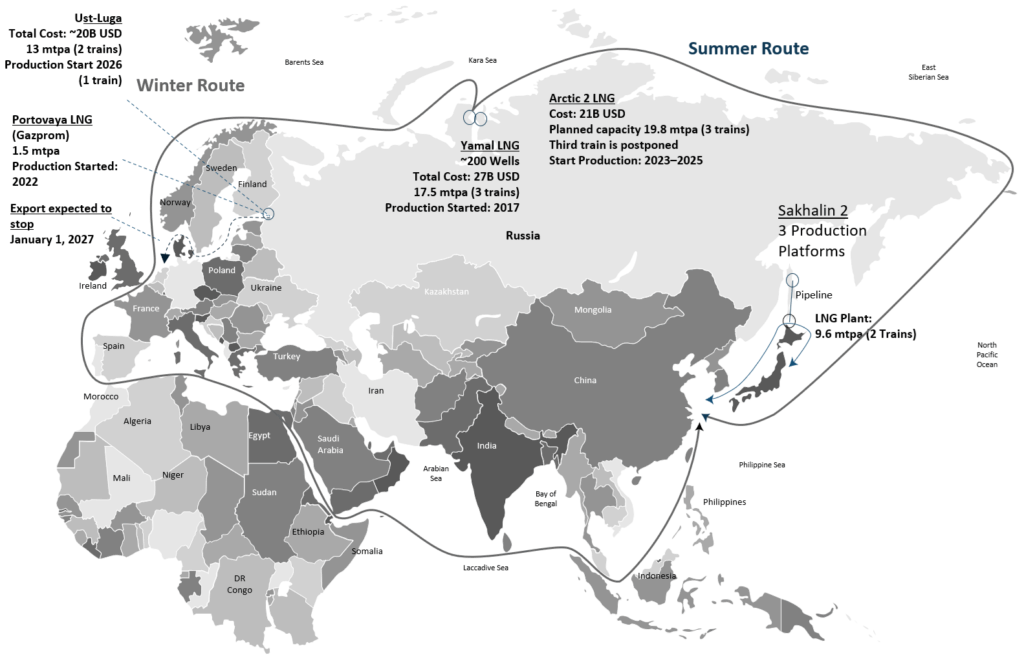

Russian liquefied natural gas (LNG) projects showing capacity in million tones per annum (MTPA), proposed operating in-service rates and seasonal shipping routes.

Russia’s strategic objective is at least 100 million mtpa of LNG exports, tripling 2022 output of 33 mtpa. Europe is the main target market with LNG delivered primarily from Yamal LNG. As part of its latest sanctions, the EU has ordered a complete stop to Russian LNG imports, with all long-term contracts set to end by January 1, 2027. Portovaya LNG T1 (1.5 mtpa) started commercial operation in November 2022.

According to the original plans, the Ust-Luga and Arctic LNG 2 projects, which are under construction, were expected to double Russia’s current capacity to over 65 mtpa.

- Ust-Luga’s 13 mtpa facility is expected to be the largest in northwestern Europe. The first phase of the complex is expected to start up in 2026, with the second in 2027. The LNG plant’s first train will begin operations in 2027, and the second train is planned to start in 2028. However, these plans are still very uncertain.

- In May 2025, Russian independent gas producer Novatek has added the second production train of the Arctic LNG 2 project in West Siberia. The capacity of the second production train is 6.6 mtpa. Also, Arctic LNG 2 has postponed the construction of the 3rd train. Work has been suspended at least until the end of 2025, and commissioning is not expected before 2028. According to the plan, the project should include 3 trains with a total capacity of 19.8 mtpa (6.6 mtpa each). In October 2024, Arctic LNG-2 suspended large-scale production as sanctions dampened interest from foreign customers. Although the plant managed to ship several LNG cargoes last summer, none of them found buyers. Despite Western restrictions, construction continued, and the plant produced the first batch of LNG from the second train.

Russia also lacks LNG specialists and advanced technology to expand output. For instance, projects will have difficulty sourcing domestically produced turbines to replace imports.

Incorrys expects additional delays in Russian LNG capacity.

See Also:

Liquefaction Capacity by Country Forecast

LNG Shipping Distances To Asia (Approximate)

LNG Export & Import Shipping Routes