North American Oil Resources

November 14, 2024

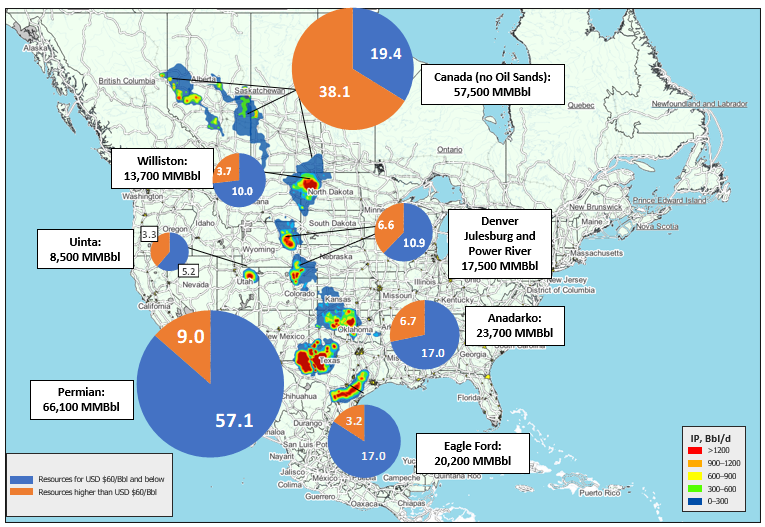

Incorrys’ assessment of North American remaining oil and lease condensate resources in major producing basins broken down between resources at <USD $60/Bbl and >USD $60.

Total remaining resources for four major US Tight Oil basins (Permian, Williston, Niobrara, and Eagle Ford) is estimated at 117,300 MMBbl, 81% at full cycle costs of USD $60/Bbl and below.

North American Oil Resource Life

November 14, 2024

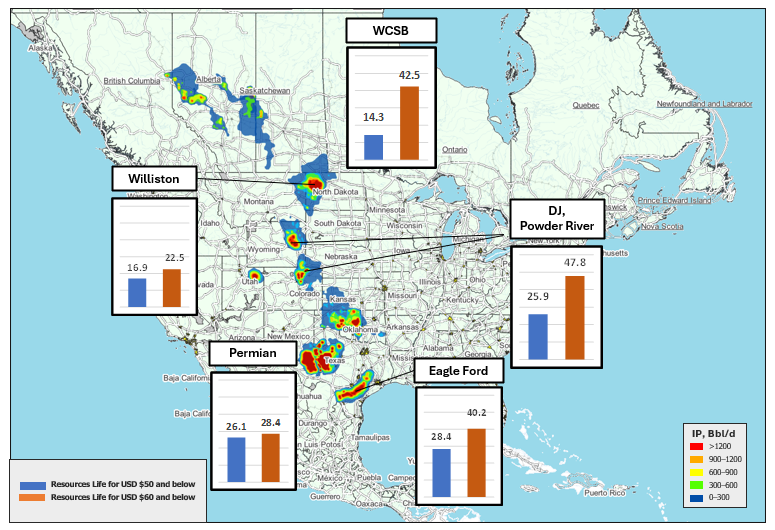

This chart shows the resource life, in years, for major North American producing basins at full cycle costs below USD $50/Bbl and USD $60/Bbl.

The US Permian has the lowest resource life compared to other US Tight oil basins at 26.1 years for a cost of USD$60/Bbl and below.

