July 5, 2021

In 2020, US natural gas production growth and development is primarily focused in two areas: Appalachia (Marcellus and Utica) – 28.7% of total North American production, and Haynesville – 9.4%. Associated gas production in 2020 was 27 Bcf/d or 26.6% of total North American production. The majority of associated gas production will come from Permian Basin. Other associated gas production regions include Bakken, Eagle Ford, and DJ Niobrara. Western Canada gas production is currently 14.8% of total production or 15 Bcf/d. It will reach 23.1 Bcf/d in 2040. In the 2020–2035 period, gas production growth will occur as overall North American demand increases to 105.8 Bcf/d by 2035. After 2035 North American gas demand will drop to 103.8 Bcf/d. The increased maturity of tight-gas plays is forecast to continue in the Rockies and in Mid-Continent (includes Arkoma and Anadarko) and gas-focused Permian. Production from Mid-Continent and Rockies will decline over the forecast period. Activity in gas focused Permian prospects will be muted over the next decade, as relative production cost competitiveness improves post-2030 development is expected to increase.

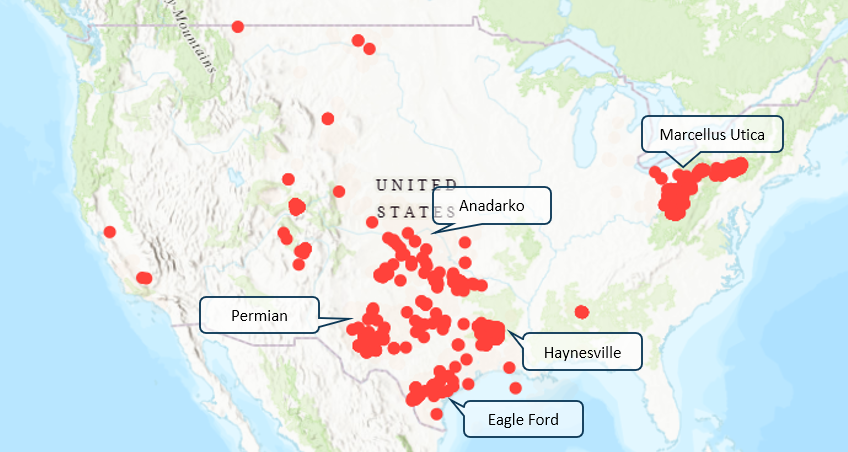

US Gas Drilling Map

Most gas wells in US in 2020 are drilled in Marcellus, Utica and Haynesville. Initial well productivity grew in all three basins with Marcellus NE now reaching 20 MMcf/d. In 2020 an average of 85 gas rigs were operating in US, down from 168 rigs in 2019. At the same time, US dry gas production increased to 86.4 Bcf/d in 2020 up from 84.5 Bcf/d in 2019. Associated gas production in 2020 dropped to 27 Bcf/d down from 29.2 Bcf/d in 2019 as oil prices in dropped in 2020.

See Also:

Global Natural Gas Reserves 2010-2022

Top 5 Global Natural Gas Reserves By Country 2010-2022

Global Natural Gas Production 2010-2022