April 30, 2025

Incorrys uses breakeven cost analysis (also known as full cycle cost) to forecast future natural gas supply and prices, and to determine where capital investment (Capex) will be focused, and where investment and production will decline. In a market with intense competition for Capex and return on investment (ROI), full cycle costs are a crucial tool to compare investment opportunities. This analysis informs Incorrys production forecast for US and Canadian natural gas to 2040.

Incorrys estimated F&D cost, Operational cost, and Capital Cost based on analysis of 275 projects from investor presentations and other public material presented by producers. Incorrys generates production maps and calculates areas based on well coordinates and productivity obtained from public databases and in order to derive initial productivity, estimated ultimate recovery per well, and full cycle cost per Mcf.

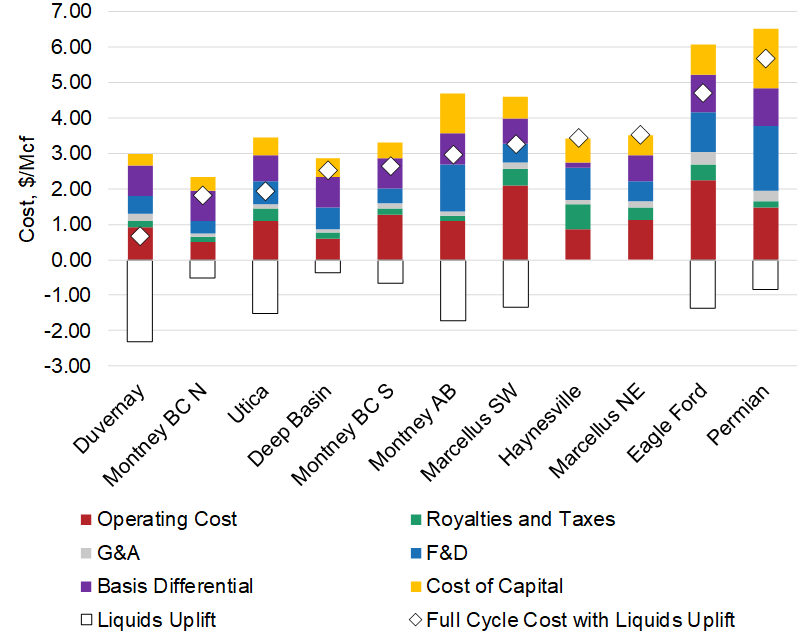

Incorrys breaks down natural gas full cycle costs into seven major components:

- Cost of Capital or Producer Return

- Basis Differential

- Operating Cost

- Royalties & Production Taxes

- General and Administrative (G&A) or Overhead

- Finding & Development (F&D

- Liquids uplift: proceeds from sales of natural gas liquids (NGL) produced as part of raw gas.

Most basins or plays have up to 7 cost bins, associated with well productivity ranges (from 0 to 3 MMcf/d, 3 to 6 MMcf/d, etc.). From this analysis, Incorrys has generated a North American natural gas cost curve, showing natural gas full cycle cost vs. resources for all major producing basins in the US (Permian, Marcellus, Eagle Ford, Haynesville and Utica), as well as western Canadian plays (Montney, Alberta Deep Basin, and Duvernay). A western Canada natural gas cost curve is also shown.

- Total remaining resources for five major US gas basins (Marcellus, Utica, Haynesville, Permian, and Eagle Ford) are estimated at 1,413 Tcf, 83% at full cycle costs of USD $4/Mcf and below.

- Western Canada Sedimentary Basin (WCSB) resources in the main producing plays (Montney, Duvernay, and Alberta Deep Basin) are 587 Tcf, 80% at or below USD $4/Mcf. Most WCSB resources (484 Tcf) are in the Montney.

- Incorrys analysis shows North America has around 556 Tcf of associated gas resource.

- Total North American natural gas resource life is 66 years at full cycle costs of USD $5/Mcf or less, 53 years at full cycle costs of USD $4/Mcf or less, and 23 years at USD $3/Mcf or less.

Incorrys prepared a comprehensive analysis of North American natural gas full cycle costs (Q1 2022 through Q3 2024) for all major producing basins in both the US and Canada. Full cycle costs in this analysis include an uplift from sale of liquids produced.

Some of the key findings include:

- Duvernay has the lowest fully cycle cost at just USD $0.67/Mcf due to having the highest liquids uplift at $2.31/Mcf. However, Duvernay has limited resources in liquid rich and superrich areas compared to other basins.

- Utica has the lowest full cycle cost in the US at $1.92/Mcf, again mainly attributable to liquids uplift of $1.53/Mcf.

- With the exception of Utica, Canadian plays have lower full cycle cost versus US basins due to lower F&D and operating costs and, on average, lower royalties and taxes. The CAD/USD exchange rate also contributes.

- Although Haynesville and Marcellus NE wells are highly productive, these basins mainly produce dry gas, and therefore, they don’t benefit from liquids uplift. Marcellus NE full cycle cost is $3.52/Mcf while Haynesville full cycle cost is $3.43/Mcf.

- Permian has highest full cycle cost at $5.66/Mcf due to less productive natural gas wells drilled over the reporting period. Permian development is currently focused on oil wells that also produce associated gas.

- Other basins and plays such as Anadarko, Green River, and San Juan in the US, and Canadian conventional gas, among others, currently have very limited drilling as the full cycle cost in these areas is higher than the major basins and plays examined.