International Oil Rig Counts

November 19, 2024

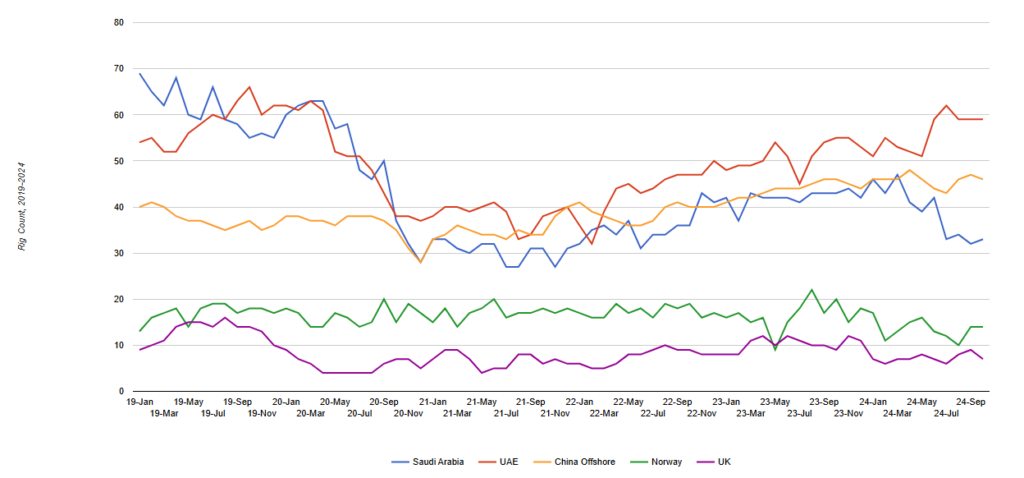

International oil rig counts (2019-2024) by main producing regions of Saudi Arabia, UAE, China offshore, Norway, and the UK. Additional chart showing the oil rig counts for the US and Canada.

The rig count usually acts as a leading indicator of expected oil production. Rig counts have remained flat in most large oil regions reporting rig count data.

Largest US Publicly Traded Oil and NGL Producers

September 28, 2023

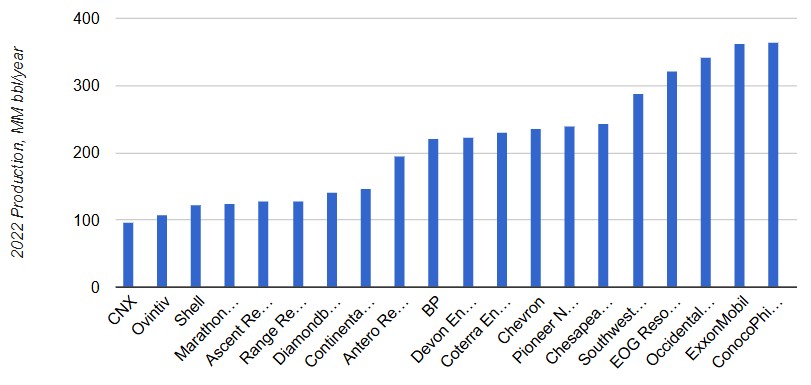

Largest US publicly traded oil and natural gas liquids (NGL) producers in 2022 based on production reported in annual reports.

The largest producer is ConocoPhillips followed by ExxonMobil and Occidental Petroleum.

