March 1, 2025

US President Donald Trump’s tariff threats on Canadian Steel and Energy arbitrarily disregard the re-worked USMCA (also referred to as CUSMA) free trade agreement, set for renewal in 2026.

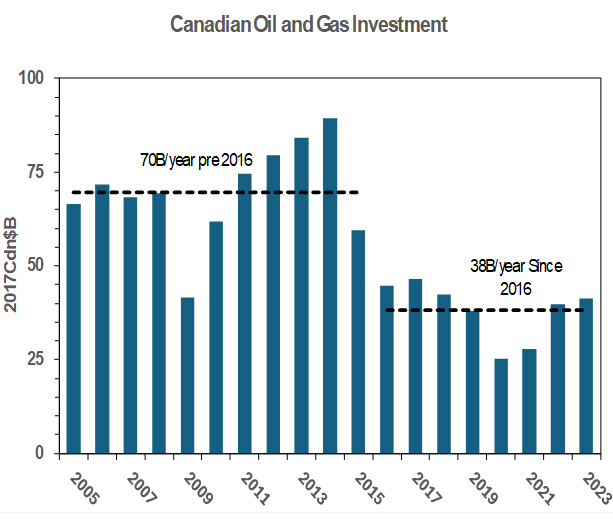

Over the past decade the Canadian Government has focused on post-national ideology, including net-zero carbon, to enhance international standing at the expense of Canadian priorities. This has led to a severe decline in productivity as investment and employment have shifted from the high capital/highly productive energy sector to low capital/below average productivity sectors such as government services. As illustrated in the figure below, Canadian Oil and Gas investment is down 45% since 2016, coincident with the current Liberal government’s ascent to power in 2015.

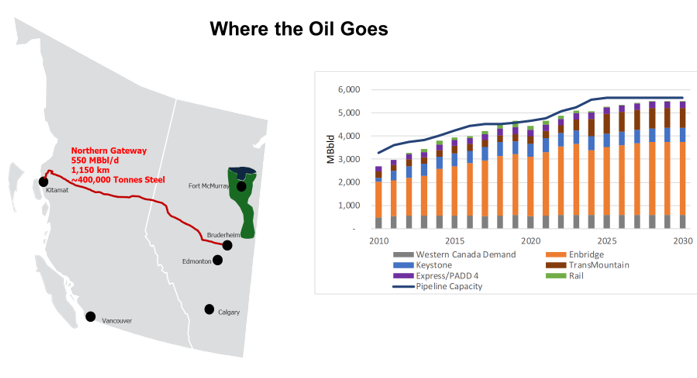

Canada must reverse this productivity slump and leverage the Canadian economy away from a US partner which has threatened tariffs on energy, steel and aluminum, all key exports to the USA. Incorrys believes that revival of the Northern Gateway pipeline project to the West Coast could provide Canada with leverage to offset US trade risk and spur productivity gains over the next decade.

Give Canadian Steel Industry a Hand Up, not a Handout?

There is no doubt that if Canadian exports of steel are constrained, the impacts will be felt directly by workers in Hamilton, Sault St. Marie and the Prairies. The Federal Government has signaled its intent to support industries impacted by a US tariff attack. For a government deep in debt post-Covid, this could be very costly.

Could there be a Canadian pipeline solution to US steel tariffs? Literally, ‘killing two birds with one stone’? A new pipeline to tidewater would provide optionality for Canadian crude to be marketed away from the US market. Pipeline egress could also ensure crude product differentials remain narrow (i.e. Canadian price discounts into the US are minimized).

Incorrys believes that a possible solution to support the Canadian steel industry would be to build a Canadian east-west pipeline. If the government wishes to support Canadian steel and jobs, perhaps building infrastructure is a better investment than mere handouts. Simply rebooting the Northern Gateway Pipeline Project (NEB approved in 2013 and subsequently denied by the current Liberal Government Cabinet) could add demand for ~400,000 tonnes of steel, and once built, would decrease reliance on US markets for steel and crude exports and add much needed construction and manufacturing jobs. Revenue to Canadian steel makers would be in the order of $USD 3 Billion for raw steel, with additional value added coming from manufacturing pipelines. The contribution to Canada’s export revenues would be in the order of USD$15 Billion per year based on a Brent price of USD$85/Bbl. For an economy in decline since 2015, this is a huge shot in the arm.

Making The Most of Canada’s Oil Endowment

Canada has the third-largest proven oil reserves globally, primarily due to vast oil sands deposits in Alberta. However, current production is about 25% that of the US and 50% Saudi Arabia and Russia. In other words, Canada is vastly under producing from its resource endowment.

There are a number of factors – some relate to the physical characteristics of Canadian oil sands, and some relate to the above-suggested pursuit of ideology. Oil Sands projects have higher processing and up-front capital costs than US (and Canadian) tight and shale oil plays. However, once the upfront investment is sunk, Oil Sands projects have a lifespan of 25-50 years.

Net-zero ideology has resulted in barriers to building additional pipeline egress, via various explicit measures, including the Federal Impact Assessment framework, the west coast tanker moratorium, and legislating the newly announced hydrocarbon carbon cap adds another barrier to investment. This lack of government support and constant churn of regulatory obstacles has resulted in the underdevelopment of our resource endowment.

If there was political will to permit Northern Gateway, Incorrys believes a viable commercial project would emerge, and Canadian producers would invest in new economic productive capacity to fill the pipe for export.

Could Small Nuclear Reactors (SMR) Create Low Emission Crude?

Incorrys also believes emerging SMR technology could be studied for suitability to reduce carbon intensity for the next tranche of oil sands productive capacity. Ontario’s nuclear industry could also benefit by manufacturing SMR’s for this application. Another win.

Benefits From a Common Oil and Gas Pipeline Corridor?

But why stop there? Canada and British Columbia could also revise policy frameworks to remove barriers for Canadian LNG projects. A new project, such as Kitimat LNG or Steelhead LNG would result in another gas pipeline to Kitimat, potentially along the same corridor as Northern Gateway, adding yet more demand for steel, more jobs at our steel mills, and for construction of the gas pipeline, and the LNG gasification plant(s), modules and infrastructure.

These projects would add to Canadian GDP, federal and provincial government resource and tax revenues, and upstream exploration and development activity in Alberta, Saskatchewan, and British Columbia. Industrial and fabrication workers and taxpayers in eastern and western Canada would benefit.

The existential threat to Canadian prosperity from US tariffs on energy and steel / aluminum looms over us. A made-in-Canada solution is at hand. Politicians of all stripes are speaking openly about the need for east-west pipelines. A subject that was political suicide in Canada before U.S. tariffs were announced.

Political will is now required to remove internal barriers to energy infrastructure and interprovincial trade, to bring mothballed projects such as the Northern Gateway Pipeline back to life, providing Canadian energy to new markets and unlocking Canadian resource and industrial might.

Two extraneous tariff threats. One Team Canada solution.

For more information, please contact:

Edward Kallio: e: ekallio@incorrys.com t: 403.978.1555