November 13, 2024

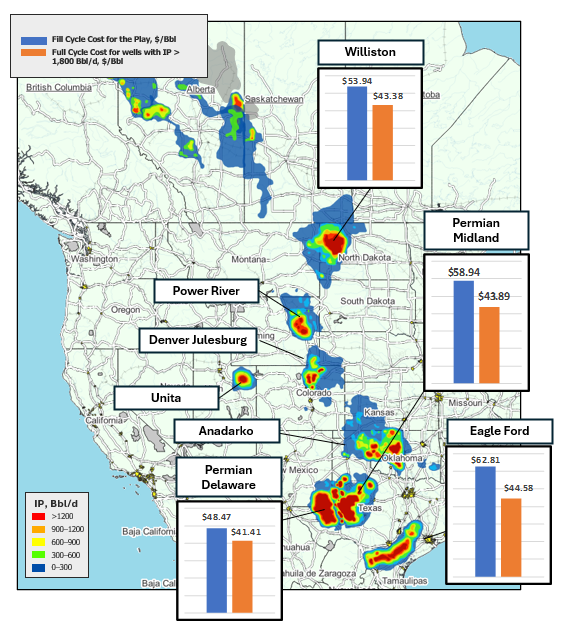

This chart shows full cycle costs for the most productive US oil basins in USD$/Bbl together with a map showing initial productivity (IP) ‘sweet spots’ (red)

- Producers allocate capital to projects earning the highest return(s).

- The lowest cost areas therefore generally see expanded production, to the extent pipeline capacity is available to transport oil produced.

- Pipeline egress is also necessary to transport associated gas. As a result, even though low-cost resource is available in some areas, production growth may be limited until transportation capacity is built.

- Producers drilling oil wells during the period Q1 2022 through to Q3 2024 were able to earn positive returns in cost bins other than the lowest cost areas, or sweet spots, due to attractive WTI pricing at the time, and ability to lock-in forward pricing on financial and physical markets.

- The lowest full cycle cost over the period analyzed is in the Permian Delaware at $48.47/Bbl followed by Williston at $53.95 /Bbl and Permian Midland at $58.95/Bbl.

- Full cycle cost in Denver Julesburg is $62.16/Bbl and in Power River is $76.89/Bbl.

- Full cycle cost in sweet spots with initial productivity > 1,800 Bbl/d is lower.

- Full cycle cost in this cost bin for Permian Delaware is $41.41/Bbl, for Williston $43.38/Bbl, and for Eagle Ford $44.58/Bbl (wells with IP > 1,800 Bbl/d).

See Also:

Crude Oil Cost – US

Crude Oil Cost – Canada