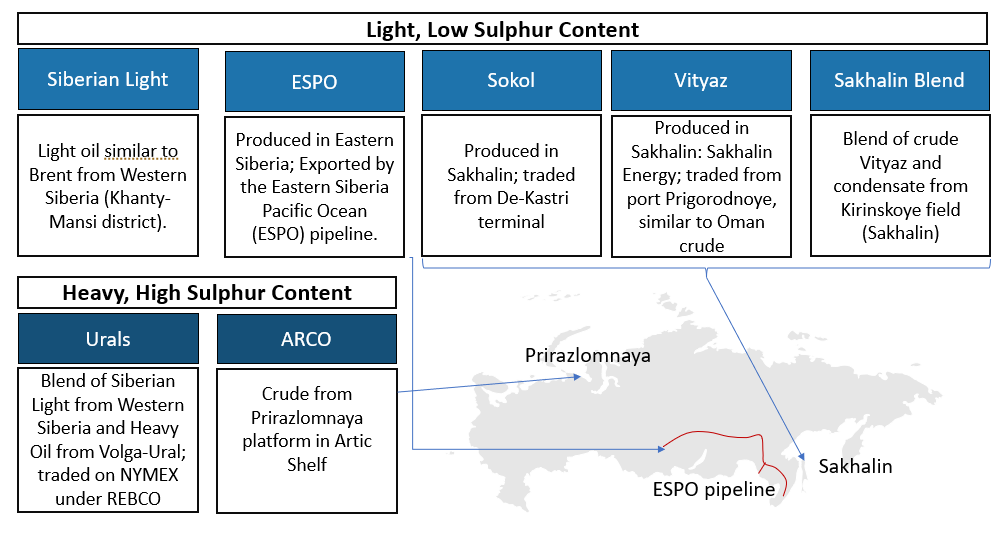

Russian Oil Crudes

December 16, 2022

Schematic illustrating the 7 Russian crudes that trade; 5 light low sulphur oils and 2 heavier, high sulphur oils.

The most common one is Urals (based on volume), a blend of heavy and light oils, which trades at a large discount because of the high sulphur content.

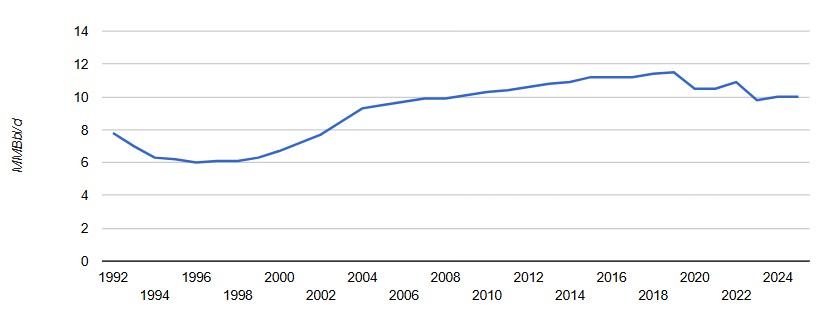

Russian Oil Production

December 16, 2022

Annual Russian oil production (MMBbl/d) from 1992 to 2025. Production decreased almost 2 MMBbl/d in early 1990’s (-25%) due to a structural crisis in the Russian economy.

Production grew after 1998 and reached its peak of 11.5 MMBbl/d in 2019, an increase of about 5.5 MMBbl/d (over 80%). The recent drop in Russian oil production is due to the Covid-related slowdown in global oil demand.

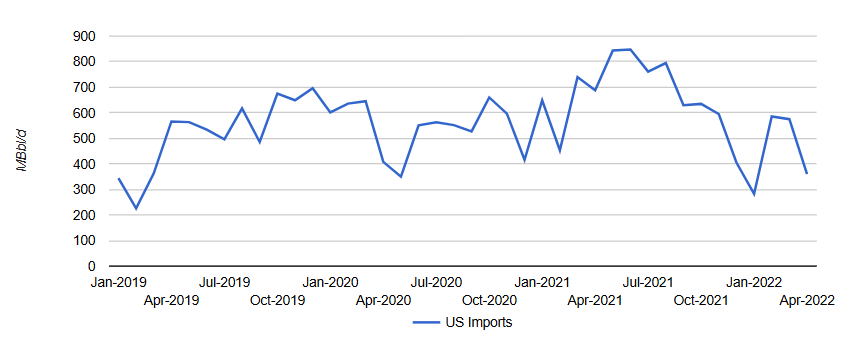

US Imports of Russian Oil and Petroleum Products

December 16, 2022

US imports of Russian crude oil and petroleum products, by month, from 2019 through April 2022. Imports range from a low of 225 MBbl/d in February 2019 to a high of 850 MBbl/d in June 2021 – averaging over 550 MBbl/d over the time period.

President Joe Biden announced on March 8, 2022, that the US will ban imports of oil from Russia, along with refined petroleum products, natural gas and coal. Banning Russian oil had minor consequences on U.S. refineries, or Russia, as the oil destined for the U.S was redirected to other countries.

