Your cart is currently empty!

September 16, 2024

Alaska Oil Production

September 16, 2024

Alaska Oil Production

The Trans-Alaska Pipeline System (TAPS) has a capacity of 2,000 MBbl/d; declining utilization during cold weather operations makes it challenging to maintain reliable throughput. Incorrys forecast assumes that the pipeline will continue to be operational during the forecast period. Alaska oil production, almost all of which comes from the North Slope, decreases from 600 MBbl/d in 2010 to 430 MBbl/d in 2023. Incorrys projects oil production to continue to decline reaching 275 MBbl/d in 2040. The production forecast does not include upside potential from Alaska LNG which, if it goes ahead, could boost oil drilling activity.

Alaska Oil Well Locations and Drilling

Note: Wells drilled in US portion of the basin since 2010

| Location: North and South Shore of Alaska Number of wells drilled since 2010: ~480 Average New Well Initial Productivity in 2023: 1,600 Bbl/d Peak Production: 1988 (2,000 MBbl/d) |

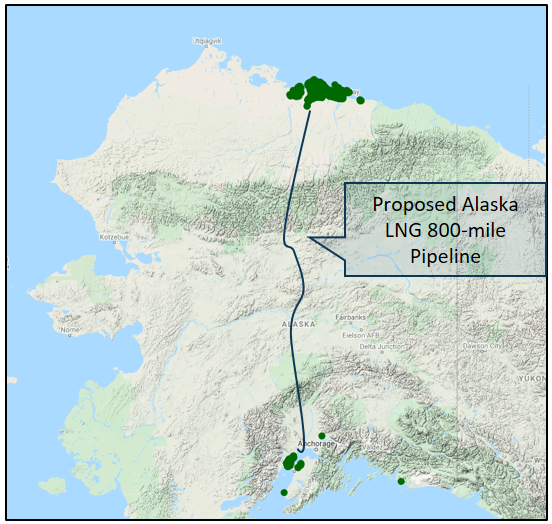

Active development started in 1977 in North Slope following by South Slope 1981. Currently development is very limited. Associated gas in Alaska mostly injected because of lack of gas pipeline. The Alaska North Slope has about 35 Tcf of associated gas reserves. Alaska LNG is proposing to bring 3.5 Bcf/d of associated gas from North Shore to Nikiski (South Shore). If the pipeline, gas processing facilities and LNG facilities are built, it may boost oil drilling. In 2020, BP sold its Alaska operation to Hilcorp. It includes 49.1% ownership share of the Trans-Alaska Pipeline System (TAPS).

Alaska Number of New Wells

The number of new oil wells peaked at about 45 in 2016 and settled at about 35 in 2023. Incorrys expects the number of new wells to decline to 25 in 2024 and continue a downward trajectory to about 5 in 2040.

Alaska Oil Well Initial Productivity (IP)

Initial oil IP has decreased from about 2,000 Bbl/d in 2010 to about 1,500 Bbl/d in 2023. Incorrys expects IP to remain in the 1,500 range for a few years before declining to under 900 Bbl/d in 2040. In May 2020 U.S. approved the $43B Alaska LNG project which still seeks investors. Alaska LNG has several advantages: lower gas production cost, the proximity to Asian markets, and LNG liquefication cost advantage due to cooler ambient temperatures. Environmental groups are challenging Alaska LNG project in courts.

See Also:

Initial Productivity (IP) of Major US Oil Basins 2023

Estimated Ultimate Recovery (EUR) of Major US Oil Basins 2023

Well Depth of Major US Oil Basins 2020-2023