November 20, 2025

OBPS Fraction of Historical Emission Cutoff

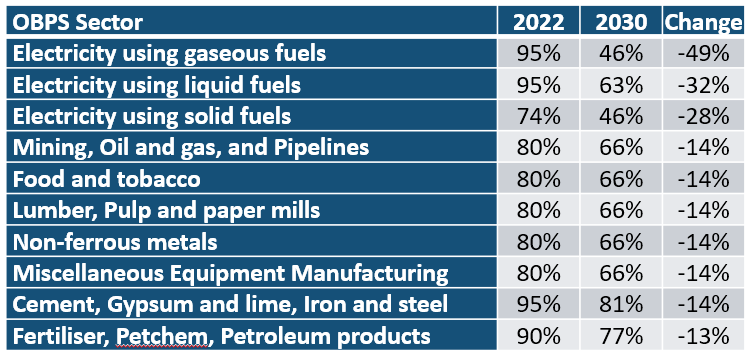

The output-based pricing system (OBPS) is designed to put a price on carbon emissions for facilities that emit >50,000 t of CO2 (large industrials) as an incentive to reduce GHG’s and spur innovation. Regulations determine permissible GHG levels based on historical industrial processes at facilities. The oil and gas standard decreases at ~2% per year to achieve increased emissions efficiency. Large industrials will pay a price on carbon emissions that exceed the set level and earn credits (one tonne CO2 e/credit) if below emission cutoff.

- For example, a normal operating pipeline compressor would pay for 20% of overall emissions in 2022 and 34% in 2030

Credits can be used to achieve compliance within a company or be marketed to other firms.

See also:

The Largest Carbon Capture Countries

Carbon Emissions Trading System (ETS) by Country 2024

Carbon Tax System by Country 2024

Carbon Crediting Mechanism by Country 2024

Canadian GHG Emissions by Sector 2005, 2019-2022, 2030

Canadian Provincial Carbon Schemes

Canada’s Carbon Price Impact on Natural Gas 2022-2030

Carbon Tax Rate and OBPS Impact on AECO-NIT 2022-2030

Federal Backstop Carbon Tax Rate Impact on Natural Gas 2020-2030