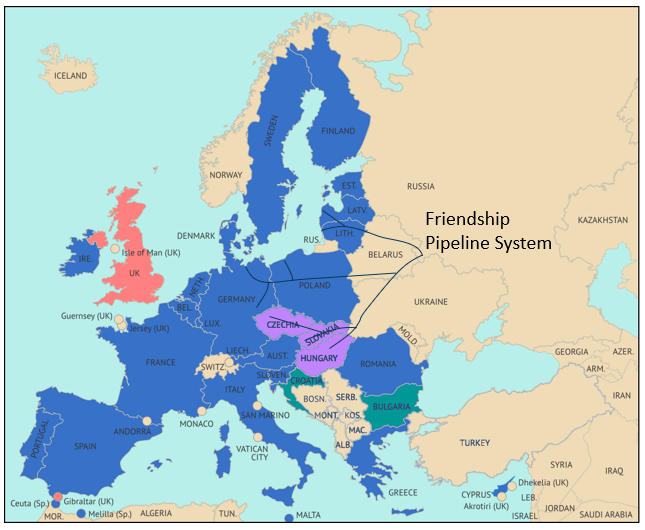

Summary of the EU Ban on Russian Oil

December 16, 2022

Map illustrates how the EU ban on Russian oil will impact each of the countries and which regions will still be able to access pipeline deliveries along the Friendship Oil Pipeline, deliveries that are exempt from the recently announced price cap.

The EU banned Russian crude oil delivered, by tankers, effective December 5, 2022 with a ban Russian petroleum products expected to start on February 5, 2023.

Russian Oil Export Worldwide

December 16, 2022

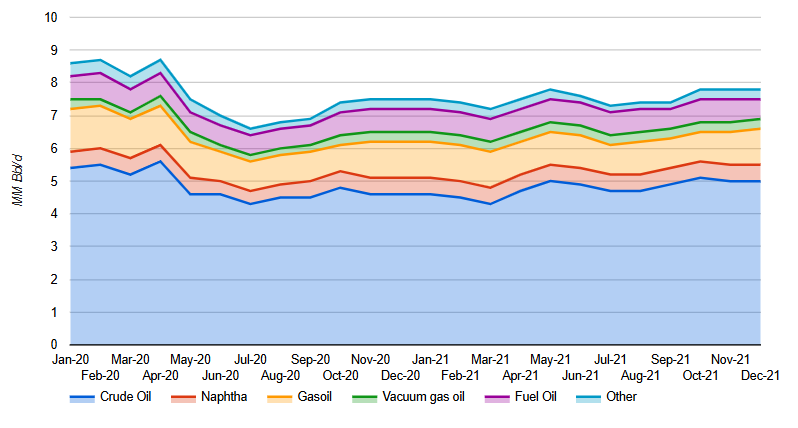

Russian global crude oil and petroleum product exports (including Naphtha, Gasoil, Vacuum gas oil , Fuel oil, and other), by month, for 2020-2021. Additional chart showing the average 2021 percentage of each.

In 2021, crude oil represented almost 2/3 of the total exports of these products followed by Gasoil at 13% and Naphtha at 7%.

How Russian Oil Revenue Affects the Russian Federal Budget

October 10, 2023

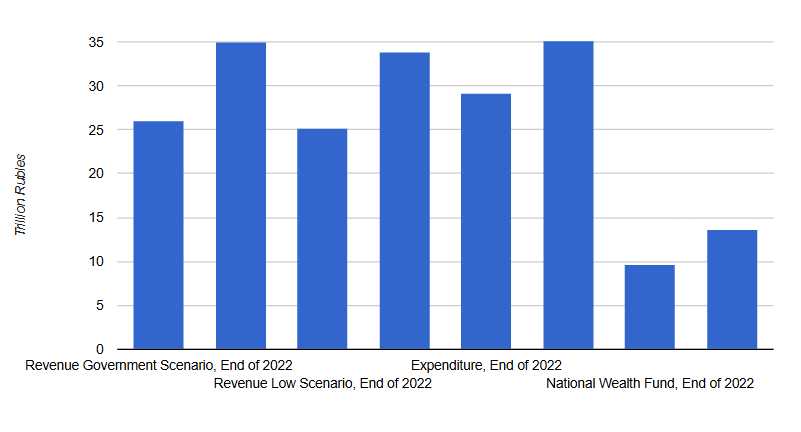

Russian budget projections for 2024 comparing the Russian Government forecast with that of a Low case scenario in trillion rubles (T RUB). Additional charts show the 2023 projected Russian expenditures and the impact on Russian revenue of changing prices and production.

