April 23, 2025

In our LNG Business Case – Part 1, we discussed the global GHG emissions reduction framework and treaties, and the outsized role of Canadian LNG as a viable and feasible solution to lower Global CO2 emissions. In this Part 2, we examine the competitive economics for west coast Canada LNG. As we will demonstrate, the economics are in west coast BC’s favour when compared to US Gulf Coast (USGC) Projects. It is only after costs associated with made-in-Canada legislation and policies are included, that major LNG Projects, on the scale of LNG Canada, are challenged.

So, what do the raw economics reveal?

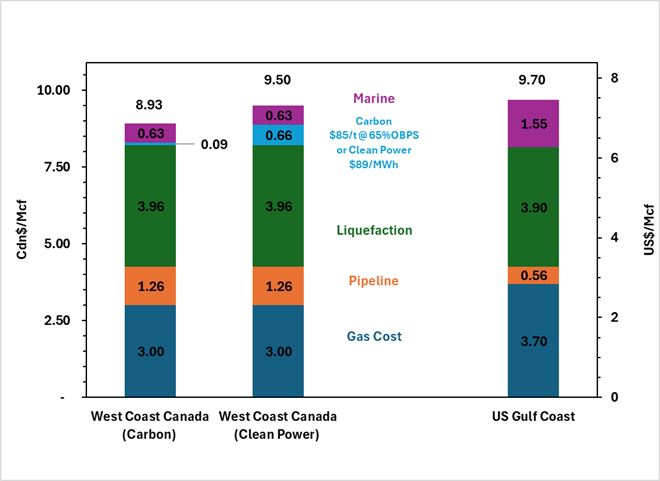

Figure #1- Natural Gas Competitiveness to Asia

Figure #1- Natural Gas Competitiveness to Asia

Figure 1 shows that west coast BC Projects, utilizing behind the fence, gas-fired electricity, (and paying a fee for carbon) still have a competitive advantage versus USGC Projects delivering to Asian markets. For the west coast Canada case we are assuming a gas-fired analogue to LNG Canada, with output at roughly 4 Bcf/d.

Gas-fired power to drive the processes will not increase measurably over the 25-to-40-year Project life cycle, due to the low-cost resource available from western Canada shale and tight gas plays. Incorrys estimates the western Canada Montney play has 465 Tcf of natural gas resource available below USD$4/Mcf – and this figure does not even consider additional low cost resource in the Duvernay and Deep Basin, not to mention the Horn River and Liard Basins–(see www.incorrys.com) As major west coast LNG Projects are intended to be integrated, with proponents owning upstream acreage, and resources, the gas cost, and power cost, can therefore be capped and de-risked.

However, the BC Government has mandated that any new LNG Projects must be net-zero carbon, or a clear path to achieve net zero carbon must be demonstrated, before Project approval. This policy essentially pushes new LNG Projects to forego creating their own behind- the-fence natural gas fired power, from their own acreage, and to purchase power from BC Hydro (grid power). When this mandated clean power cost is considered, with a current industrial power cost of $89/MWh¹, the competitive advantage with US Gulf Coast projects is closed to within $0.20/Mcf.

Furthermore, and this is the more important aspect, experience in other countries and with other power utilities, shows the future risk of increased power prices is highly likely as new net-zero power projects and transmission are added to cost of service to supply new demand. New demand from one or several major LNG Projects will necessitate an increase in power supply, from net-zero sources². Averaging these higher cost generation assets, and associated backup power supply, with the current mix of heritage generating assets, will increase the current industrial power and transmission cost to LNG Producers and other industrials. The inability to control future power input costs makes the BC Clean Power case uncompetitive with the USGC and BC Projects utilizing behind the fence gas-fired power.

What will be the BC Hydro price for power in 2030? Or 2040? New power demand from net-zero policies will include a drive to replace natural gas in residential and commercial buildings with electric heat pumps and replace internal combustion vehicles with electric vehicles. The BC power grid is currently in balance, but how much incremental demand will come from these net-zero policies, on top of demand from several additional large-scale LNG Projects?

And where will this incremental power supply come from? Power from the 1,100 MW Site C hydroelectric project (expected to average ~50% load factor) has been spoken for several times over, and this, or any power from any future generation source will need to be connected to major population centres and ostensibly new Pacific Coast LNG Projects. This will require major investment in intermittent renewables, backup power and transmission.

The future cost risk, over and above the cost disadvantage from the current industrial power cost, essentially blows out completely the competitiveness gap with LNG from the USGC and other projects from around the world (including Alaska).

As we stated in LNG Business Case – Part 1 , a gas-fired Canadian LNG Project, of the same size as LNG Canada, would reduce global emissions by 75 mtpa, even accounting for the small increase in Canadian emissions.

Domestic net-zero policies expressly penalize these Canadian Projects that would reduce global emissions, as they are unable to capture CO2 reduction credits from lowering C02 emissions in downstream markets. These policies are in place specifically to comply with Canada’s greenhouse gas reduction commitments under the Paris Accord and global carbon reduction framework and treaties. So, it all comes back to these made-in-Canada policies, which comport with the Paris Accord and resultant treaties. The federal carbon tax, net-zero power targets, and BC’s net-zero requirement for new LNG Projects have all been enacted to achieve Canada’s Paris carbon reduction goals.

Is there a Business Case for BC LNG?

During the period from 2008 to date, seven major LNG Projects have been commissioned in the US, and a further 20 are fully permitted. By comparison, the LNG Canada Project, currently under construction, is the only major Canadian Project approved and under construction. It is grandfathered from the BC net-zero mandate but will be subject to the tax on carbon emitted. It is quite clear that BC LNG development ‘missed the boat’, save for the LNG Canada Project and two smaller Projects which will be electric drive versus gas drive (Woodfibre and Cedar). Several other projects are under development and have not taken a Final Investment Decision (FID).

These mega investments require cost certainty and must be cost competitive to secure downstream market commitments. The risk of power price spikes from BC Hydro / grid power, over the 25-to-40-year economic life of these Projects has pushed investment away. As we suggested in LNG Business Case – Part 1 the global emissions framework, specifically Article 6, needs to be changed so Canadian gas-drive LNG Projects are credited with emissions reductions in downstream market jurisdictions. Failing this, Canadian Projects could be allocated (carbon) credit(s) within Canada for such global emissions reductions, so they are net-zero compliant. The Canadian projects could then utilize cheap and plentiful natural gas to produce behind-the-fence power, lowering costs and risk, and resulting in a positive business case for Canadian LNG.

For more information, please contact:

See also:

The Business Case for Canadian LNG – Part 1

References:

¹Incorrys included BC Hydro expectations for 3.75%/year rate increases in 2025-26 time period as per BCUC rate application

²March 21, 2025, from Minister Dix highlights difficulties in BC being net zero prepared for LNG proponents by 2030