September 16, 2024

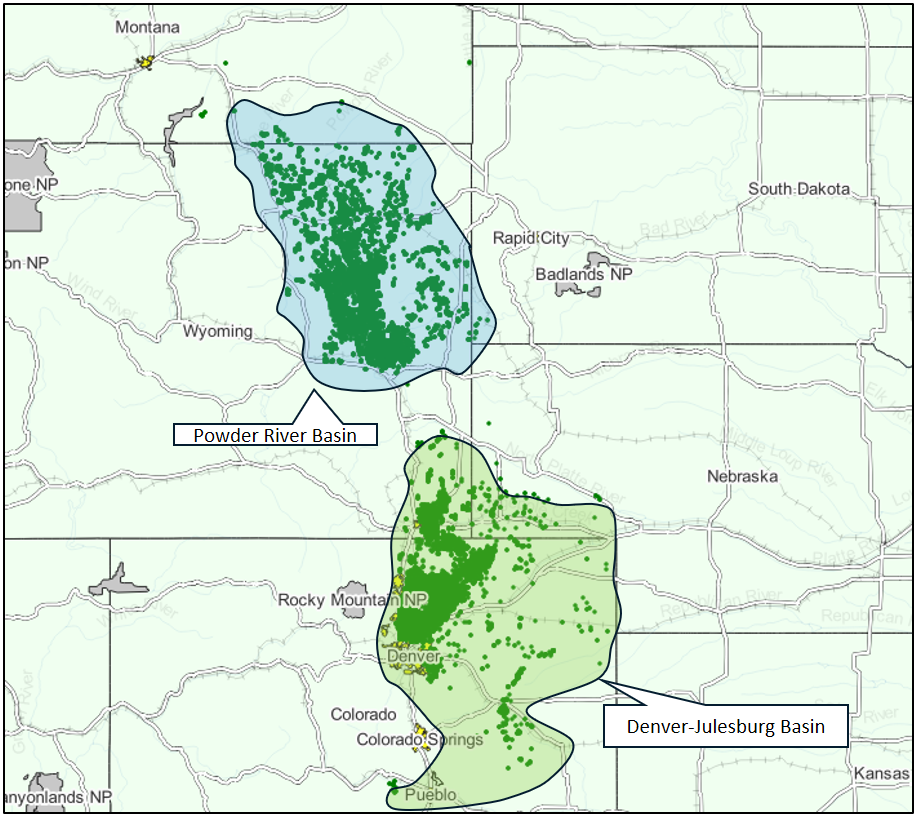

Niobrara oil production forecast to 2040 (MBbl/d) including Denver-Julesburg (DJ) and Powder River.

DJ and Powder River Oil Production Forecast

DJ Oil Production

Denver-Julesburg production reached its peak of 580 MBbl/s in 2019 and is expected to continue a general downtrend to about 250 MBbl/d in 2040. Denver-Julesburg average new well initial productivity is lower than other Tight Oil basins, such as Willison and Permian. It reached its peak of 1000 Bbl/d in 2017 and then dropped significantly to the 600 Bbl/d range through 2023.

Powder River Oil Production

Powder River production in 2023 reached 160 MBbl/d compared to around 450 MBbl/d in DJ. Total well depth in Powder River is 10% higher than in DJ, which may lead to higher F&D costs in Powder River. Incorrys expects Powder River production to continue to grow and reach 180 MBbl/d in 2028. Production will start to decline after 2030.

Niobrara Oil Well Locations and Drilling

| 2020-2023 | Powder River | DJ |

| Average Lateral Length, ft | 9,550 | 10,350 |

| Average Total Depth, ft | 17,800 | 16,100 |

| Location: Niobrara Shale is located in southern Powder River (Wyoming) and Denver-Julesburg (Colorado) basins Number of oil wells drilled since 2010: ~ 16,400 Average New Well Initial Productivity in 2023:

Peak Production:

|

Niobrara Number of New Wells

DJ Number of New Wells

| 2020-2023 | Average Lateral Length, ft | 10,350 |

| 2020-2023 | Average Total Depth, ft | 16,100 |

| Location: Colorado Number of oil wells drilled since 2010: ~ 14,000 Average New Well Initial Productivity in 2023: 600 Bbl/d Peak Production: 2019 – 580 MBbl/d |

Most production in the Denver-Julesburg (DJ) basin comes from the Niobrara formation. Another producing formation is Codell Sandstone. The number of wells in DJ reached its peak of almost 1,400 wells in 2018 but dropped to under 600 in 2020 before increasing slightly through 2023 to about 700. The number of new wells levels off at about 640 through 2030 before declining to about 350 in 2040.

DJ Crude Oil Well Initial Productivity (IP)

The IP is expected to decline slowly over the forecast period reaching about 500 in 2040.

DJ Well Estimated Ultimate Recovery (EUR)

EUR peaked at about 400 MBbl in 2019 and has dropped to just under 350 MBbl in 2023 where it is expected to remain until 2030.

Powder River Number of New Wells

| 2020-2023 | Average Lateral Length, ft | 9,550 |

| 2020-2023 | Average Total Depth, ft | 17,800 |

| Location: Wyoming Number of oil wells drilled since 2010: ~ 2,400 Average New Well Initial Productivity in 2023: 750 Bbl/d Peak Production: 2023 – 155 MBbl/d |

Most production in southern Powder River basin comes from Niobrara formation. Other producing formations in Powder River are Parkman, Frontier-Turner, Shannon, Muddy and others. Incorrys expects that most production in Powder River will continue to come from Niobrara. The number of wells drilled in Powder River reached its peak of 330 wells in 2014 drilled in multiple formations. In 2023, the number of new wells drilled was just under 200. The number of wells drilled is expected to increase slowly from 2024-2029 before beginning to decline through 2040 to about 90.

Powder River Crude Oil Well Initial Productivity (IP)

Powder River average new well initial productivity reached its peak of 820 Bbl/d in 2022.

Powder River Well Estimated Ultimate Recovery (EUR)

It is expected to decline to 540 MBbl/d in 2040 due to maturity of the basin. The EUR for Powder River also peaked in 2022 at 500 MBbl and is expected to gradually decline through 2026 to 370 MBbl.

See Also:

Niobrara Associated Gas Production Forecast to 2040

Initial Productivity (IP) of Major US Oil Basins 2023

Estimated Ultimate Recovery (EUR) of Major US Oil Basins 2023

Well Depth of Major US Oil Basins 2020-2023