The Russian budget very heavily depends on revenue from the energy sector; particularly from oil and gas. Of the total 2024 Russian federal budget revenue of 35 trillion rubles, 34% is expected to come from the energy sector. The Russian deficit, according to the 2024 budget, is expected to be around 1.6 trillion rubles – an optimistic scenario. Although the National Wealth Fund will be sufficient to finance the Russian economy and war efforts in 2024, and perhaps longer, the financial stability of Russia remains uncertain.

Russian Oil Production Forecast

December 15, 2022

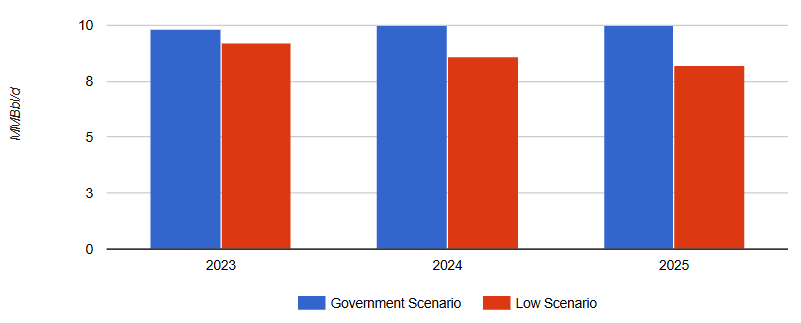

Russian oil production forecast (2023-2025) comparing an optimistic Russian government scenario and a Low case Scenario – both going in opposite directions.

Due to the financial issues facing Russia (from sanctions, the cost of the war on Ukraine and inability to access capital in western markets) coupled with the lack of new western technologies, Incorrys expects Russian oil production will decrease significantly over the coming years as little to no new development is expected to occur.

Russian Oil Production Basins

October 25, 2022

Russia has four main oil production regions: Western Siberia, Volga-Ural and North Caucasus, Sakhalin, and Timano-Pechora. While Russia primarily produces conventional oil, they also have a very large resource of Tight Oil however, there currently is no active exploration.

A significant portion of Russian oil production, particularly in Timano-Pechora and Volga-Ural regions, are coming from mature fields where production from many wells is close to their economic limit. If older wells in such fields have to be shut-in, it will be impossible or uneconomical to restart these wells due to technical issues with well completion

Russian Oil Resources

October 11, 2022

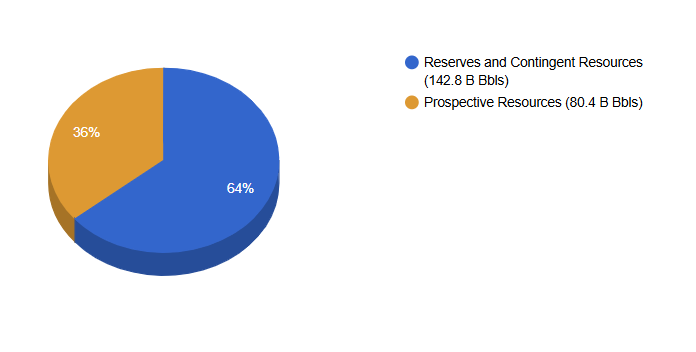

Russian oil resources, in billions of barrels (B Bbls), broken down between Reserves & Contingent (recoverable oil from known accumulations but not considered to be commercial recoverable) Resources (143 B Bbls) and Prospective (yet-to-be discovered reserves) Resources (80 B Bbls).

Due to the sanctions against Russia following the invasion of the Ukraine, many of the western producers and service companies have left, or are planning to leave, Russia. While many producers have had to leave billions of dollars in stranded assets behind, the move will hinder Russia’s ability to take advantage of their new technologies and drilling techniques.