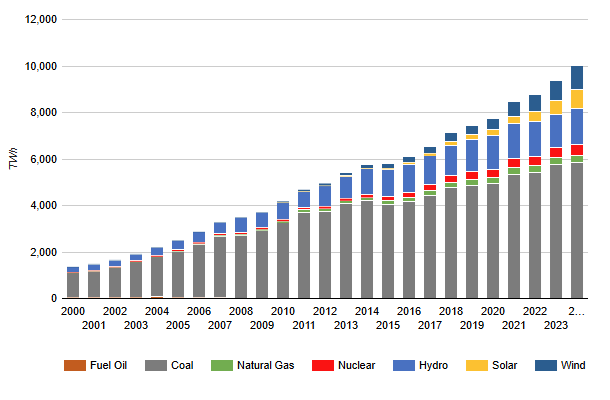

World Power Generation

Global Electricity Generation by Energy Source 2010-2030

July 22, 2024

Global power generation (TWh) by energy source from 2010 to 2030 including hydro, nuclear, biogas, coal, gas, wind, and solar. Total global power generation from all sources grew at an average annual rate of 2.8% between 2010 and 2022 from under 20,000 TWh to over 27,000 TWh. Incorrys expects total generation to grow at a robust 3.3% annually through 2030 reaching 35,000 TWh.

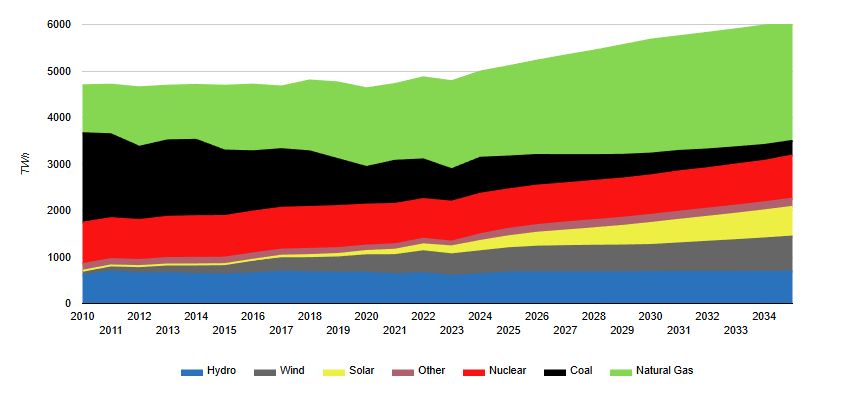

China’s Power Generation

October 15, 2025

The share of natural gas in China’s power generation sector remains low, while coal still accounts for more than 55%. Although the development of renewable energy in the coming decades may slow the growth of fossil fuel consumption and help reduce the use of coal, it is unlikely to impact the increase in natural gas demand.

North American Power Generation

North American Power Generation to 2035

November 03, 2025

North American power generation to 2035 by fuel type. Coal-fired power generation continues to lose market share through retirements with natural gas and renewables (wind and solar) meeting this lost coal-fired generation and future demand growth.

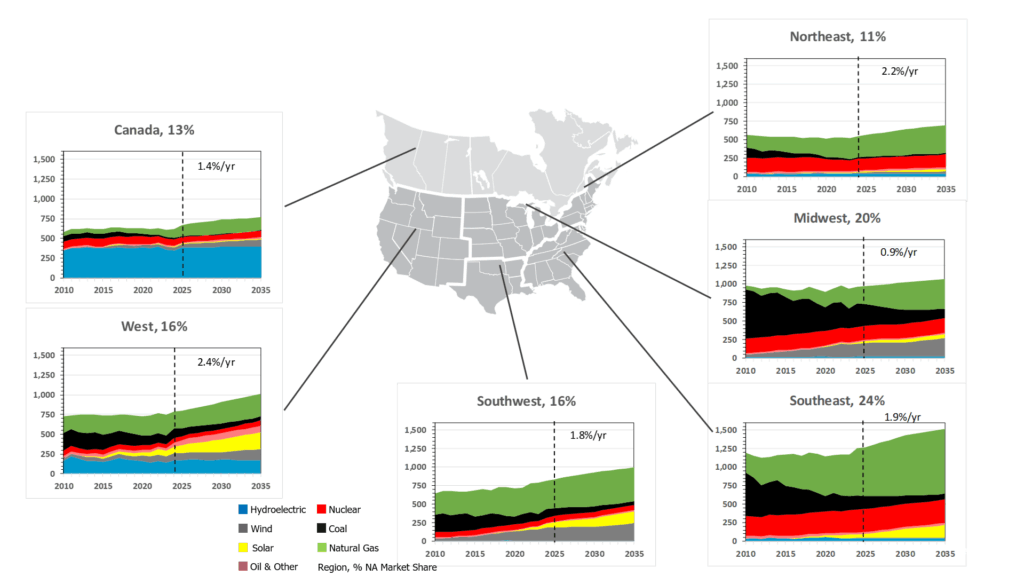

North American Power Demand to 2035 by Region

November 03, 2025

Regional power demand forecasts for North America to 2035, by fuel type.

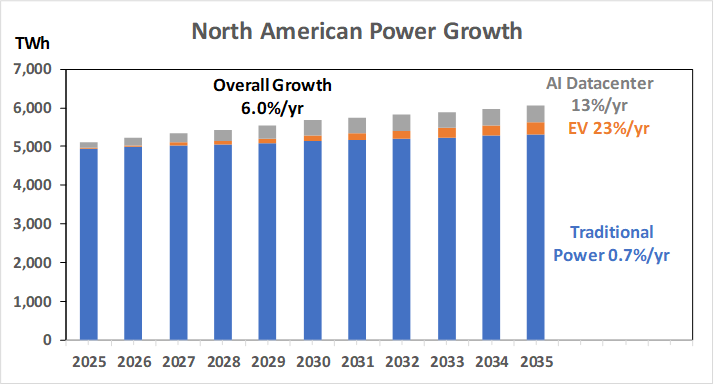

North American Power Generation Growth Sectors

November 06, 2025

Traditional power demand sectors such as Residential, Commercial and Industrial remain are tied to economic activity and constraints therein. Therefore, modest growth of 0.7%/yr is expected. Electric Vehicles (EV) growth is expected at 23% to 2035.