January 27, 2025

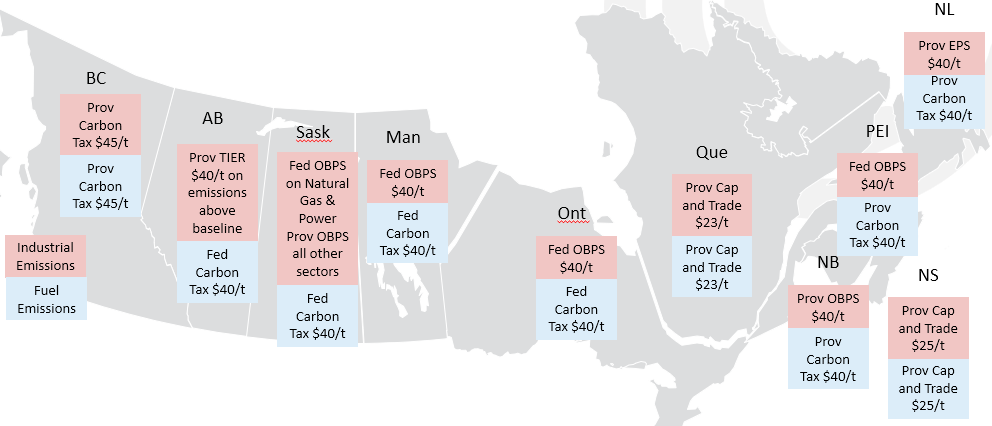

In March 2021, the Canadian Supreme Court released its decision to uphold the constitutionality of the Federal Greenhouse Gas Pollution Pricing Act. The law establishes a minimum standard for carbon pricing required to meet emission reduction targets as set out in the Paris Agreement. The Act has two parts: Output Based Pricing System (OBPS) for large industrial emitters and a fuel charge. Also, all provinces and territories must maintain a carbon price of at least $80 per tCO2e in 2024. Provinces are allowed to enact their own schemes as long as Federal emission targets are met. Incorrys believes as we move toward the 2030 Federal government target emission reductions, it will be more likely that Provincial plans assimilate with Federal policy.

See also:

The Largest Carbon Capture Countries 2023

Carbon Emissions Trading System (ETS) by Country 2024

Carbon Tax System by Country 2024

Carbon Crediting Mechanism by Country 2024

Canadian GHG Emissions by Sector 2005, 2019-2022, 2030

Large Emitters – Canadian Carbon Tax

Canada’s Carbon Price Impact on Natural Gas 2022-2030

Carbon Tax Rate and OBPS Impact on AECO-NIT 2022-2030

Federal Backstop Carbon Tax Rate Impact on Natural Gas 2020-2030

References:

Government of Canada: Carbon pollution pricing systems across Canada

Government of Canada: Canada Carbon Rebate amounts for 2024-25