Published on October 22, 2025. Breakeven cost of Russian oil continues to grow. This article explains how sanctions, cost inflation and maturing fields are pushing up the breakeven cost of Russian oil and eroding Russia’s oil revenues.

Growing Breakeven Cost of Russian Oil

On October 22, 2025, the U.S. government imposed sanctions on Rosneft and Lukoil, adding external pressure to an industry already struggling with rising drilling costs and declining output. This represents the largest and most consequential set of U.S. sanctions against the Russian oil sector to date. Even before the introduction of these recent sanctions, the Russian oil industry faced a significant but often overlooked problem: cost escalation. Even if oil prices remain stable, rising costs will have a substantial impact on oil revenues.

Drilling Activity and Production Trends in 2024

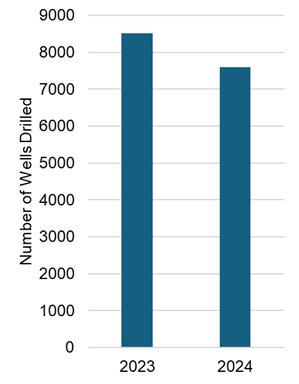

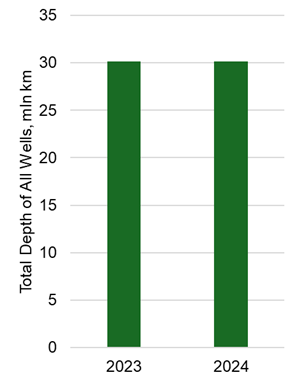

In 2024, total oil production in Russia averaged 9.2 MMbbl/d, which is over 4% lower than in 2023, when total production reached 9.6 MMbbl/d. According to Russian sources, around 7,600 new wells were drilled and connected in 2024—a 12% decline compared with 2023. The majority of these wells were vertical. The total depth of all wells drilled in Russia in 2024 was 30.17 million meters, roughly the same as in the previous year (see Figure 1). The total depth of horizontal wells reached 20.5 million meters, a 9.5% increase compared with 2023. The average depth of an individual well in Russia reached 4 km, up from 3.5 km in 2023.

|

|

Figure 1. Total number of wells and total depth of all wells drilled in Russia in 2024

Limited New Discoveries and Reserve Life

In 2024, about 0.15 MMBbl of new oil resources were discovered in Russia. Estimates of total oil resources in the country range from 80 to 100 BBbl, so 2024 discoveries represent only a minor addition. The estimated reserve life of Russian oil is slightly over 20 years, calculated based on proven reserves rather than total resources.

Well Productivity and Decline Analysis

Detailed public information about well productivity and production over time in Russia is limited or unavailable. Incorrys conducted a decline analysis and full-cycle cost estimation for drilling in Russia. The company assumes that initial production (IP) and estimated ultimate recovery (EUR) for wells drilled in 2023 and 2024 have not changed significantly. Without the development of new major plays, existing ones will mature, requiring longer and more expensive wells to sustain production. Consequently, the cost per unit of production will continue to rise.

Cost Escalation and Economic Impact

Incorrys estimates that cost escalation in 2024 was at least 3%, driven primarily by increases in finding and development (F&D) costs. The total cost includes operating expenses, F&D, overhead, and transportation, but excludes royalties, taxes (which the Russian government seeks to maximize), and cost of capital. A sustained 3% annual cost increase driven by higher F&D expenses would have a major impact on the Russian economy. In fact, this may be a conservative estimate, as without new field development, EUR and IP will decline while operating costs rise. This trend will lead to a significant decline in Russian government revenues, even without considering the effects of sanctions.

See also:

US Sanctions Against Russian Oil Industry and Their Implications

References:

“Treasury Sanctions Major Russian Oil Companies, Calls on Moscow to Immediately Agree to Ceasefire.”, US Department of Treasury, October 22, 2025, https://home.treasury.gov/news/press-releases/sb0290

“In 2024 39 new oil and gas fields were discovered in Russia.”, Portnews, February 2025, https://portnews.ru/news/373189/

“They’ll run out. Russia’s oil reserves last just over 20 years.”, The Moscow Times, September 2025, https://www.moscowtimes.ru/2025/09/04/oni-zakonchatsya-zapasov-nefti-vrossii-chut-bolshe-chem-na-20-let-a173539