February 09, 2026

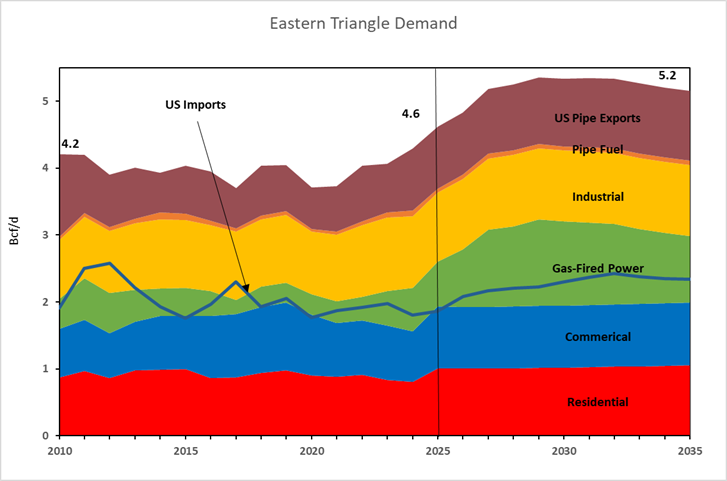

Ontario plan to refurbish 8,000 MW of nuclear capacity at the Bruce and Darlington sites during 2016–2032 time period and close 3,000 MW of Pickering capacity after 2026. Increased gas utilizing the Eastern Triangle should put downward pressure on TC Mainline tolls going forward.

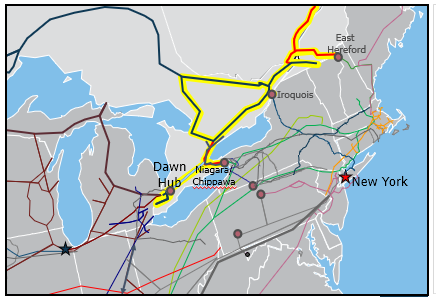

Map of the Eastern Triangle Region

TransCanada’s Northern Ontario Line (NOL) interconnects with the Eastern Triangle portion of the Mainline south of Station 116 at North Bay and extends to the southeast and southwest portions of the system to supply Ontario, Quebec and US export markets.

See Also:

Canadian Natural Gas Exports by Pipeline Forecast to 2035

Eastern Triangle Supply Sources Forecast to 2035

Eastern Triangle Exports Forecast to 2035