December 16, 2024

US President-elect Donald Trump has warned the Canadian Federal Government that the US will impose a 25% tariff on all Canadian imports unless Canada ensures border security, among other things.

However, Incorrys believes the direct and visible impact of a 25% tariff on gasoline consumers will quickly put pressure on policymakers to exempt energy, if its even enacted. With this in mind, what does Team Canada really mean? Will it truly be Team Canada? Or Team Ontario and Quebec? There are rumblings that any Team Canada negotiations could sacrifice Alberta energy exports in order to protect such sectors as Quebec Aluminum and Ontario Auto exports. Will Alberta energy be the sacrificial lamb for these Quebec and Ontario sectors?

And what is a tariff? Is there a difference between a tariff imposed by a trading partner, and a tax imposed internally? The result is the same, except that to fight an internal tax, there are no effective retaliatory measures, other than the courts. To wit: Alberta’s constitutional challenge of the federal carbon tax scheme. If Ottawa imposes restrictions or discriminatory measures on foreign companies importing goods or products (such as crude oil) into Canada for instance, but not on Canadian producers, foreign companies may file an action with the World Trade Organization (WTO). No such action is possible, however, when the Canadian Government imposes restrictions or costs on Canadian companies, but not on foreign ones.

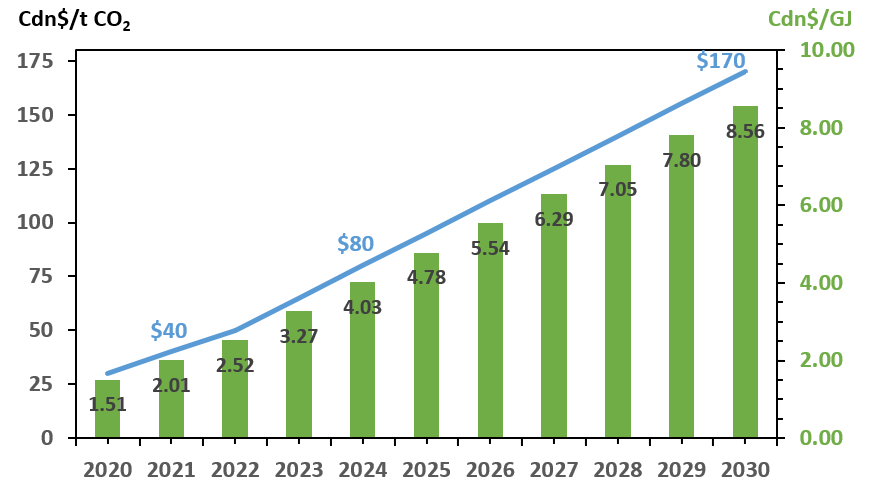

The chart shows the 2024 impact of the federal carbon tax (an internal ‘tariff’) on Alberta natural gas. The carbon tax is currently Cdn$80/t CO2 or Cdn$4.03/GJ (rising to $170/t CO2 in 2030). This equates to a 345% ‘tariff’ on natural gas, based on the year-to-date 2024 average Alberta price of $1.15/GJ. There is no such U.S. carbon tax on natural gas production, disadvantaging Canadian producers and consumers – in Canadian AND US markets.

Since 2015, Alberta producers and taxpayers have faced a host of taxes, ‘tariffs’ and restrictions on carbon. Regulatory measures and uncertainty, including the reorganization of the NEB to the CER, the Impact Assessment Act – also known as the ‘No More pipelines Act’, and the recent introduction of a federal emissions-cum-production cap on Alberta energy producers all create investment risk. Multinational firms including Shell (BG), Chevron, Woodside, ExxonMobil and Petronas have all cancelled multi-Billion Dollar LNG projects since the current federal government has been in power. Many of these firms have also divested Billions of dollars in Canadian assets, scaling back investment commitments in Canada.

The threat of tariffs creates uncertainty and risk for investors, which is precisely the point. An investor unable to quantify costs will defer investments or move capital to alternative jurisdictions, where there is less risk. Such as the United States. Ontario and Quebec are facing up to the disruptive force tariffs will have on their provincial economies, and there is now a federally organized rallying cry for Team Canada. Will Team Canada now wake up to the disruptive impact of Canadian carbon ‘tariffs ‘on Alberta? Go get ‘em Team Canada….

References:

Government of Canada. Nov 26, 2023. Greenhouse Gas Pollution Pricing Act (S.C. 2018, c. 12, s. 186). Available at https://laws-lois.justice.gc.ca/eng/acts/g-11.55/. Retrieved Dec 20, 2024

Government of Canada. Nov 26, 2023. Impact Assessment Act (S.C. 2019, c. 28, s. 1). Available at https://laws.justice.gc.ca/eng/acts/i-2.75/index.html. Retrieved Dec 20, 2024

Canada Energy Regulator. Dec 13, 2024. Canadian Energy Regulator Act – Regulations and Related Regulatory Documents. Available at https://www.cer-rec.gc.ca/en/about/acts-regulations/cer-act-regulations-guidance-notes-related-documents/index.html. Retrieved Dec 20, 2024

Government of Canada. Nov 26, 2023. Canadian Energy Regulator Act (S.C. 2019, c. 28, s. 10). Available at https://laws-lois.justice.gc.ca/eng/acts/C-15.1/index.html. Retrieved Dec 20, 2024