November 13, 2025

Daily LNG shipping charter rates by vessel technology type and a discussion on the global LNG shipping fleet.

LNG Shipping Fleet:

The global LNG shipping fleet increased by 5% in 2023 with the delivery of 32 new vessels and grew by a further 11 vessels in the first 2 months of 2024 to ~ 701 active vessels; including 47 operational Floating Storage and Regasification Units (FSRUs) and 10 Floating Storage Unit (FSUs). There are currently 359 newbuild vessels under construction, almost 51% more than the existing fleet; 88 of these new vessels were delivered at the end of 2024. There were 7004 trade voyages in 2023, with increased shipping to Europe to offset Russian gas pipeline declines due to the Ukraine / Russia conflict.

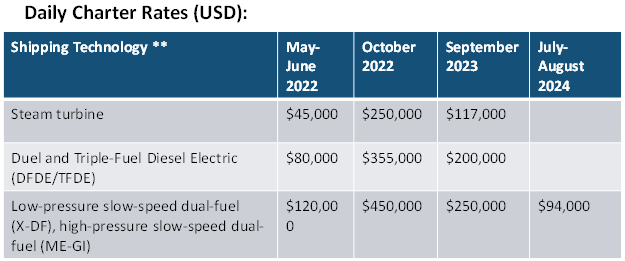

By the end of September 2023, Europe prepared in advance for winter and pushed the LNG shipping market into the peak season. West of Suez rates reached $117,000/day for steam turbine vessels, $200,000/day for TFDE/DFDE vessels and $250,000/day for X-DF/ME-GI vessels which, like the previous year, saw a buildup of floating storage. Thanks to the mild winter of 2022, market fundamentals in 2023 were well balanced, which eased freight rates. However, 2023 was marked by a major disruption to the Panama Canal on account of drought conditions reducing water levels in the Gatun Lake, which forced US-Asia voyages through the Cape of Good Hope and the Suez Canal. In 2024, following three volatile years, the large number of LNG vessel deliveries to the market, coupled with minimal LNG production growth, led to an oversupplied shipping market. Peak charter rates were achieved at the start of the year, followed by another localized peak in July and August, when X-DF/ME-GI vessels (West of Suez) fetched up to $94,000 per day.

See Also:

LNG Shipping Distances To Asia (Approximate)

LNG Export & Import Shipping Routes

References:

“2025 World LNG Report.”, International Gas Union, May 2025, https://www.igu.org/igu-reports/2025-world-lng-report