September 16, 2024

Gulf of Mexico Offshore Oil Production

Note: includes new wells drilled on existing projects with declines starting after 2023.

Incorrys forecasts Gulf of Mexico production based on analysis of new announced or under construction projects. There is significant uncertainty in new projects after 2028, as some announced projects may not go forward. Incorrys expects that Gulf of Mexico production will reach its peak of 1800 MBbl/d in 2026 and then start to decline reaching 1250 MBbl/d in 2040.

Gulf of Mexico (GOM) Offshore Oil

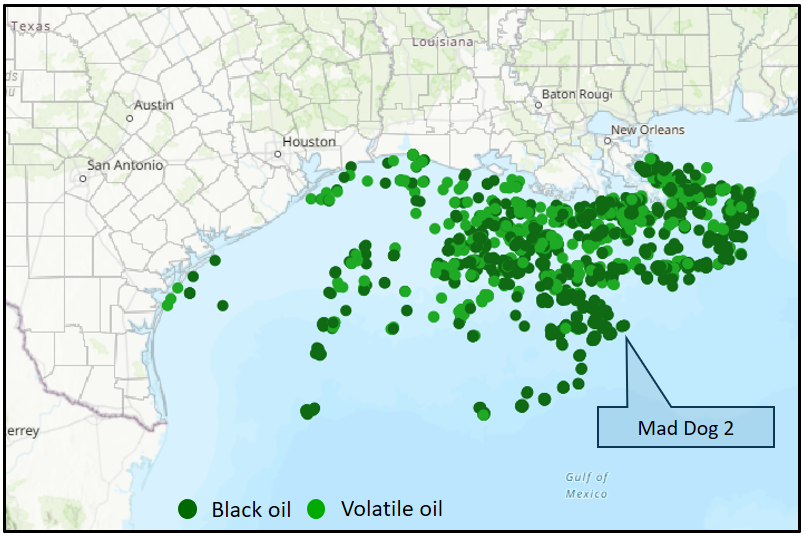

*Active oil wells from January 2000

| Number of wells drilled since 2010: ~1230 Average New Well Initial Productivity in 2023: 5,640 Bbl/d Peak Production: 2023 (1,865 MBbl/d) |

On January 27, 2021, President Joe Biden temporarily stopped issuing new permits on federal lands. In July 2024, U.S. Senate Energy and Natural Resources Committee passed the Energy Permitting Reform Act of 2024. As of August 2024, it still needs to be considered by the full Senate before it can become law. According to the bill, the Secretary of the Interior (referred to in this title as the ‘‘Secretary’’) shall conduct not less than 1 oil and 1 gas lease sale in each of the calendar years 2025 through 2029 (subject to minimum acreage requirements).

Gulf of Mexico Well Count

The GOM Offshore well count has dropped from a high of 140 in 2013 and 2014 to about 40 in the Covid pandemic year of 2020. It has since increased gradually to about 75 in 2023. The major new project for 2023 was BP’s Mad Dog 2 with capacity of 140 MBbl/d.

Gulf of Mexico Offshore Oil Well Initial Productivity (IP)

GOM oil IP peaked in 2021 at over 8,000 Bbl/d before dropping to 5,600 in 2023. The average IP over the past 5 years has averaged 6,800 Bbl/d.

Major New Projects post 2023 (including start date and peak capacity):

- Anchor, Chevron & Total, 2024 – 75 MBbl/d

- Whale, Chevron & Shale, 2024 – 90 MBbl/d

- Dover, Shell, 2025 – 21 MBbl/d

- Leon-Castile, LLOG, Repsol, Beacon, 2025 – 60 MBbl/d

- Trion, BHP & Pemex, 2025 – 100 MBbl/d

- Gettysburg, Kosmos, 2025 – 40 MBbl/d

- Ballymore, Chevron, 2025 – 75 MBbl/d

- Fort Sumter, Shell, 2025 – 30 MBbl/d

- Zama, PEMEX, 2025 – 130 MBbl/d

- Sparta, Cobalt & Total, 2028 – 75 MBbl/d

- North Platte, Shell, 2028 – 70 MBbl/d

Note: Federal offshore PADD 5 (Pacific coast) is not included. In 2023 PADD 5 production was 8 MBbl/d.

See Also:

Initial Productivity (IP) of Major US Oil Basins 2023

Estimated Ultimate Recovery (EUR) of Major US Oil Basins 2023

Well Depth of Major US Oil Basins 2020-2023

References:

The Energy Permitting Reform Act of 2024