Your cart is currently empty!

November 14, 2024

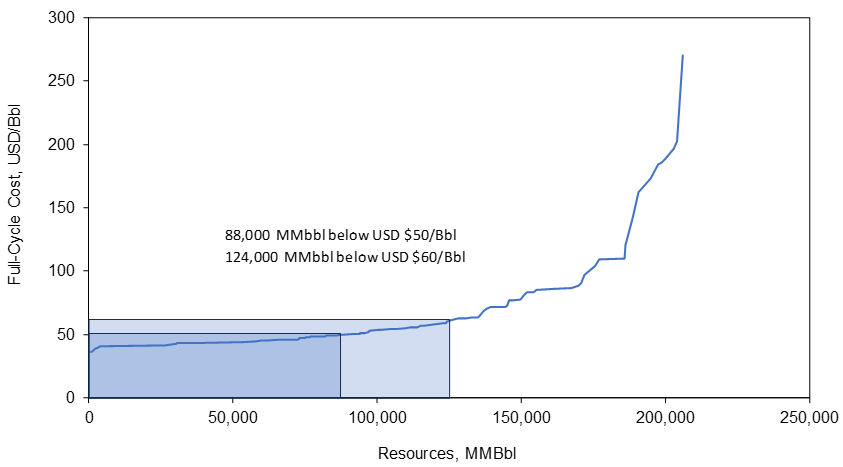

Incorrys examined the North American Oil Full-Cycle Costs by basin and cost category, these are all of the costs associated with finding and producing the oil, a key factor used by producers (among others) for corporate planning, risk management, and various other purposes. Taking this analysis a step further, Incorrys combined all of these results to produce a full-cycle cost curve that essentially shows the potential amount of oil and lease condensate resource available in North America at varying price levels.

It is important to note that we are talking about resources here, these are quantities of oil that are potentially recoverable, but not yet commercially – not to be confused with reserves, which are quantities of oil that are commercially recoverable today.

Incorrys analyzed the full-cycle costs of all of the major oil basins in the US and Canada, excluding none-growth conventional basins, Alberta oil sands, and Eastern Canada. The Permian basin, located in west Texas and southeast New Mexico, has by far the largest oil resource endowment. Alaska, Gulf of Mexico, Appalachian, South Texas, Canada East Offshore and California are also excluded as they are not growth basins. Each US basin has 7 data points associated with 7 well productivity ranges (from 0 to 300 Bbl/d, from 300 to 600 Bbl/d, etc.). Each Canadian play has up to 5 data points associated with 5 well productivity ranges (from 0 to 300 Bbl/d, from 300 to 600 Bbl/d, etc.). Incorrys estimates resources and full cycle cost for each data point in each basin. The resource cost curve has 106 data points in total.

The North American oil full-cycle cost curve, in USD/Bbl at the West Texas Intermediate benchmark price or market price, shows that there are 88 BILLION barrels of oil with a full-cycle cost less than $50/Bbl and 124 billion Bbls at or below $60.

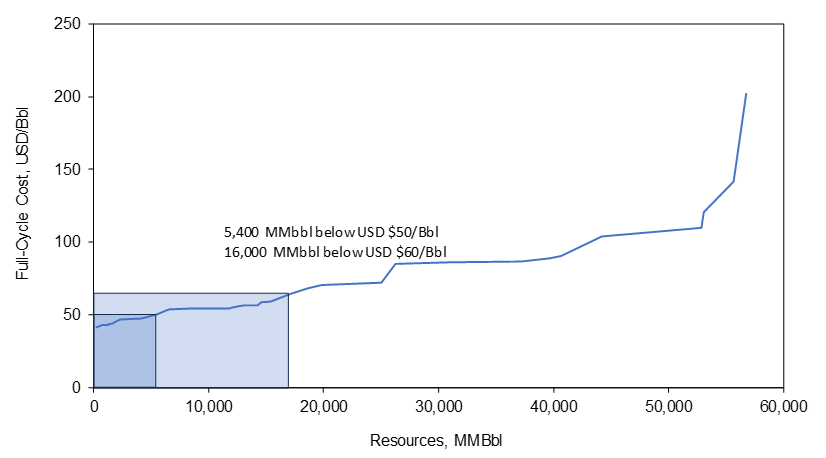

Incorrys also developed a full-cycle cost curve for Western While the US accounts for almost 90% of the total North American oil resource below $60/Bbl, Western Canada still offers substantial oil resources with about 5 ½ billion barrels below $50 and 16 billion barrels below $60. With current West Texas Intermediate prices in the $70/barrel range and a huge oil endowment below $60, these resources will be produced for many years to come.

See Also:

Crude Oil Full Cycle Cost Components

Incorrys Cost Analysis Methodology

Full Cycle Cost of North American Oil by Basin