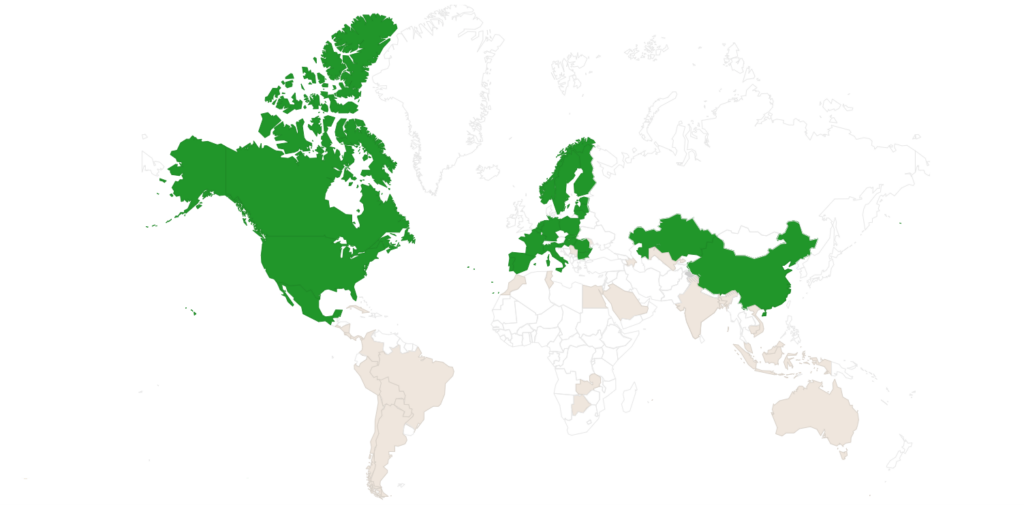

International Policies

The Largest Carbon Capture Countries 2024

November 20, 2025

In 2024, various countries are contributing to global efforts in carbon capture with capacities measured in megatonnes (Mt) per year. Below is a summary of the top contributors and other notable countries in carbon capture…

Carbon Emissions Trading System (ETS) by Country 2024

November 13, 2024

Countries around the world are implementing or considering carbon emissions trading systems (ETS) to incentivize emission reductions. The following overview provides insights into the current status of ETS adoption globally…

Carbon Tax System by Country 2024

November 13, 2024

A carbon tax is a policy tool that places a direct price on carbon emissions, encouraging reduction efforts across industries. Here’s a summary of countries with a carbon tax implemented in at least one sector…

Carbon Crediting Mechanism by Country 2024

November 13, 2024

Carbon crediting mechanisms allow countries to offset emissions by earning credits for emission reduction projects, which can be traded or used to meet climate goals. Below is an overview of the countries with established carbon crediting mechanisms…

Canadian Policies

Canadian GHG Emissions by Sector 2005, 2019-2022, 2030

January 24, 2025

Canada’s actual 2005 and 2022 greenhouse gas (GHG) emissions, by industry sector, as compared to 2030 levels in the Paris Agreement, Federal Budget, and Leaders Summit. The oil and gas sector accounts for 20%-30% of Canada’s total GHG’s in 2005, 2019-2022 and 2030 forecasts under the Paris Agreement and the Federal Budget.

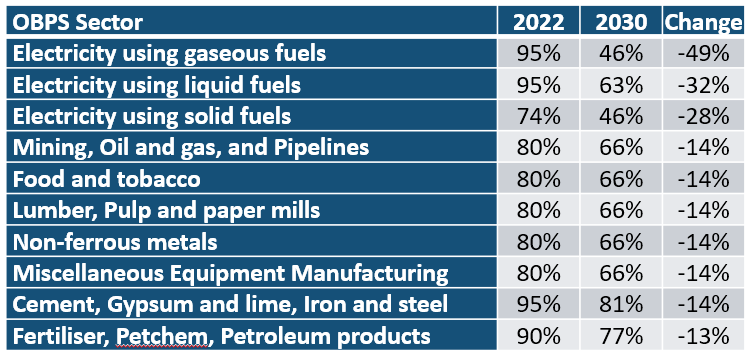

Large Emitters – Canadian Carbon Tax

OBPS Fraction of Historical Emissions Cutoff

November 20, 2025

The output-based pricing system (OBPS) is designed to put a price on carbon emissions (large industrials) as an incentive to reduce greenhouse gas (GHG) emissions and spur innovation. Regulations determine permissible GHG levels based on historical industrial processes at facilities. Depending on the amount of emissions compared to the cutoff, large industrials will either pay a price if over or earn credits if under their allowable levels.

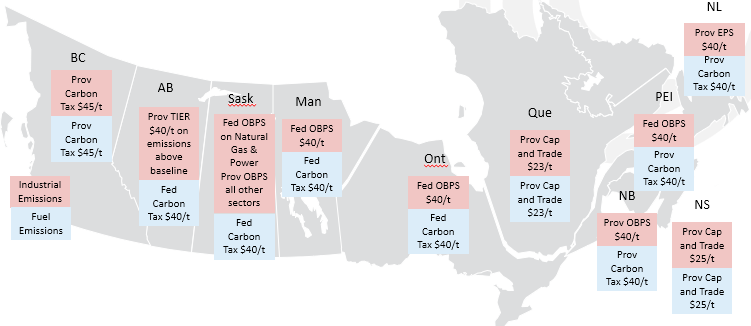

Canadian Provincial Carbon Schemes

January 27, 2025

Provincial carbon schemes for both large industrial and fuel emissions must meet Federal emissions targets under the Greenhouse Gas Pollution Pricing Act. Incorrys believes as we move toward the 2030 Federal government target emission reductions, it will be more likely that Provincial plans assimilate with Federal policy.

Carbon Tax Rate and OBPS Impact on AECO-NIT 2022-2030

June 28, 2023

Impact on Alberta’s AECO-NIT natural gas price, to 2030, from the carbon tax rate and Output Based Pricing System (OBPS). Natural gas producers utilize natural gas from wellhead to burner tip. Canadian producers will be limited in their ability to pass carbon costs onto consumers with access to gas produced without a carbon tax in a well integrated North American market.