February 09, 2026

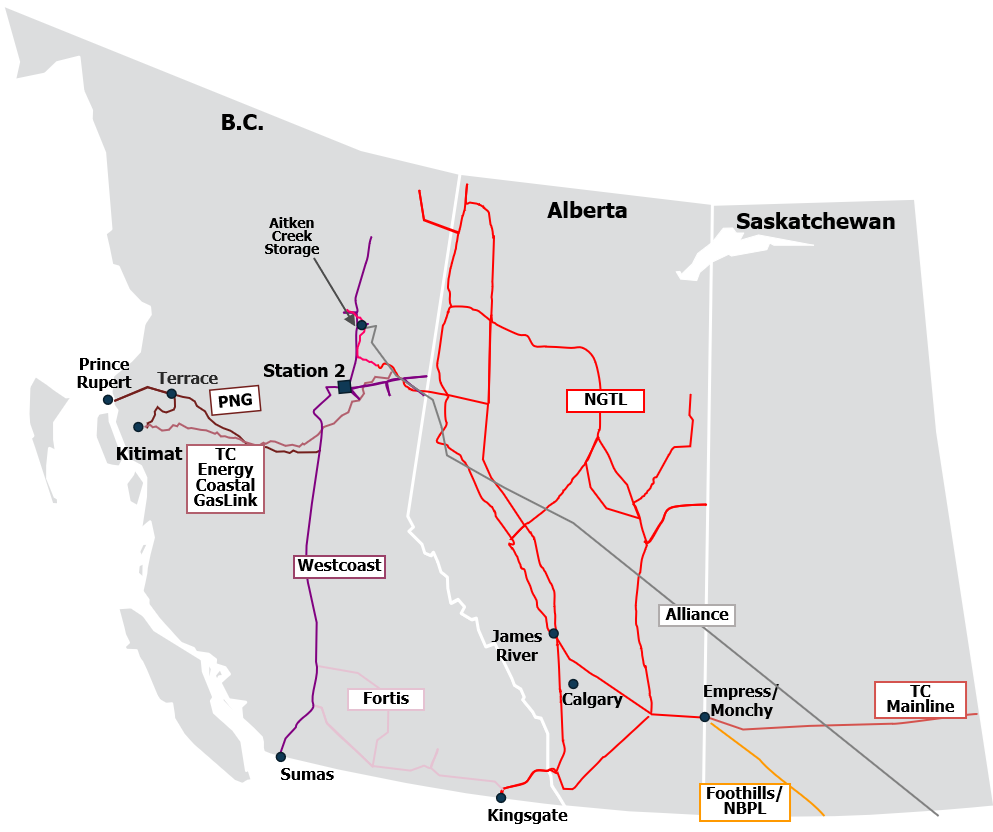

As producers have migrated activity to the low cost Montney play, NGTL has enhanced capacity along the Western leg upstream of James River (USJR). As a result, the basin has become less geographically diversified with the majority of production now on the West leg.

- USJR Capacity has doubled from 6.4 Bcf/d in 2011 to just over 12.5 Bcf/d in early 2023 and over 13.3 Bcf/d in time for the 2023/24 gas year.

- NGTL has been building capacity to keep up, and, as the capacity has been put in-service, the impact of both planned and unplanned maintenance on AECO-HH basis has been exacerbated.

- Going forward, west leg capability should be better matched with USJR receipts allowing AECO-HH basis volatility to be reduced.

- Aitken Creek Storage was connected to NGTL via the North Montney Mainline in January 2020, providing better connectivity between Station 2 and AECO pricing.

The Coastal GasLink is in-service with the second train of LNG Canada completed in 2025. Additional demand will narrow AECO/Station 2-Henry Hub Basis. TC Mainline tolls are expected to drop as the toll settlement expires in 2026. Western Canada supply then becomes more competitive in Eastern Triangle markets for export– AECO/Station 2 basis should narrow slightly.

See Also:

Will Coastal GasLink Natural Gas Pipeline be Filled?

Tanker Fleet to Redirect Russian Oil from Europe to Asia

Shipping Russian Oil

African Gas Supply to Europe

Canada Can Supply More Oil to Global Markets in Medium Term

Canadian Oil Pipelines & Western Canada Flows